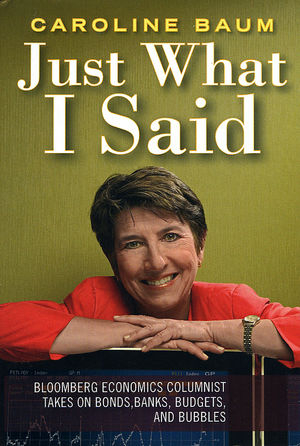

Just What I Said (eBook)

318 Seiten

John Wiley & Sons (Verlag)

978-0-470-88309-9 (ISBN)

nearly two decades, Caroline Baum has produced incisive commentary

on central bank policy, the ebbs and flows of the economy, and how

they influence the bond market. Her much sought-after, real-time

analysis is read by a devoted audience on the BLOOMBERG

PROFESSIONAL service within seconds after it appears. The word on

the Street is that reading Caroline Baum is an economic education

in itself.

This selection from her more than 1,300 Bloomberg News columns,

arranged by major themes and with new introductions by the author,

condenses and organizes that wisdom for the first time in print

form.

Caroline Baum has been a columnist at Bloomberg News since 1998. She has been writing about the economy and the bond market since 1987. In 2004 and 2005, she received first-place National Headliner Awards in the wire service/commentary category.

Preface

Acknowledgments.

Introduction.

1 Ye of Little Faith.

Why the Federal Reserve gets so much attention, yet so little

credit, for the outcomes it effects.

2 The Bubble, or This Time Really Is Different!

Like terminally ill patients, the late 1990s bubble in

technology and Internet stocks passed through the five stages of

dying: denial, anger, bargaining, depression, acceptance. It didn't

turn out any better for the market.

3 Still Nonsense After All These Years.

Driving a stake through the heart of popular delusions: Why

acts of God aren't good for growth, costs don't push up inflation,

and demand in the economy isn't finite.

4 Myths Under the Microscope.

Repeating something often enough doesn't make it true. You'd

never know it from the misconceptions that survive about tax cuts,

trade, and liquidity traps.

5 First Principles.

How the Pilgrims learned about the value of incentives, and

how backyard birding sheds light on the law of supply and

demand.

6 Understanding the Yield Curve.

One rate is set by the central bank, the other by the market.

The message couldn't be simpler, which is probably why most

economists ignore it.

7 The "Political" Economy.

What happens when the heavy hand of government tries to

intrude on the invisible hand of the market.

8 Sir Alan.

To some, he's a man for all seasons, a knight for all ages.

To others, he's the emperor with no clothes. His day job is

chairman of the Federal Reserve Board.

9 What Would We Do Without a Dollar Policy?

How an insipid slogan morphed into a policy, and why we are

stuck with it.

10 Off the Charts.

Sexagenarians bracket the big bull market in bonds, while

technical traders are blindsided by the canoe over the

waterfall.

11 Odd Ducks.

It's a challenge to ring out the year on a creative note, but

sniffing out a shaggy dog story from Petsmart is a slam

dunk.

12 Oil Things to Oil People.

We can't live without it, but we don't seem to understand it:

Why the Fed can't sign over monetary policy to OPEC.

13 Rewriting History.

Politicians never let the facts stand between them and a

little historical revisionism.

14 Men in Black.

Who are the Plunge Protection Team, and what are they doing

in the financial markets?

15 No One Else Would Write About This.

Why automated phone menus and other productivity-enhancing

devices are a headache for the consumer and an unmeasured form of

inflation.

16 Love Affair.

Why bonds like to hook up and even fall in love.

17 Bumbling Bureaucrats.

How an international lending agency reinvented itself as an

überadviser once it had outlived its purpose.

18 The 2004 Election.

Why a presidential candidate has to run as somebody, not as

anybody-but-his-opponent.

19 Readers Write Back at You.

Readers send their unedited thoughts into cyberspace, never

expecting anyone to read them or reply.

Index.

"Among her rarefied and demanding readership she has earned a reputation for timeliness, originality, knowledge, and--believe it or not--wit. How has she pulled it off? She's a reporter first and an analyst second, which means she actually knows what she's talking about, and this allows her to cut the columnizer smoke blowing to a bare minimum. She knows everybody, and fears nobody. Most important of all, she has a strong point of view, best tagged as 'classical liberal,' which equips her with a refreshing impatience with cant and self-serving obfuscation." (The Weekly Standard, 10/31/05)

"Caroline Baum is one of the few topical commentators who write

things that have lasting value. This compilation provides a history

of the economic issues of the time and timeless insights."

--Paul H. O'Neill

Former Secretary of the U.S. Treasury

"Caroline Baum is a rarity--an economics commentator who

actually understands economics and writes about it with clarity and

passion. Read her and learn! Read her and enjoy!"

--Gregory Mankiw

Professor of Economics, Harvard University

Chairman, U.S. Council of Economics Advisors, 2003-2005

"If you are interested in the Fed, interest rates, the budget

deficit, taxes, China, or anything economic under the sun, Caroline

Baum is a must-read."

--Lawrence Kudlow

Host, CNBC's Kudlow & Company

"Not many financial journalists' columns repay a reading months

or years later. Caroline Baum's knack for making complex ideas

understandable and her irreverent style make her book one of the

rare exceptions."

--Dr. Allan H. Meltzer

The Allan H. Meltzer University Professor of Political Economy,

Carnegie Mellon University

| Erscheint lt. Verlag | 9.6.2010 |

|---|---|

| Reihe/Serie | Bloomberg | Bloomberg |

| Sprache | englisch |

| Themenwelt | Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Bankbetriebslehre | |

| Wirtschaft ► Volkswirtschaftslehre ► Finanzwissenschaft | |

| Schlagworte | Economics • Volkswirtschaftslehre • Wirtschaftswissenschaften |

| ISBN-10 | 0-470-88309-X / 047088309X |

| ISBN-13 | 978-0-470-88309-9 / 9780470883099 |

| Haben Sie eine Frage zum Produkt? |

Größe: 1,2 MB

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Zusätzliches Feature: Online Lesen

Dieses eBook können Sie zusätzlich zum Download auch online im Webbrowser lesen.

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich