Sustainability Insights For Electric Power Sector Transformation (eBook)

320 Seiten

Bookbaby (Verlag)

978-1-0983-8476-0 (ISBN)

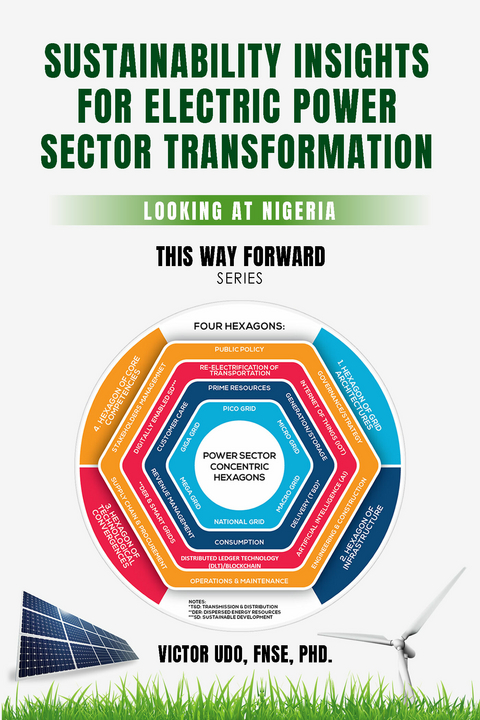

This book presents the electric power sector as the combination of Alternating Current (AC) and Direct Current (DC) systems into an infrastructural value chain managed by a value constellation of stakeholders. The demand for global sustainability and emerging technological convergences are synergizing to transform the sector towards decarbonization enabled by digitalization and decentralization. Sustainability insights on the simultaneously evolutionary and revolutionary processes that are helping the electric power sector to improve is provided by using Nigeria as a metaphor of underperformance. Effective application of these insights will encourage a leapfrog into transformational service provisioning for customers and the public in general. Presently across the globe (in most modern societies), AC and DC generation and utilization/consumption of electricity occurs as large-scale integrated systems - known as the electric power infrastructure or grid. Such large-scale grid infrastructure requires certain competencies to develop, implement and manage effectively. With new technologies and the increasing demand for sustainability, this mostly centralized grid approach is transitioning from the existing to an emerging architecture. Both the existing and the emerging grid architecture require core competency and human development. The electric power sector provides services from the local to global (villages, communities, localities, state/provinces, regions, nations and internationally) as an infrastructural value chain/constellation. With appropriate leadership, these infrastructural value chain and constellation of stakeholder ensure customer satisfaction while enabling social sustainability, technological sustainability and environmental sustainability. Technology convergence is driving the transformation of the sector. The two domains that determine the success of functional electric power sectors are covered in the book. These are the infrastructural value chain and utility services competencies. Contemporarily, both domains are being transformed by synergistic impacts of technological convergence and the emerging hierarchical grid architecture. The book summarizes these changes as four groups of concentric hexagons - grid architecture, infrastructure, technological convergence and core competencies. The first which is Hexagon of Grid Architecture includes Giga, Mega, National, Macro, Micro and Pico/Nano grids. Critical sub-systems in the sector are covered as the second Hexagon of Infrastructure including prime resources, generation/storage, deliver ((transmission/ distribution), utilization/consumption, revenue collection and customer care. The third is Hexagon of Technological Convergences which include distributed energy resources (DER)/smart grids, re-electrification of transportation, internet of things (IoT), distributed ledger technology (DLT)/blockchain and digitally enabled sustainable development (DESD). Hexagon of Core Competencies is the fourth in the group and the most important aspect of the electric power sector. It has to do with people - human capital in critical areas including public policy, corporate governance, strategic management, engineering, design/construction, supply chain/procurements, stakeholders' relationships management, finance, accounting/administration and operations, scheduling/maintenance.

| Erscheint lt. Verlag | 10.6.2021 |

|---|---|

| Sprache | englisch |

| Themenwelt | Wirtschaft |

| ISBN-10 | 1-0983-8476-8 / 1098384768 |

| ISBN-13 | 978-1-0983-8476-0 / 9781098384760 |

| Haben Sie eine Frage zum Produkt? |

Größe: 20,4 MB

Digital Rights Management: ohne DRM

Dieses eBook enthält kein DRM oder Kopierschutz. Eine Weitergabe an Dritte ist jedoch rechtlich nicht zulässig, weil Sie beim Kauf nur die Rechte an der persönlichen Nutzung erwerben.

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür die kostenlose Software Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür eine kostenlose App.

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich