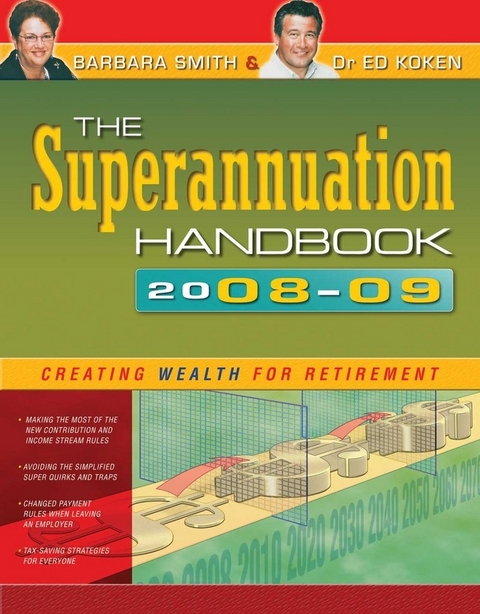

Superannuation Handbook 2008-09 (eBook)

400 Seiten

Wiley (Verlag)

978-1-74216-921-7 (ISBN)

- Comprehensive single-volume reference on all aspects of superannuation, from established expert authors

- Now in its sixth year of publication

- Published each year in August so that the latest changes to super, including those announced for the May Federal Budget, are covered

- Plain-English, concise explanations and over 100 practical examples to illustrate money-saving, wealth-creating strategies

- Barbara Smith won an Order of Australia in 2006 for her contribution to the Australian financial services industry, reinforcing her reputation as a trusted and reputable adviser and commentator

The authors are tax, superannuation and self managed superannuation fund specialists. Barbara Smith AM, CPA (Taxation), CFP, FTIA, MTax, Mbus, Bed, Dip Financial Planning is a leading authority on superannuation and retirement planning in Australia.

Dr. Ed Koken is a PhD, MBA, MMT, MSc, BSc, is an accountant, a registered tax agent and a certified financial planner. Together they run Oasis Wealth www.oasiswealth.com.au

Each year The Superannuation Handbook is fully revised and updated to reflect the many changes to superannuation rules, the ways you can save for retirement and the best way to eventually access your savings without it costing you thousands in fees. It includes information on the myriad changes that have been recently proposed and come into effect after July 1, including the changes that effect self-managed superannuation funds and small business owners. Comprehensive single-volume reference on all aspects of superannuation, from established expert authors Now in its sixth year of publication Published each year in August so that the latest changes to super, including those announced for the May Federal Budget, are covered Plain-English, concise explanations and over 100 practical examples to illustrate money-saving, wealth-creating strategies Barbara Smith won an Order of Australia in 2006 for her contribution to the Australian financial services industry, reinforcing her reputation as a trusted and reputable adviser and commentator

| Erscheint lt. Verlag | 19.9.2011 |

|---|---|

| Sprache | englisch |

| Themenwelt | Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Geld / Bank / Börse |

| Sachbuch/Ratgeber ► Gesundheit / Leben / Psychologie ► Lebenshilfe / Lebensführung | |

| Recht / Steuern ► Wirtschaftsrecht | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| ISBN-10 | 1-74216-921-X / 174216921X |

| ISBN-13 | 978-1-74216-921-7 / 9781742169217 |

| Haben Sie eine Frage zum Produkt? |

Größe: 1,7 MB

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich