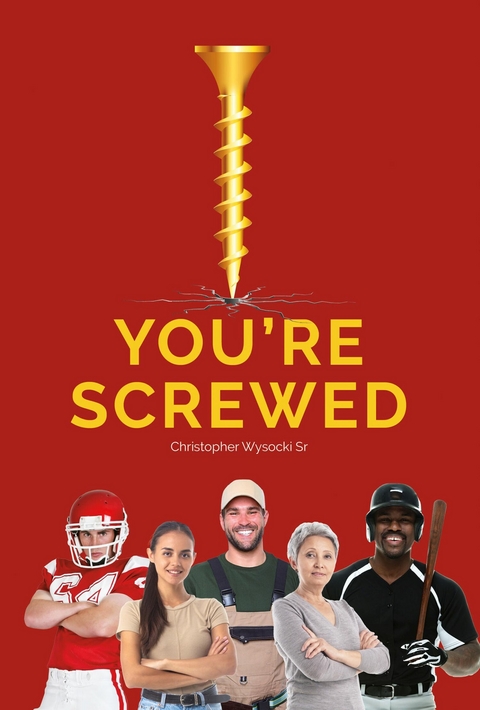

You're Screwed (eBook)

180 Seiten

Bookbaby (Verlag)

979-8-3509-6669-5 (ISBN)

Christopher Wysocki Sr. is an accomplished professional with extensive achievements in manufacturing simulation, defense, and quality leadership. He has spoken at international symposiums and universities, received numerous awards including the Million Dollar Savings Award and NASA's Team Achievement Award, and helped establish a top-rated ballistic missile cleanroom. Holding a Bachelor of Science, an MBA, and a teaching certificate in business, Christopher is not a Certified Financial Advisor. He enjoys biking, hiking, fishing, hunting, and volunteering, and has been married for over 39 years with four children.

Discover the ultimate guide to mastering investments with "e;You're Screwed"e; by Christopher Wysocki Sr. In a world where financial literacy is paramount, this book offers unparalleled insights and practical concepts to elevate your understanding of stocks and securities. Designed for both novice and seasoned investors, Wysocki's teachings illuminate the path to securing your financial future. The book emphasizes the importance of investing wisely, making it an essential read in today's economy. With a vision to inspire educational reforms, Wysocki advocates for integrating these invaluable lessons into high school and university curricula, as well as corporate training programs. This book is not just a read but a movement towards financial empowerment.

Copyright © 2024 Christopher Wysocki Sr

All rights reserved.

No part of this publication may be reproduced or transmitted in any form or by any means electronic or mechanical, including photocopy, recording, or any information

storage and retrieval system now known or invented, without permission in writing from the publisher, except by a reviewer who wishes to quote brief passages in connection

with a review written for inclusion in a magazine, newspaper, or broadcast.

Print ISBN: 979-8-35096-668-8

eBook ISBN: 979-8-35096-669-5

Printed in the United States of America

However, this book can change your life,

yep.

If you have a job and you don’t read this book, you’re screwed!

If you’re in school, teacher, craftsman or athlete, and you don’t read this book, you’re REALLY screwed!

If you’re investing and you don’t read this book, you’re screwed!

If you retired and don’t read this book, you’re screwed!

The good news is this book can teach and educate you for a better chance at a brighter, financial and retirement investment future.

Adults/Students,-You will be starting some kind of job or position that offers you retirement investments. So, once you complete your education/training and start the job, most companies will offer you some type of 401(k) or Roth or retirement fund. In your first job, you must review where your money is being invested by this company,- because it usually picks a low valued default fund for your investments dollars. You can do this type of review with any brokerage house or investment company that your job has setup for your investment retirement dollars out of your paycheck. Remember, this is your money coming on your paycheck so don’t get screwed! The options that a company gives you on investments might have a smaller list of investments to choose from, so the risk investment review could go quickly but you still have to do it. Simply use the 11 questions that are in this book to develop any stock symbol risk and then the other set of questions to review any types of mutual funds or index funds that you can choose from risk levels calculated. So then, if you want to change your Investment sections you can then make changes or not. It’s your money, know how it’s being invested, and its risks. If you don’t do this type of review at least once or twice in the first or second year of your job, you’re screwed! You could easily lose $200,000,- of future growth revenue because you didn’t start checking your invests early! The sooner you start, paying a little bit more attention to your investment strategy, and read this book the sooner you’ll be unscrewed! Read the book twice, but for your future, do some investment action! Or not, then you’re gonna really be screwed when you try to retire! When you go to retire, you could be living on the street poor or become part of the Hidden Homeless and be poor. I am going to teach you, my friends, how to get unscrewed when it comes to investing, so read on please. I want to help with your future happy retirement. If you don’t start right now, planning your investment strategy for your future retirement you will end up poor and on the street. Or if you don’t plan now for when you go to retire in 35 or 40 years, you will end up poor in the group of hidden homeless. You should be scared.

Retirees,-it’s never too late to become more active and have more education about how your retirement dollars are being invested. I am 70 years young now and I sure wish I knew all this information when I was 20 years old. If you have grandkids, I strongly suggest you buy them this book and give it to them for Christmas or a lot cheaper download it for them on an e-reader book. I am just so sick,- that no one is teaching the youth how to invest it’s terrible. In almost all cases opening a retirement investment account or even just an investment account is free. Now on all retirement, investment firms or companies that are handling your retirement dollars usually have many options of index fund and mutual funds stocks or bond they will recommend. The real question as a retiree is, how did they determine what your money is being invested in and is it really the best option for you. Here’s another question you are really voting with your retirement dollars. So ask yourself what type of companies are they investing your retirement money into and is it in line with your personal beliefs? Because your retirement advisor wears a suit and a tie and is in a big office doesn’t mean he’s/she’s is a lot smarter investor than you will become by reading this book. Yes, you need to read the whole book maybe twice. You work so hard for your retirement dollars. Remember, it’s your money fight for your money. Wake up!! Request from your investment company, a list of the stock symbols of where all your money, emphasis on your money,- is being invested. When you get home, have your cuppa coffee or organic tea and then begin the process to review your retirement investments selections. If you have some investments in stock, use the stock risk assessment, 11 questions or whatever questions you develop to get a risk rating on your stocks. If you’re invest in an index fund or mutual funds, use the questions, I developed to get a risk rating on your index fund or mutual funds or some kind of review financially you developed which is similar to what I present. Use the bigger checklist to evaluate your mutual funds, index funds or bond funds as described later in the book. If you’re not invested in any index funds, ask your advisor why?? Index funds are possible good investment option and they have low expense ratio fees charged to your account. Expense ratio fees for lack of a better term are hidden cost charged to your account. Also, ask your advisor and stick to your question. How much money do they charge you out of your account,- if your funds lose money? Be forceful with your questions. Now, back to the review. Lets say that you’ve done this review, go take your wife or partner or a friend out for a nice dinner to celebrate because you are a lot smarter investor already. Yes, go out and have a little fun, you’re doing great. Now, when you get back home the next morning, maybe just a cup of organic tea review the numbers again and understand how all your investments are invested. Once you have your ratings and your review, think of the questions you want to ask your financial advisor in your next meeting which you will schedule within a week! You must schedule an early,- meeting with your advisor especially if you have concerns about how your retirement dollars are being invested. As a retiree at this point in your life, you do not want to get screwed. Or another way, how your retirement dollars are being voted into various company types. There is a good chance the longer you wait for a meeting, the more money you’re going to lose or even pay hidden fees. Wake up! Schedule a meeting with your advisor. Or I can say respectfully you are screwed too!!! It saddens me and hurts me. It makes me feel sick, that so many people don’t know how their investing dollars are being invested and that’s you’re giving up the biggest voting,- right you have as a free citizen. Today in 2024 you have the easiest tools to check your investments so you don’t,- get screwed. It is so sad because it’s a you’re retirement money. You worked so hard for your money. If you don’t get up and fight for your retirement man you’re just screwed. And if you’re paying for an investor, tell them, you want them to calculate, using the information in the book, a risk grading on all your investments. If you’re paid investment advisor says oh no we can’t do that. You seriously may want to consider going to a different company. Remember, it’s your money. I am going to teach you, my friends, how to get unscrewed when it comes to investing, so read on.

High school students&Teachers,- You have the best opportunity in your life to have a chance at more than a million dollars when you decide to retire in say 35 years! Yes, you a high school students in the year 2024 just starting out in your investment careers. In your early lifetime right now, it is so easy to invest in any stock around the world. Today you live in the most advanced, but extremely simple to use technology to invest. The key to your retirement investment or investing success is to read this book and start early investing. I am teaching you to be a much smarter way to be an investor. The bottom line is you,- by investing early, you have such a potential to maximizing your monies growth. Now, teachers, if you think you can rely just on your pension funds from teaching you’re screwed! Teachers, this is a true story when I was at lunch with a certified financial planner. Teachers, the planner said, a husband and wife both teachers relying 100% on their teacher pension plan when they retired and now they were both screwed! Teachers you doing such a wonderful job and giving so much of your life to help young children, I thank you so much. I want teachers to have a chance at a better future too. This is a true story again as a financial planner was telling me a couple of teachers could barely make their living expenses on both their pensions! Yes, teachers, who gave so much to youth,- could barely,- meet all their...

| Erscheint lt. Verlag | 13.9.2024 |

|---|---|

| Sprache | englisch |

| Themenwelt | Wirtschaft ► Betriebswirtschaft / Management |

| ISBN-13 | 979-8-3509-6669-5 / 9798350966695 |

| Haben Sie eine Frage zum Produkt? |

Größe: 5,1 MB

Digital Rights Management: ohne DRM

Dieses eBook enthält kein DRM oder Kopierschutz. Eine Weitergabe an Dritte ist jedoch rechtlich nicht zulässig, weil Sie beim Kauf nur die Rechte an der persönlichen Nutzung erwerben.

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür die kostenlose Software Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür eine kostenlose App.

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich