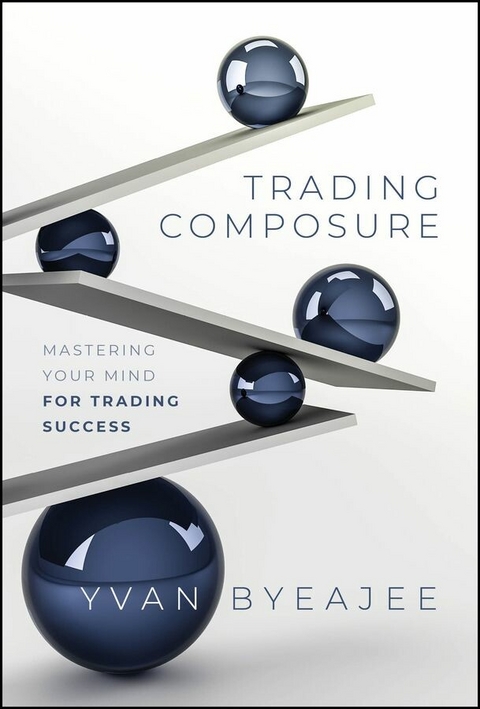

Trading Composure (eBook)

246 Seiten

Wiley (Verlag)

978-1-394-24446-1 (ISBN)

Unlock consistent trading success with the power of Trading Composure!

Embark on a transformative journey with Trading Composure: Mastering Your Mind for Trading Success. Supported by paradigm-shifting exercises, case studies, and personal anecdotes from successful career trader and trading psychology coach Yvan Byeajee, readers will learn how to befriend uncertainty and build a trading psychology edge amidst the market's dynamic dance. Whether you're a newbie trader or a seasoned one, this insightful read will reshape your trading perspective and help you deliver tangible results.

Highlights of the Book:

- Embracing Uncertainty: Learn what uncertainty is, how and why it manifests, and how to turn it to your advantage.

- The Emotional Edge: Gain a comprehensive understanding of your mental landscape and cultivate a trading psychology that thrives amidst trading's challenges.

- Discover the Winner's Traits: Uncover why some traders strike gold while others falter, and position yourself in the winning camp.

- Experiential Learning: Engage with paradigm-shifting exercises, candid anecdotes, and real-life case studies that illuminate the path to trading consistency.

If you are serious about taking your trading game to the next level, Trading Composure is your playbook. It will equip you with the psychological tools and insights for trading excellence. It is your roadmap to thriving in the uncertainty-riddled field that is trading. Dive in now!

YVAN BYEAJEE is known for his work in the field of trading psychology and personal development related to trading. His approach centers on the discipline and philosophy of mindfulness. He is the founder of the popular trading psychology blog, Trading Composure.

Preface

Composure

noun

The ability to remain serene and collected, particularly amidst adversity.

Similar: equanimity, self‐control, level‐headedness

Imagine a tranquil lake, its surface like a flawless mirror reflecting the expansive sky and surrounding forest. Even when stirred by winds, causing ripples to dance across its surface, the lake's depths remain quiet and undisturbed. The state of composure, much like the depth of that lake, embodies a state of profound inner peace and equilibrium. It's not merely about appearing calm on the surface but having an inner reservoir of stillness that isn't easily disrupted by the storms of life—or the market, in the case of trading.

In 2006, when I transitioned from the security of a regular paycheck to the exhilarating yet turbulent world of financial markets, I underestimated the pivotal role that composure plays in achieving trading success. Like many, I thought that mastery of chart analysis was the sole requirement for success in this endeavor. Operating from a mindset entirely focused on prediction, the allure of quick riches overshadowed all else. I believed that with just the right tools and strategies, I could conquer every swell and ebb of the market.

But if predicting the market is as straightforward as it seems, one might wonder why our cities aren't teeming with newly minted billionaires. Why aren't Lamborghinis lining our streets? Moreover, why do statistics consistently reveal that most traders lose more than they make (Rolf 2019)? These piercing questions never crossed my mind back then, being too blinded by the lure of vast riches. However, as the months rolled by, the reality of trading started to sink in. It became abundantly clear that charts, tools, and strategies were merely instruments in an orchestra. And like any orchestra, success wasn't just about playing each instrument flawlessly but about harmonizing them with the one element I had overlooked: my mindset.

From a young age, I knew that I was going to have a life as a risk manager. This conviction stemmed from an innate pull to understand and control the uncertainties of my life. I was raised in a broken family—divorced parents, a mother battling psychological demons, the constant specter of financial strain—and chaos indelibly etched its mark on my worldview; it became the crucible in which unproductive beliefs and patterns took root, shaping my experiences of life. Then, during my teenage years, I discovered trading, and it ignited an immediate passion and sense of purpose within me. At the time, I couldn't quite pinpoint why I was so mesmerized by the intricate world of financial markets. On the surface, it seemed to be all about the money. After all, in trading, fortunes can be made in the blink of an eye. However, with time, I've come to realize that my fascination ran much deeper than mere financial gain. It wasn't just about the potential for wealth; it was about something far more profound. It was about my innate yearning to conquer uncertainty and chaos, as those were recurring themes in my life.

Needless to say, one doesn't just “conquer chaos.” If it were as simple as that, the landscape of successful traders would be vastly different. At this juncture, success would simply hinge on crunching numbers, pinpointing chart patterns and formations, executing trades, and immediately enjoying the rewards. However, reality paints a more nuanced picture. Market dynamics are imbued with an inherent uncertainty that defies analysis and prediction. Most people don't want to hear this harsh reality—they prefer the allure of quick fixes and guaranteed profits. Nevertheless, confronting the truth of uncertainty head‐on is essential for anyone seeking long‐term success in trading.

