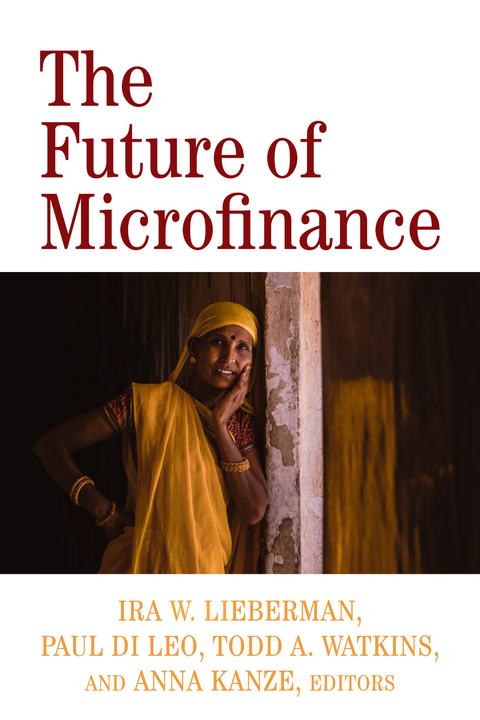

Future of Microfinance (eBook)

491 Seiten

Brookings Institution Press (Verlag)

978-0-8157-3764-3 (ISBN)

lt;div>

Ira W. Lieberman was the founding director of the CGAP Secretariat, the de facto secretariat for the microfinance sector globally. He has continued to work on and write about microfinance over the past twenty-five years. He is also author of In Good Times Prepare for Crisis: From the Great Depression to the Great Recession; Sovereign Debt Crises and Their Resolution (Brookings, 2018).

Paul DiLeo is a managing director of Grassroots Capital Management.

Todd A. Watkins is professor of economics and executive director of the Martindale Center for the Study of Private Enterprise at Lehigh University. He is the author of Introduction to Microfinance and co-editor of the book Moving Beyond Storytelling: Emerging Research in Microfinance.

Anna Kanze is a managing director of Grassroots Capital Management.

Contents:

Foreword

Preface

Acknowledgments

Abbreviations

Introduction, Paul DiLeo and Jose Ruisanchez

Section I: Background

1. The Growth and Commercial Evolution of Microfinance, Ira W. Lieberman

Section II: Where We Are Now—What Is Needed in the Future

2. The Changing Face of Microfinance and the Role of Funders: Financing the Future, Paul DiLeo and Anna Kanze

Vision Statement. Fifteen Years of Financing MFIs: From Microcredit to SDG Integration, Roland Dominicé

3. The Future of Microcredit Depends on Social Investors, Timothy N. Ogden

4. Microfinance Industry Concentration and the Role of Large-Scale and Profitable MFIs, Todd A. Watkins

5. The Future of Microfinance as Knowledge Management: The Experience of the BBVA Microfinance Foundation, Claudio Gonzalez-Vega

6. Refocusing on Customer Value: Meaningful Inclusion through Positive Partnerships, Gerhard Coetzee

7. Understanding the Impact of Microcredit, Timothy N. Ogden

Section III: The Challenge of Technology and New Product Innovation and Development

8. Microfinance in the Age of Digital Finance, Momina Aijazuddin and Matthew Brown

Vision Statement. Microfinance and Digital Finance, Greta Bull

9. Governance in the Digital Age: Responsible Finance for Digital Inclusion, Lory Camba Opem

10. Product Diversification: Consumer Loans for Education and Housing, Alex Silva

11. Insurance for Development: How Has It Evolved and Where Is It Going? Craig Churchill and Aparna Dalal

Section IV: A Geographic Perspective

12. Asia and the Pacific: Tremendous Progress, but Hundreds of Millions Yet to Serve, Jennifer Isern

13. Financial Inclusion in India—A Himalayan Feat, Jennifer Isern

14. Inclusive Financial Development in China, Enjiang Cheng

15. The Future of Microfinance in Africa: Differentiating East and West, Renée Chao-Beroff and Kimanthi Mutua

Vision Statement. The Future of Microfinance in Africa, Renée Chao-Beroff

16. Latin America and the Caribbean: The Journey, the Gap, and a Vision of the New Microfinance Revolution, Jose Ruisanchez

Appendix: What the Data Tell Us, Blaine Stephens and Nikhil Gehani

Glossary

Contributors

Index

| Erscheint lt. Verlag | 30.6.2020 |

|---|---|

| Zusatzinfo | 30 Illustrations including: - 30 Tables. |

| Verlagsort | Washington |

| Sprache | englisch |

| Themenwelt | Sachbuch/Ratgeber ► Freizeit / Hobby ► Sammeln / Sammlerkataloge |

| Wirtschaft ► Allgemeines / Lexika | |

| Wirtschaft ► Betriebswirtschaft / Management ► Allgemeines / Lexika | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Wirtschaft ► Betriebswirtschaft / Management ► Unternehmensführung / Management | |

| Wirtschaft ► Volkswirtschaftslehre | |

| Schlagworte | Anna Kanze • Bangladesh • bangladesh, non-governmental organizations • cgap • Economic Development • Entrepreneurs • Financial Services • grassroots capital • Ira Lieberman • Microfinance • Micro Loans • Mobile Banking • NGOs • Non-governmental organizations • Paul DiLeo • Small Business • The Future of Microfinance • Todd Watkins |

| ISBN-10 | 0-8157-3764-5 / 0815737645 |

| ISBN-13 | 978-0-8157-3764-3 / 9780815737643 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich