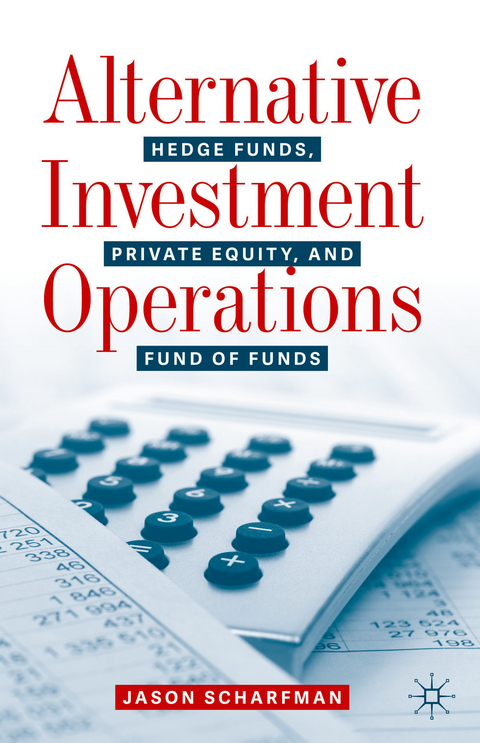

Alternative Investment Operations (eBook)

XVII, 198 Seiten

Springer International Publishing (Verlag)

978-3-030-46629-9 (ISBN)

Alternative investments such as hedge funds, private equity, and fund of funds continue to be of strong interest among the investment community. As these investment strategies have become increasingly complex, fund managers have continued to devote more time and resources towards developing best practice operations to support the actual trade processing, fund accounting, and back-office mechanics that allow these strategies to function. Representative of this operational growth, estimates have indicated that fund managers have seen increased operating budgets of 30% or more in recent years.

In today's highly regulated environment, alternative investment managers have also increasingly had to integrate rigorous compliance and cybersecurity oversight into fund operations. Additionally, with recent advances in artificial intelligence and big data analysis, fund managers are devoting larger portions of their information technology budgets towards realizing technology-based operational efficiencies. Alternative investment fund service providers have also substantially increased their scope and breadth of their operations-related services. Furthermore, investors are increasingly performing deep-dive due diligence on fund manager operations at both fund level and management company levels.

This book provides current and practical guidance on the foundations of how alternative investment managers build and manage their operations. While other publications have focused on generalized overviews of historical trading procedures across multiple asset classes, and the technical intricacies of specific legacy operational procedures, Alternative Investment Operations will be the first book to focus on explaining up-to-date information on the specific real-world operational practices actually employed by alternative investment managers. This book will focus on how to actually establish and manage fund operations. Alternative Investment Operations will be an invaluable up-to-date resource for fund managers and their operations personnel as well as investors and service providers on the implementation and management of best practice operations.

Jason Scharfman is the Managing Partner of Corgentum Consulting, a specialist consulting firm that performs operational due diligence reviews and background investigations of fund managers of all types, including hedge funds, private equity, real estate, and long-only funds on behalf of institutional investors, including pensions, endowments, foundations, fund of funds, family offices, and high-net-worth individuals. He is recognized as one of the leading experts in the field of due diligence and fund operations. He is the author of several publications including Private Equity Compliance: Analyzing Conflicts, Fees and Risks (2018), Hedge Fund Compliance: Risks, Regulation and Management (2016), Hedge Fund Governance: Evaluating Oversight, Independence, and Conflicts (2014), Private Equity Operational Due Diligence: Tools to Evaluate Liquidity, Valuation, and Documentation (2012), and Hedge Fund Operational Due Diligence: Understanding the Risks (2008). Jason has also contributed to the Chartered Alternative Investment Analyst (CAIA) curriculum on due diligence, has served on the organization's Due Diligence, Risk Management and Regulation Committee, and holds the CAIA charter.

| Erscheint lt. Verlag | 29.8.2020 |

|---|---|

| Zusatzinfo | XVII, 198 p. 7 illus. |

| Sprache | englisch |

| Themenwelt | Wirtschaft |

| Schlagworte | Alternative Investment Operations • Alternative Investments • Artificial Intelligence • Cash Management • Compliance • cybersecurity • Fund Accounting • Fund Managers • Fund of Funds • Fund operations • Hedge Funds • Information Technology • Investment Strategy • Operational practices • Private Equity • Trade Operations |

| ISBN-10 | 3-030-46629-9 / 3030466299 |

| ISBN-13 | 978-3-030-46629-9 / 9783030466299 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Größe: 3,3 MB

DRM: Digitales Wasserzeichen

Dieses eBook enthält ein digitales Wasserzeichen und ist damit für Sie personalisiert. Bei einer missbräuchlichen Weitergabe des eBooks an Dritte ist eine Rückverfolgung an die Quelle möglich.

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür einen PDF-Viewer - z.B. den Adobe Reader oder Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür einen PDF-Viewer - z.B. die kostenlose Adobe Digital Editions-App.

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich