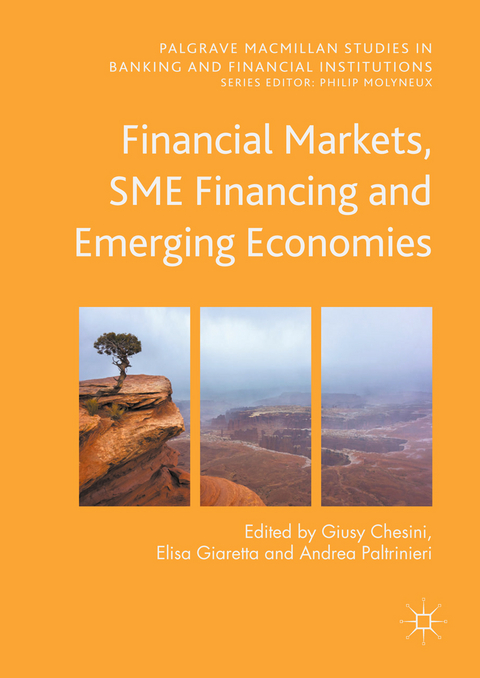

Financial Markets, SME Financing and Emerging Economies (eBook)

XI, 159 Seiten

Springer International Publishing (Verlag)

978-3-319-54891-3 (ISBN)

This book investigates small and medium sized enterprises (SMEs) access to credit, the earning quality, and the cost of debt in the European Union. It also examines two important risk measures in financial markets: the volatility index (VIX) and Credit Default Swaps (CDS). Finally, it deep dives inside one of the most important emerging markets, China, to assess monetary policy and the relationship between financial institutions and real estate firms. This work will appeal to both academics and practitioners in the areas of SME financing, financial markets and emerging economies.

Giusy Chesini is Associate Professor in Banking and Finance at the University of Verona, Italy. She holds a PhD in financial markets and intermediaries from the University of Bergamo, Italy. Giusy is also the author of several papers and books related to the evolution of financial intermediation. Her research topics include financial markets, stock exchanges, banking and corporate finance.

Elisa Giaretta is a Research Fellow at the University of Verona, Italy, where she received a PhD in Business Administration and Management. She works in the 'Polo Scientifico e Didattico di Studi sull'Impresa', an academic centre focused on the analysis of Italian enterprises. Her research topics include private equity, companies' networks and bank risks.

Andrea Paltrinieri is Assistant Professor in Banking and Finance at the University of Udine, Italy. He holds a PhD in Business Administration from the University of Verona, Italy. Research topics include asset management and institutional investors, with a particular focus on sovereign wealth funds, Islamic finance and the relative financial instruments such as sukuk, commodity markets and exchange traded products.

Giusy Chesini is Associate Professor in Banking and Finance at the University of Verona, Italy. She holds a PhD in financial markets and intermediaries from the University of Bergamo, Italy. Giusy is also the author of several papers and books related to the evolution of financial intermediation. Her research topics include financial markets, stock exchanges, banking and corporate finance.Elisa Giaretta is a Research Fellow at the University of Verona, Italy, where she received a PhD in Business Administration and Management. She works in the ‘Polo Scientifico e Didattico di Studi sull’Impresa’, an academic centre focused on the analysis of Italian enterprises. Her research topics include private equity, companies’ networks and bank risks. Andrea Paltrinieri is Assistant Professor in Banking and Finance at the University of Udine, Italy. He holds a PhD in Business Administration from the University of Verona, Italy. Research topics include asset management and institutional investors, with a particular focus on sovereign wealth funds, Islamic finance and the relative financial instruments such as sukuk, commodity markets and exchange traded products.

Chapter 1: Credit conditions and UK SMEs: An empirical investigation.- Chapter 2: Earning quality and the cost of debt of SMEs.-Chapter 3: Which factors determine credit availability? Evidence from the current crisis.- Chapter 4: What is and what is not regulatory arbitrage? A review of the literature in search for an operative definition.- Chapter 5: Forecasting models and probabilistic sensitivity analysis: an application to bank’s risk appetite thresholds within the Risk Appetite Framework.- Chapter 6: Forecasting volatility and computing value-at-risk with the VIX index: is it worthwhile?- Chapter 7: The determinants of CDS spreads: the case of banks.- Chapter 8: Liquidity Co-movement between Financial Institutions and Real Estate Firms: Evidence from China.- Chapter 9: China’s policy transition from trilemma to quadrilemma in light of its “new normal” economy.”

| Erscheint lt. Verlag | 11.10.2017 |

|---|---|

| Reihe/Serie | Palgrave Macmillan Studies in Banking and Financial Institutions | Palgrave Macmillan Studies in Banking and Financial Institutions |

| Zusatzinfo | XI, 159 p. 13 illus. |

| Verlagsort | Cham |

| Sprache | englisch |

| Themenwelt | Wirtschaft |

| Schlagworte | Banking • cost of debt • Financial Crisis • Financial Markets • liquidity risk • monetary policy • risk measure • Securitization • SMEs • Volatlity • Z-Score |

| ISBN-10 | 3-319-54891-3 / 3319548913 |

| ISBN-13 | 978-3-319-54891-3 / 9783319548913 |

| Haben Sie eine Frage zum Produkt? |

Größe: 2,8 MB

DRM: Digitales Wasserzeichen

Dieses eBook enthält ein digitales Wasserzeichen und ist damit für Sie personalisiert. Bei einer missbräuchlichen Weitergabe des eBooks an Dritte ist eine Rückverfolgung an die Quelle möglich.

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür einen PDF-Viewer - z.B. den Adobe Reader oder Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür einen PDF-Viewer - z.B. die kostenlose Adobe Digital Editions-App.

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich