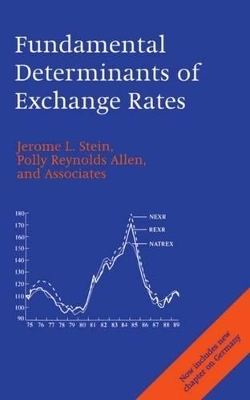

Fundamental Determinants of Exchange Rates

Seiten

1998

Oxford University Press (Verlag)

978-0-19-829306-4 (ISBN)

Oxford University Press (Verlag)

978-0-19-829306-4 (ISBN)

The Natural Real Exchange Rate model (NATREX) taken in this book explains the medium- to longer-term evolution of the real exchange rate and current account in terms of economic fundamentals. This book applies it to the US, the G10 countries, Australia, Latin America, France and Germany.

Existing models fail to explain the large fluctuations in the real exchange rates of most currencies over the past twenty years. The Natural Real Exchange Rate approach (NATREX) taken here offers an alternative paradigm to those which focus on short-run movements of nominal eschange rates, purchasing power parity of the representative agent intertemporal optimization models. Yet it is also neo-classical in its stress upon the accepted fundamentals driving a real economy. It concentrates on the real exchange rate, and explains medium- tolong-run movements in equilibrium real exchange rates in terms of fundamental variables: the productivity of capital and social (public plus private) thrift at home and abroad. The NATREX approach is a family of growth models, each tailored to the characteristics of the countries considered. The authors explain the real international value of the US dollar relativ to the G10 countries, and the US current account. These are two large economies. The model is also applied to small economies, where it explains the real value of the Australian dollar and the Latin American currencies relative to the US dollar. The model is relevant for developing countries where the foreign debt is a concern. Finally, it is applied to two medium-sized economies to explain the bilateral exchange rate between the French franc and the Deutsche Mark.

The authors demonstrate both the promise of the NATREX model and its applicability to economies large and small. Alongside the analysis, econometrics, and technical details of these case studies, the introductory chapter explains in accessible terms the rationale behind the approach. The mix of theory and empirical evidence makes this book relevant to academics and advanced graduate students, and to central banks, ministries of finance, and those concerned with the foreign debt of developing countries.

Existing models fail to explain the large fluctuations in the real exchange rates of most currencies over the past twenty years. The Natural Real Exchange Rate approach (NATREX) taken here offers an alternative paradigm to those which focus on short-run movements of nominal eschange rates, purchasing power parity of the representative agent intertemporal optimization models. Yet it is also neo-classical in its stress upon the accepted fundamentals driving a real economy. It concentrates on the real exchange rate, and explains medium- tolong-run movements in equilibrium real exchange rates in terms of fundamental variables: the productivity of capital and social (public plus private) thrift at home and abroad. The NATREX approach is a family of growth models, each tailored to the characteristics of the countries considered. The authors explain the real international value of the US dollar relativ to the G10 countries, and the US current account. These are two large economies. The model is also applied to small economies, where it explains the real value of the Australian dollar and the Latin American currencies relative to the US dollar. The model is relevant for developing countries where the foreign debt is a concern. Finally, it is applied to two medium-sized economies to explain the bilateral exchange rate between the French franc and the Deutsche Mark.

The authors demonstrate both the promise of the NATREX model and its applicability to economies large and small. Alongside the analysis, econometrics, and technical details of these case studies, the introductory chapter explains in accessible terms the rationale behind the approach. The mix of theory and empirical evidence makes this book relevant to academics and advanced graduate students, and to central banks, ministries of finance, and those concerned with the foreign debt of developing countries.

1. The Economic and Policy Implications of the Natural Real Exchange Rate (NATREX) Models ; 2. The Natural Real Exchange Rate of the United States Dollar, and Determinants of Capital Flows ; 3. The Dynamics of the Real Exchange Rate and Foreign Debt in a Small Open Economy: The Case of Australia ; 4. The Natural Real Exchange Rate between the French Franc and the Deutsche Mark: Implications for Monetary Union ; 5. The Equilibrium Real Exchange Rate: Theory and Evidence for Latin America ; Appendix: International Finance Theory and Empirical Reality

| Erscheint lt. Verlag | 30.4.1998 |

|---|---|

| Zusatzinfo | 23 figures, 28 tables |

| Verlagsort | Oxford |

| Sprache | englisch |

| Maße | 139 x 216 mm |

| Gewicht | 358 g |

| Themenwelt | Wirtschaft ► Volkswirtschaftslehre ► Finanzwissenschaft |

| Wirtschaft ► Volkswirtschaftslehre ► Makroökonomie | |

| ISBN-10 | 0-19-829306-2 / 0198293062 |

| ISBN-13 | 978-0-19-829306-4 / 9780198293064 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

Wie Bitcoin, Ether und digitaler Euro unsere Wirtschaft …

Buch | Softcover (2022)

Schäffer-Poeschel (Verlag)

29,95 €

New Foundations

Buch | Softcover (2022)

Edward Elgar Publishing Ltd (Verlag)

64,75 €

and why it doesn't work the way we think it does

Buch | Softcover (2023)

Pan Books (Verlag)

13,70 €