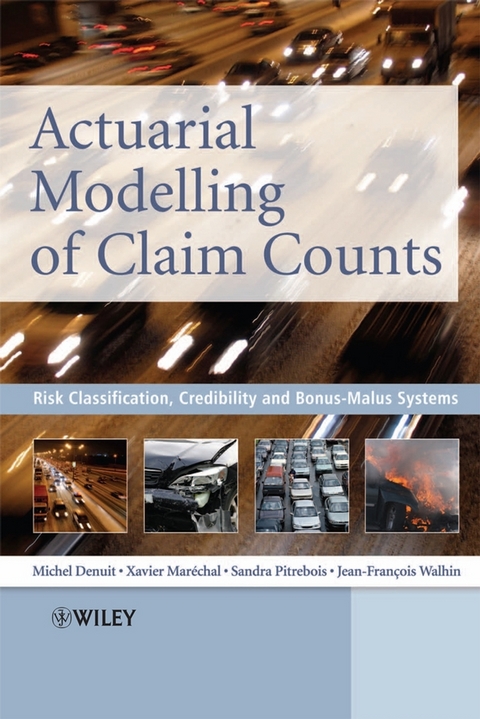

Actuarial Modelling of Claim Counts (eBook)

384 Seiten

John Wiley & Sons (Verlag)

978-0-470-51741-3 (ISBN)

calculating a motorist's insurance premium, such as age,

gender and type of vehicle. Further to these factors,

motorists' rates are subject to experience rating systems,

including credibility mechanisms and Bonus Malus systems (BMSs).

Actuarial Modelling of Claim Counts presents a

comprehensive treatment of the various experience rating systems

and their relationships with risk classification. The authors

summarize the most recent developments in the field, presenting

ratemaking systems, whilst taking into account exogenous

information.

The text:

* Offers the first self-contained, practical approach to a priori

and a posteriori ratemaking in motor insurance.

* Discusses the issues of claim frequency and claim severity,

multi-event systems, and the combinations of deductibles and

BMSs.

* Introduces recent developments in actuarial science and

exploits the generalised linear model and generalised linear mixed

model to achieve risk classification.

* Presents credibility mechanisms as refinements of commercial

BMSs.

* Provides practical applications with real data sets processed

with SAS software.

Actuarial Modelling of Claim Counts is essential reading

for students in actuarial science, as well as practicing and

academic actuaries. It is also ideally suited for professionals

involved in the insurance industry, applied mathematicians,

quantitative economists, financial engineers and statisticians.

Michel Denuit - Professor, Institute of Actuarial Science, UCL, Belgium. Michel Denuit is Professor of Statistics and Actuarial Science at the Université Catholique de Louvain, Belgium. His major fields of research are risk theory and stochastic inequalities. He has (co-)authored numerous articles that have appeared in applied and theoretical journals and served as member of the editorial board for several journals (including Insurance: Mathematics and Economics). He is a section editor on Wiley's Encyclopedia of Actuarial Science, and is the author of two previous books, one of them with Wiley. Xavier Maréchal - Université Catholique de Louvain, Belgium & CEO of Reacfin, Belgium. Sandra Pitrebois - Université Catholique de Louvain, Belgium & Secura Belgian Re, Brussels. Jean-François Walhin - Université Catholique de Louvain, Belgium & Secura Belgian Re, Brussels

Foreword.

Preface.

Notation.

Part I Modelling Claim Counts.

1 Mixed Poisson Models for Claim Numbers.

1.1 Introduction.

1.2 Probabilistic Tools.

1.3 Poisson Distribution.

1.4 Mixed Poisson Distributions.

1.5 Statistical Inference for Discrete Distributions.

1.6 Numerical Illustration.

1.7 Further Reading and Bibliographic Notes.

2 Risk Classification.

2.1 Introduction.

2.2 Descriptive Statistics for Portfolio A.

2.3 Poisson Regression Model.

2.4 Overdispersion.

2.5 Negative Binomial Regression Model.

2.6 Poisson-Inverse Gaussian Regression Model.

2.7 Poisson-LogNormal Regression Model.

2.8 Risk Classification for Portfolio A.

2.9 Ratemaking using Panel Data.

2.10 Further Reading and Bibliographic Notes.

Part II Basics of Experience Rating.

3 Credibility Models for Claim Counts.

3.1 Introduction.

3.2 Credibility Models.

3.3 Credibility Formulas with a Quadratic Loss Function.

3.4 Credibility Formulas with an Exponential Loss Function.

3.5 Dependence in the Mixed Poisson Credibility Model.

3.6 Further Reading and Bibliographic Notes.

4 Bonus-Malus Scales.

4.1 Introduction.

4.2 Modelling Bonus-Malus Systems.

4.3 Transition Probabilities.

4.4 Long-Term Behaviour of Bonus-Malus Systems.

4.5 Relativities with a Quadratic Loss Function.

4.6 Relativities with an Exponential Loss Function.

4.7 Special Bonus Rule.

4.8 Change of Scale.

4.9 Dependence in Bonus-Malus Scales.

4.10 Further Reading and Bibliographic Notes.

Part III Advances in Experience Rating.

5 Efficiency and Bonus Hunger.

5.1 Introduction.

5.2 Modelling Claim Severities.

5.3 Measures of Efficiency for Bonus-Malus Scales.

5.4 Bonus Hunger and Optimal Retention.

5.5 Further Reading and Bibliographic Notes.

6 Multi-Event Systems.

6.1 Introduction.

6.2 Multi-Event Credibility Models.

6.3 Multi-Event Bonus-Malus Scales.

6.4 Further Reading and Bibliographic Notes.

7 Bonus-Malus Systems with Varying Deductibles.

7.1 Introduction.

7.2 Distribution of the Annual Aggregate Claims.

7.3 Introducing a Deductible within a PosterioriRatemaking.

7.4 Numerical Illustrations.

7.5 Further Reading and Bibliographic Notes.

8 Transient Maximum Accuracy Criterion.

8.1 Introduction.

8.2 Transient Behaviour and Convergence of Bonus-MalusScales.

8.3 Quadratic Loss Function.

8.4 Exponential Loss Function.

8.5 Numerical Illustrations.

8.6 Super Bonus Level.

8.7 Further Reading and Bibliographic Notes.

9 Actuarial Analysis of the French Bonus-MalusSystem.

9.1 Introduction.

9.2 French Bonus-Malus System.

9.3 Partial Liability.

9.4 Further Reading and Bibliographic Notes.

Bibliography.

Index.

"An excellent text on experience rating that picks up the actuarial reader at almost every level. The authors have found an excellent balance between theory and practice." (Journal of the American Statistical Association, June 2009)

| Erscheint lt. Verlag | 27.9.2007 |

|---|---|

| Sprache | englisch |

| Themenwelt | Mathematik / Informatik ► Mathematik ► Statistik |

| Mathematik / Informatik ► Mathematik ► Wahrscheinlichkeit / Kombinatorik | |

| Recht / Steuern ► Wirtschaftsrecht | |

| Technik | |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Versicherungsbetriebslehre | |

| Schlagworte | Accounting • Finanz- u. Wirtschaftsstatistik • Rechnungswesen • Statistics • Statistics for Finance, Business & Economics • Statistik • Wirtschaftsstatistik |

| ISBN-10 | 0-470-51741-7 / 0470517417 |

| ISBN-13 | 978-0-470-51741-3 / 9780470517413 |

| Haben Sie eine Frage zum Produkt? |

Größe: 4,1 MB

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich