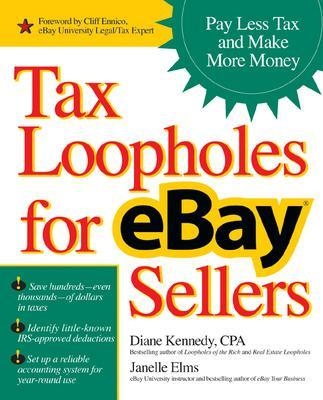

Tax Loopholes for eBay Sellers

Seiten

2006

McGraw Hill Higher Education (Verlag)

978-0-07-226242-1 (ISBN)

McGraw Hill Higher Education (Verlag)

978-0-07-226242-1 (ISBN)

Helps readers discover hundreds of little-known, completely legal tax deductions and reporting tips that are unique to eBay and designed to benefit small business owners. This book offers advice on various things from setting up a business and getting a business license to creating a bookkeeping system.

Hundreds of Legal Deductions for eBay Sellers!

If you’re an online seller, take note: now you can reduce--or even eliminate--the taxes you pay using the insider tips in Tax Loopholes for eBay Sellers. You’ll discover hundreds of little-known, completely legal tax deductions and reporting tips that are unique to eBay and designed to benefit small business owners. Learn what the IRS is looking for when sorting out a real business from a hobby and why it matters.

You’ll get step-by-step advice on everything from setting up your business and getting a business license to creating a bookkeeping system. Use the power of eBay and the tax strategies in this book to increase your wealth, protect your assets--and lower your tax bill.

How much can you fit into your eBay tax loophole?

Learn what the best tax-advantaged business structures are for your type of eBay business Get the free “The 9 Steps to Business Test” to see if your business measures up against IRS guidelines Identify and take advantage of hundreds of legal deductions for eBay business owners Determine how often you will prepare a sales and use tax report based on volume Set up a payroll system with the proper withholding deductions for all employees including yourself Create an accounting system to pay bills, input transactions, record sales, keep track of PayPal fees, and balance your business checkbook

Hundreds of Legal Deductions for eBay Sellers!

If you’re an online seller, take note: now you can reduce--or even eliminate--the taxes you pay using the insider tips in Tax Loopholes for eBay Sellers. You’ll discover hundreds of little-known, completely legal tax deductions and reporting tips that are unique to eBay and designed to benefit small business owners. Learn what the IRS is looking for when sorting out a real business from a hobby and why it matters.

You’ll get step-by-step advice on everything from setting up your business and getting a business license to creating a bookkeeping system. Use the power of eBay and the tax strategies in this book to increase your wealth, protect your assets--and lower your tax bill.

How much can you fit into your eBay tax loophole?

Learn what the best tax-advantaged business structures are for your type of eBay business Get the free “The 9 Steps to Business Test” to see if your business measures up against IRS guidelines Identify and take advantage of hundreds of legal deductions for eBay business owners Determine how often you will prepare a sales and use tax report based on volume Set up a payroll system with the proper withholding deductions for all employees including yourself Create an accounting system to pay bills, input transactions, record sales, keep track of PayPal fees, and balance your business checkbook

McGraw-Hill authors represent the leading experts in their fields and are dedicated to improving the lives, careers, and interests of readers worldwide McGraw-Hill authors represent the leading experts in their fields and are dedicated to improving the lives, careers, and interests of readers worldwide

| Erscheint lt. Verlag | 16.1.2006 |

|---|---|

| Zusatzinfo | 100 Illustrations |

| Verlagsort | London |

| Sprache | englisch |

| Maße | 183 x 229 mm |

| Gewicht | 523 g |

| Themenwelt | Recht / Steuern ► Steuern / Steuerrecht |

| Wirtschaft ► Betriebswirtschaft / Management ► Marketing / Vertrieb | |

| Wirtschaft ► Volkswirtschaftslehre ► Wirtschaftspolitik | |

| ISBN-10 | 0-07-226242-7 / 0072262427 |

| ISBN-13 | 978-0-07-226242-1 / 9780072262421 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

Grundlagen marktorientierter Unternehmensführung : Konzepte, …

Buch (2024)

Springer Gabler (Verlag)

49,99 €

Aufgaben, Werkzeuge und Erfolgsfaktoren

Buch | Softcover (2023)

Vahlen (Verlag)

21,90 €