While it may initially appear that the presence of uncertainty casts trading pursuits in a negative light, making it seem like a losing proposition, it's essential to recognize that this perception is not entirely accurate. In fact, uncertainty is precisely what creates opportunities, making trading an exquisitely profitable endeavor for those who have successfully shifted their mindset from trying to predict every market movement to playing the numbers game. In other words, success comes to those traders who can consistently execute their well‐defined trading strategy or system. Instead of aiming for perfection in each trade, they prioritize maintaining a positive expected value—a statistical concept that implies taking strategically sound trades that might not necessarily work individually but would squarely tilt the odds in their favor over time.

Now, this is simple in theory but challenging in practice. I know this all too well—embracing uncertainty is no easy feat; something about it strikes at our very core, deeply triggering us. If you want to get philosophical about it, maybe it's because uncertainty gives us existential dread and reminds us of our mortality. That is why we're caught in an endless cycle of craving certainty, even where it cannot exist. It gives us a sense of control over the absurdity of existence. Trading exemplifies this struggle exceptionally well. Most traders are inconsistent and unprofitable primarily because they are deeply intolerant of uncertainty; hence, they allow their emotions to dictate their decisions. They exhibit discipline and consistency when circumstances feel favorable, convenient, or motivating. They falter when faced with challenges, setbacks, or negative emotions. This “on and off” cycle keeps them tethered to mediocrity.

To do well as a trader, one needs not just a surface‐level acceptance of uncertainty but a profound, soul‐deep embrace of it. For me, getting to this point was a long and tedious journey that entailed acquiring new knowledge while unlearning old paradigms. I found myself frequently reassessing my entire worldview, enduring numerous highs and lows along the way. Admittedly, trading losses would affect me not only mentally but also spiritually, as muddled as this sounds. It was a lengthy process before I truly grasped, on a visceral level and not just intellectually, that one cannot conquer chaos; instead, one must surrender to it, embracing what I call “trading composure” through personal development. Therein lies the key.

In pursuing my trading dreams, I faced storms I had never anticipated—storms that weren't on any chart or in any market prediction model. They were internal tempests, fueled by overconfidence, underconfidence, despair, impatience, anger, and so on. It was during these tumultuous times that the significance of composure became crystal clear to me. As someone who appears calm and composed externally, composure had to mean something more, something deeper. It had to transcend mere surface appearances or even the archaic notion of “trading without emotions,” as frequently touted by some traders. As I discovered, composure is about maintaining clarity, perspective, and emotional stability in an ongoing way amidst the ups and downs of the market or life. To be more specific, it is the radical noninterference with the natural flow of sensory experiences. For instance, if emotions arise in response to market fluctuations, rather than ignoring them or pushing them down, you adopt an observer stance, allowing them to arise and dissipate naturally. By practicing composure—indeed, it is a practice—you cultivate a capacity to avoid impulsive reactions. This detachment, or sangfroid, as the French would say, enables actions aligned with core values rather than transient emotions or wavering convictions.

Through numerous highs and lows, the market repeatedly showed me how it distributes profits to a select few. However, some lessons take time to sink in; thus, the market reiterated these teachings until they became deeply embedded in my consciousness. As I contemplate my journey—from zero to managing a multi‐million‐dollar fund—a smile creeps onto my face as I replay the profound changes and growth I've undergone. While some core essence of “me” seems unchanging, my beliefs, desires, and perspectives have evolved significantly over the years. Previously, my mindset wasn't calibrated for trading; I grappled with a fear of change and uncertainty, which led to impulsive tendencies. Over time, I've acquired wisdom in embracing uncertainty, and while my composure is still a work in progress, it's better than it's ever been. Intrinsically, most traders simply don't possess the right mindset for trading, and this not only dims their performance but also casts a shadow over their overall well‐being. Sure, one could have the drive and requisite intelligence; one might even be naturally diligent and cool‐headed. Still, that doesn't necessarily mean that they possess a mindset that is calibrated for the realities of this game. In this book, we'll explore what it means to have such a mindset; we'll also see how to develop it.

Trading is a game one plays against oneself. While anyone can analyze the market and devise trading strategies to gain a statistical edge, the matter of who actually comes out with consistent profits is often decided by their mindset. To emerge as a consistently profitable trader in the long term, one must exhibit utmost dedication to honing their craft and mastering their mind, starting with confronting their fear of uncertainty. My aim is not merely to guide you toward realizing your potential as a trader but...

| Erscheint lt. Verlag | 9.9.2024 |

|---|---|

| Sprache | englisch |

| Themenwelt | Wirtschaft ► Betriebswirtschaft / Management |

| Schlagworte | Consistent trading • Day Trading • Forex • market uncertainty • mindfulness trading • profitable trading • Swing Trading • Technical Analysis • trading discipline • Trading Edge • trading emotions • trading mindset • trading psychology • trading risk management |

| ISBN-10 | 1-394-24446-0 / 1394244460 |

| ISBN-13 | 978-1-394-24446-1 / 9781394244461 |

| Haben Sie eine Frage zum Produkt? |

Digital Rights Management: ohne DRM

Dieses eBook enthält kein DRM oder Kopierschutz. Eine Weitergabe an Dritte ist jedoch rechtlich nicht zulässig, weil Sie beim Kauf nur die Rechte an der persönlichen Nutzung erwerben.

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür die kostenlose Software Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür eine kostenlose App.

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich