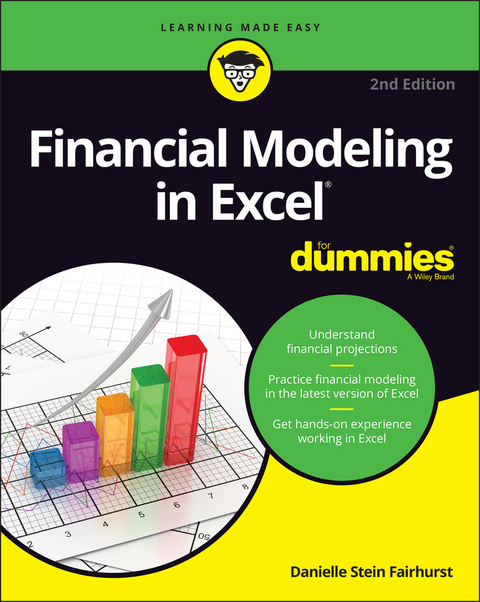

Financial Modeling in Excel For Dummies (eBook)

352 Seiten

John Wiley & Sons (Verlag)

978-1-119-84453-2 (ISBN)

Interested in learning how to build practical financial models and forecasts but concerned that you don't have the math skills or technical know-how? We've got you covered! Financial decision-making has never been easier than with Financial Modeling in Excel For Dummies. Whether you work at a mom-and-pop retail store or a multinational corporation, you can learn how to build budgets, project your profits into the future, model capital depreciation, value your assets, and more.

You'll learn by doing as this book walks you through practical, hands-on exercises to help you build powerful models using just a regular version of Excel, which you've probably already got on your PC. You'll also:

* Master the tools and strategies that help you draw insights from numbers and data you've already got

* Build a successful financial model from scratch, or work with and modify an existing one to your liking

* Create new and unexpected business strategies with the ideas and conclusions you generate with scenario analysis

Don't go buying specialized software or hiring that expensive consultant when you don't need either one. If you've got this book and a working version of Microsoft Excel, you've got all the tools you need to build sophisticated and useful financial models in no time!

Danielle Stein Fairhurstis a Sydney-based financial modeling consultant who helps her clients create meaningful financial models for business analysis. She is regularly engaged around Australia and globally as a speaker and course facilitator. She received the Microsoft MVP Award in 2021 in recognition of her technical expertise and contributions to the community.

Introduction 1

Part 1: Getting Started with Financial Modeling 5

Chapter 1: Introducing Financial Modeling 7

Chapter 2: Getting Acquainted with Excel 15

Chapter 3: Planning and Designing Your Financial Model 35

Chapter 4: Building a Financial Model by the Rulebook 53

Chapter 5: Using Someone Else's Financial Model 71

Part 2: Diving Deep into Excel 97

Chapter 6: Excel Tools and Techniques for Financial Modeling 99

Chapter 7: Using Functions in Excel 131

Chapter 8: Applying Scenarios to Your Financial Model 173

Chapter 9: Charting and Presenting Model Output 195

Part 3: Building Your Financial Model 227

Chapter 10: Building an Integrated Financial Statements Model 229

Chapter 11: Building a Discounted Cash Flow Valuation 263

Chapter 12: Budgeting for Capital Expenditure and Depreciation 273

Part 4: The Part of Tens 291

Chapter 13: Ten Strategies for Reducing Error 293

Chapter 14: Ten Common Pitfalls to Avoid 303

Index 315

| Erscheint lt. Verlag | 14.12.2021 |

|---|---|

| Sprache | englisch |

| Themenwelt | Informatik ► Office Programme ► Excel |

| Informatik ► Office Programme ► Outlook | |

| Recht / Steuern ► Wirtschaftsrecht | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Schlagworte | Computer-Ratgeber • End-User Computing • Excel • Financial Modelling • Microsoft Excel |

| ISBN-10 | 1-119-84453-3 / 1119844533 |

| ISBN-13 | 978-1-119-84453-2 / 9781119844532 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Größe: 19,5 MB

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich