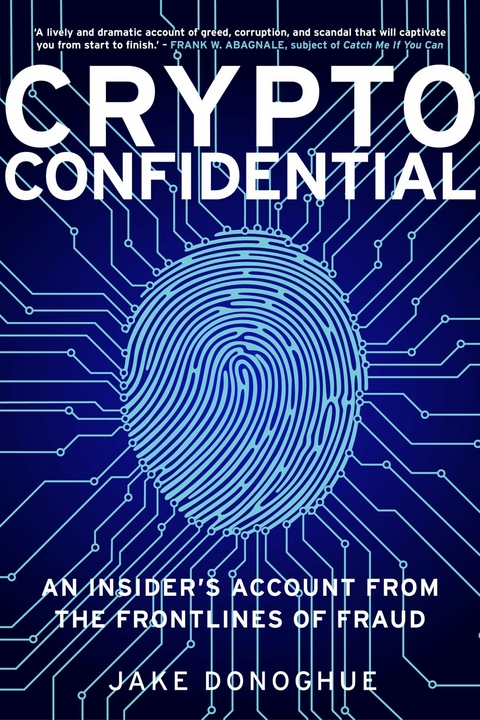

Crypto Confidential (eBook)

256 Seiten

Flint (Verlag)

978-1-80399-619-6 (ISBN)

In past lives, Jake Donoghue held numerous positions within finance, politics and PR. He went on to co-found the UK's foremost crypto marketing agency, working with the biggest names in the business. A frequent key-note speaker on the conference circuit, he has also written extensively for publications such as The Times, The FT, and The Spectator. Crypto Confidential presents his scandalous insider's account of the world's fast-growing, most tempestuous asset class.

1

Slowly, then Suddenly

‘So, Miles, how’s everything with you? You’ve been quiet this evening. Everything okay with that digital coin thing you’re working on?’

Miles glanced up from the phone he had been glued to all through dinner. His cheeks were flushed, either from awkwardness or from the heat, or both. It was a particularly warm night in August 2020. Back in those days, I was working as a PR consultant. A spinner for a large transatlantic agency, massaging the public perception of hedge funds and asset managers. The kind of firms that make billions on oil investments, and then bring people like me in to drum up press coverage for their CEO’s keynote speech at a climate conference.

That night, I was at a dinner party hosted by my old university friend Eliza, to celebrate her new job. We were all quite surprised that Miles had joined us. He was another friend of ours from university, but we hadn’t seen him much in the years since we graduated. And, in fact, we didn’t see him much when we were at uni either; he was a maths undergrad, who shunned nightclubs and student bars in preference to staying in on the weekends and studying the financial markets. He thought his flair for numbers gave him an edge, which he could use to make his fortune.

‘Yeah, no, I’m all good, thanks,’ came Miles’s reply. ‘Things are ticking along well with the crypto. Me and my cousin have just brought a head of branding on board, to design our white paper and stuff.’

Miles had been an early bitcoin evangelist. Along with an older cousin of his, he began buying it when we were students in 2016. Despite his usually reserved disposition, he was never shy when it came to talking about money. He would seize every opportunity that came his way to tell us just how much bitcoin he was holding. When the price was hovering around the $800 mark, he and his cousin had tens of thousands of pounds’ worth of it.

We all thought he was crazy. We thought the bitcoin thing was just a fad, and that he should cash out while he was ahead. That is, until bitcoin crossed the $10,000 threshold later that year. Miles was quick to inform us he had made over 1,000 per cent profit, and his bitcoin position was now worth more than a quarter of a million. At this point, he became something of a campus celebrity. The contemptuous amusement previously felt towards his bitcoin fanaticism quickly morphed into envy. And I felt the envy more than most. Miles had been exhorting me to get involved in his operation from the start, but I hadn’t taken his advice.

From then until the time of the dinner party, it had always been a bitter source of regret, and the cause of many sleepless nights spent imagining what I could have done with the small fortune I’d turned down.

As soon as he made the comment about his crypto project going well, I sat bolt upright in my seat. And I wasn’t alone in wanting to hear more; the conversations in his vicinity ground to a halt, heads turned his way, and he suddenly found himself with half a dozen pairs of eyes staring at him.

‘Oh, right,’ came the response from the girl sitting opposite him. Miles looked uncomfortable, and a bit apprehensive. He could sense the impending cross-examination. ‘I didn’t know you were into crypto. I thought bitcoin crashed and died a few years ago?’

‘It crashed, but it didn’t die. It nearly topped $19,000 at the end of 2017, but then dropped back down to around 3,000 within a year or so. Things were pretty slow for a while after that, but we’re back above ten K now.’

Miles had barely finished speaking when the next question came from someone two seats down: ‘And what do you mean you’ve just hired a head of branding? How can you be hiring anyone? I thought you were just investing?’

‘We were investing back at uni, but we’re launching our own crypto project now. We’ve been fundraising and need to bring more people on board.’

‘And what the fuck is a white paper?’

‘Umm, well it’s kind of like a document, which just explains what a crypto project does, and what benefits the token has. The bitcoin white paper set the precedent for this and was a document of great elegan—’

‘Right. Got it. Cool.’ After the initial wave of curiosity, the crowd seemed to quickly lose interest. Their previous conversations were resumed, and Miles went back to scrolling through his phone. My interest, on the other hand, had intensified. I was surprised to learn that Miles was still into crypto, and not just investing, but running what sounded like a proper company. I resolved to find out more.

I stood up and extricated Miles from the frivolous chatter taking place around the table, steering us to a quieter corner of the flat. He didn’t need much encouragement to tell me more about his project and the broader state of the crypto industry. While he floundered somewhat in social situations, he relished talking shop.

He started to explain that the crypto markets were undergoing a substantial uptick. He said that the $12,000 mark was in sight for bitcoin and reckoned it would only be a matter of time before a new all-time high was set. And it wasn’t just bitcoin that was flourishing: there was a slew of new projects entering the market. Every week, dozens of tokens were being launched. Their prices were skyrocketing, as speculators who hadn’t bought bitcoin early enough were now snapping up other tokens to get some skin in the game.

This was a renaissance period for crypto, after the 2018 slump. Commentators were calling it the ‘DeFi Summer’, with ‘DeFi’ being an abbreviation of decentralised finance. And Miles was getting in on the action. He was setting about founding his own DeFi project, called Portent Protocol.

He explained that Portent Protocol would be composed of two elements: a platform and a token. This is the typical project set up in the industry. All the money in crypto lies in launching tokens onto the market, so there’s often little incentive to launch a platform without an accompanying token. And, conversely, there’s an abundance of incentive to launch a token without the inconvenience of having to build a platform.

Portent Protocol, I learned, would essentially be a gambling platform, enabling users to bet on the future price of bitcoin. Unlike other trading or betting platforms, however, Portent wouldn’t make users pay if they made a bad bet. Users would simply state how much money they wanted to gamble, input their price prediction, and wait the given amount of time to see the outcome. If their bet was right, they would win a payout. And, if it was wrong, then they would get their initial stake back, fully intact and undiminished. Miles thought he had invented risk-free gambling and discovered a source of free money for all.

Of course it sounded too good to be true. However, Miles quickly reassured me that his project was the exception to the otherwise immutable saying around propositions of this nature. He told me that, after launch, a large amount of tokens would be set aside to pay out the betting rewards. This, combined with a small usage fee that users would pay to place their bets, would more than cover the amount needed to pay winning gamblers. It wasn’t until much later that I discovered this to be a totally implausible business model. One that would ultimately bring about the downfall of the project. However, for now, it sufficed to dismiss any doubts I had.

Miles then went on to inform me that the platform – and its fanciful logistics – weren’t his priority at the time. The token was. And the token had to be launched, he asserted, before the platform could be launched or even built. He cited a number of compelling reasons for this, chief among them being that people would not be able to use the platform without the token. It was only through buying and holding the Portent token – called TENT – that users could access this economic fairy tale of a gambling site.

I didn’t question Miles any further on this point. I didn’t cast any doubts on the necessity of launching a token. Nor did I put forward any counter arguments (for example, that his platform would work just as well if a token wasn’t used to access it, with bettors just gambling their funds directly). I simply marvelled at the entrepreneurship of it all, impressed to think of a 25-year-old peer as a ‘founder’ of anything, let alone something as esoteric and explosive as a cryptocurrency.

After I lathered the praise on thick, Miles carried on justifying his project and the practices of the industry in general. He started to talk at length about why crypto tokens are launched, explaining that tokens typically serve two functions: ‘access’ and ‘governance’. The former of these he had already covered with the spurious argument around needing tokens to use platforms, thereby lending the tokens a facade of utility and drumming up demand for people to buy them. The question of ‘governance’ is slightly more nuanced. But while it may appear more convincing on the surface, at heart this concept is just as fundamentally flawed.

Essentially, ‘governance’ means decision making. Token holders, in many projects, are given the right to vote on decisions affecting the project in question. As a user, your voting power is often proportionate to the number of tokens you hold. These voting rights cover all manner of sins and allow for a wide range of management decisions to...

| Erscheint lt. Verlag | 22.8.2024 |

|---|---|

| Verlagsort | London |

| Sprache | englisch |

| Themenwelt | Wirtschaft |

| Schlagworte | Bernie Madoff • Binance • Bitcoin • coindesk • Corruption • Crypto Crime • crypto cult • Cryptocurrency • crytp crime • currencies • Currency trading • dogecoin • Elon Musk • financial scams • Flash Crash • Fraud • FTX • ftx collapse • geoff white • liam vaughan • luna collapse • Ponzi • professor rosa lastra • sam bankman-fried • sir john lubbock chair • The Inside Story of the Great Crypto Scam • the lazarus chair |

| ISBN-10 | 1-80399-619-6 / 1803996196 |

| ISBN-13 | 978-1-80399-619-6 / 9781803996196 |

| Haben Sie eine Frage zum Produkt? |

Größe: 2,5 MB

DRM: Digitales Wasserzeichen

Dieses eBook enthält ein digitales Wasserzeichen und ist damit für Sie personalisiert. Bei einer missbräuchlichen Weitergabe des eBooks an Dritte ist eine Rückverfolgung an die Quelle möglich.

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür die kostenlose Software Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür eine kostenlose App.

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich