Interest Rate Modeling

Chapman & Hall/CRC (Verlag)

978-1-4200-9056-7 (ISBN)

- Titel erscheint in neuer Auflage

- Artikel merken

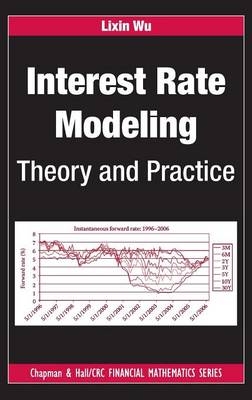

Containing many results that are new or exist only in recent research articles, Interest Rate Modeling: Theory and Practice portrays the theory of interest rate modeling as a three-dimensional object of finance, mathematics, and computation. It introduces all models with financial-economical justifications, develops options along the martingale approach, and handles option evaluations with precise numerical methods.

The text begins with the mathematical foundations, including Ito’s calculus and the martingale representation theorem. It then introduces bonds and bond yields, followed by the Heath–Jarrow–Morton (HJM) model, which is the framework for no-arbitrage pricing models. The next chapter focuses on when the HJM model implies a Markovian short-rate model and discusses the construction and calibration of short-rate lattice models. In the chapter on the LIBOR market model, the author presents the simplest yet most robust formula for swaption pricing in the literature. He goes on to address model calibration, an important aspect of model applications in the markets; industrial issues; and the class of affine term structure models for interest rates.

Taking a top-down approach, Interest Rate Modeling provides readers with a clear picture of this important subject by not overwhelming them with too many specific models. The text captures the interdisciplinary nature of the field and shows readers what it takes to be a competent quant in today’s market.

This book can be adopted for instructional use. For this purpose, a solutions manual is available for qualifying instructors.

Lixin Wu is an associate professor at the Hong Kong University of Science and Technology. Best known in the financial engineering community for his work on market models, Dr. Wu co-developed the PDE model for soft barrier options and the finite-state Markov model for credit contagion.

The Basics of Stochastic Calculus

Brownian Motion

Stochastic Integrals

Stochastic Differentials and Ito’s Lemma

Multi-Factor Extensions

Martingales

The Martingale Representation Theorem

Changing Measures with Binomial Models

Change of Measures under Brownian Filtration

The Martingale Representation Theorem

A Complete Market with Two Securities

Replicating and Pricing of Contingent Claims

Multi-Factor Extensions

A Complete Market with Multiple Securities

The Black–Scholes Formula

Notes

Interest Rates and Bonds

Interest Rates and Fixed-Income Instruments

Yields

Zero-Coupon Bonds and Zero-Coupon Yields

Forward Rates and Forward-Rate Agreements

Yield-Based Bond Risk Management

The Heath–Jarrow–Morton Model

Lognormal Model: The Starting Point

The HJM Model

Special Cases of the HJM Model

Estimating the HJM Model from Yield Data

A Case Study with a Two-Factor Model

Monte Carlo Implementations

Forward Prices

Forward Measure

Black’s Formula for Call and Put Options

Numeraires and Changes of Measure

Notes

Short-Rate Models and Lattice Implementation

From Short-Rate Models to Forward-Rate Models

General Markovian Models

Binomial Trees of Interest Rates

A General Tree-Building Procedure

The LIBOR Market Model

LIBOR Market Instruments

The LIBOR Market Model

Pricing of Caps and Floors

Pricing of Swaptions

Specifications of the LIBOR Market Model

Monte Carlo Simulation Method

Calibration of LIBOR Market Model

Implied Cap and Caplet Volatilities

Calibrating the LIBOR Market Model to Caps

Calibration to Caps, Swaptions, and Input Correlations

Calibration Methodologies

Sensitivity with Respect to the Input Prices

Notes

Volatility and Correlation Adjustments

Adjustment due to Correlations

Adjustment due to Convexity

Timing Adjustment

Quanto Derivatives

Notes

Affine Term Structure Models

An Exposition with One-Factor Models

Analytical Solution of Riccarti Equations

Pricing Options on Coupon Bonds

Distributional Properties of Square-Root Processes

Multi-Factor Models

Swaption Pricing under ATSMs

Notes

References

Index

| Erscheint lt. Verlag | 14.5.2009 |

|---|---|

| Reihe/Serie | Chapman & Hall/CRC Financial Mathematics Series |

| Zusatzinfo | 864 Equations; 19 Tables, black and white; 65 Illustrations, black and white |

| Sprache | englisch |

| Maße | 156 x 234 mm |

| Gewicht | 635 g |

| Themenwelt | Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung |

| ISBN-10 | 1-4200-9056-9 / 1420090569 |

| ISBN-13 | 978-1-4200-9056-7 / 9781420090567 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich