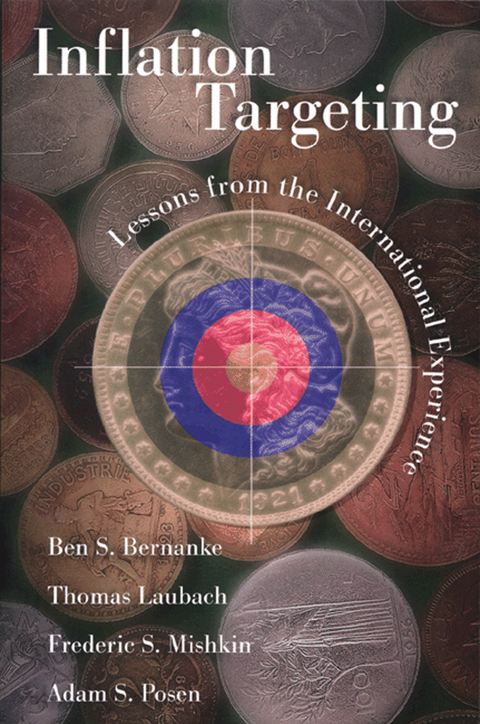

Inflation Targeting (eBook)

392 Seiten

Princeton University Press (Verlag)

978-0-691-18739-6 (ISBN)

Ben S. Bernanke is Howard Harrison and Gabrielle Snyder Beck Professor of Economics and Public Affairs at Princeton University. Thomas Laubach is an economist at the Federal Reserve Bank of Kansas City. Frederic S. Mishkin is A. Barton Hepburn Professor of Economics at the Graduate School of Business, Columbia University, and former Director of Research at the Federal Reserve Bank of New York. Adam S. Posen is Research Associate at the Institute for International Economics.

| Erscheint lt. Verlag | 5.6.2018 |

|---|---|

| Verlagsort | Princeton |

| Sprache | englisch |

| Themenwelt | Wirtschaft |

| Schlagworte | And Interest • balance of trade • Bank for International Settlements • Basis Point • Behavioral Economics • Black Wednesday • Bond Yield • Broad money • Central Bank • Comparative Advantage • Consumer confidence index • Convertibility plan • core inflation • Credit (finance) • Currency • Currency intervention • debt deflation • Debt Overhang • Default (finance) • Deutsche Bundesbank • Devaluation • discretionary policy • disinflation • Downside Risk • Economic Growth • Economic indicator • economic recovery • Economics • European Exchange Rate Mechanism • European Monetary System • Exchange Rate • Expansionary Policy • Export Performance • Export subsidy • Financial Account • financial fragility • Fiscal imbalance • Fiscal Policy • global recession • Government bond • Government Debt • Headline inflation • indexation • Inflation • Inflationary bias • Inflation Targeting • Interest Cost • Interest Rate • International Monetary Fund • Investment • labour market flexibility • Liberalization • Long run and short run • Macroeconomics • Market Indicators • Market rate • monetary authority • monetary policy • Monetary Reform • Monetary Theory • Money illusion • Money multiplier • Output Gap • Overnight rate • Phillips Curve • Plaza Accord • Policy • price change • price level • Profit (economics) • Public Expenditure • purchasing power • Purchasing Power Parity • Quantitative Easing • Quantity theory of money • rationing • real gross domestic product • Real interest rate • Real versus nominal value (economics) • real wages • Recession • Rediscount • Repurchase Agreement • Retail Price Index • Risk • Risk Premium • rogernomics • RPIX • Sacrifice Ratio • Speculative attack • stabilization policy • Substitution bias • Supply shock • Tax • Tax Cut • Tight Monetary Policy • Unemployment • upward spiral • write-off • Yield spread |

| ISBN-10 | 0-691-18739-8 / 0691187398 |

| ISBN-13 | 978-0-691-18739-6 / 9780691187396 |

| Haben Sie eine Frage zum Produkt? |

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich