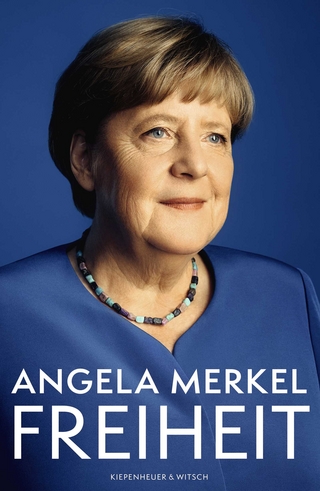

Government and Not-for-Profit Accounting

John Wiley & Sons Inc (Verlag)

978-1-119-80389-8 (ISBN)

Preface vii

1 The Government and Not- for- Profit Environment 1

How Do Governments and Not- For- Profits Compare With Businesses? 2

In Practice: Why Is State And Local Government Accounting Important? 6

What Other Characteristics of Governments and Not- For- Profits Have Accounting Implications? 9

How Do Governments Compare With Not-For- Profits? 12

What Are The Overall Purposes of Financial Reporting? 14

Who are The Users, and What are The Uses of Financial Reports? 14

What are The Specific Objectives of Financial Reporting As Set Forth By The GASB and The FASB? 17

Example: Clash Among Reporting Objectives 19

Do Differences In Accounting Principles Really Matter? 22

In Practice: Will Accounting Changes Make A Difference? 24

Who Establishes Generally Accepted Accounting Principles? 24

In Practice: Assessing the Profitability of An Athletic Program 25

In Practice: Governments and Not- For- Profits May Also Be Aggressive In Their Accounting 26

Summary 29

Key Terms In This Chapter 30

Questions For Review and Discussion 30

Exercises 31

Continuing Problem 33

Problems 33

Questions For Research, Analysis, And Discussion 37

2 Fund Accounting 38

What is a Fund? 39

What are the Key Elements of Government Financial Statements? 39

What Characterizes Funds? 41

Use of Multiple Funds to Account for An Entity 44

Basis of Accounting and Measurement Focus 45

Example: Fund Accounting in a School District 46

Major VS. Nonmajor Funds 49

How Can Funds be Combined and Consolidated? 49

What are the Main Types of a Government’s Funds? 59

What’s Notable About Each Type of Governmental Fund? 61

What’s Notable About Each Type of Proprietary Fund? 64

What’s Notable About Each Type of Fiduciary Fund? 70

What is Included in a Government’s Annual Comprehensive Financial Report (ACFR)? 71

Example: Government-Wide Statement of Activities 74

How Do the Funds and Annual Reports of Not-For-Profits Differ From Those of Governments? 75

Summary 78

Key Terms In This Chapter 80

Exercise for Review and Self-Study 80

Questions for Review and Discussion 81

Exercises 82

Continuing Problem 85

Problems 86

Questions for Research, Analysis, and Discussion 91

Solution to Exercise for Review and Self-Study 92

3 Issues of Budgeting and Control 95

What are the Key Purposes of Budgets? 96

Why is More Than One Type of Budget Necessary? 96

How are Expenditures and Revenues Classified? 98

Why are Performance Budgets Necessary? 99

What are the Key Phases of the Budget Cycle? 101

In Practice: Budgeting In The Midst of a Pandemic 103

On What Basis of Accounting are Budgets Prepared? 105

In Practice: States Balance Their Budgets the Painless Way 106

In Practice: The Cost of GAAP 107

In Practice: Balancing the Budget by Selling Assets to Yourself 108

What Cautions Must be Taken in Budget-to-Actual Comparisons? 108

How Does Budgeting in Not-For-Profit Organizations Compare with that in Governments? 111

How Do Budgets Enhance Control? 112

What are the Distinctive Ways Governments Record Their Budgets? 114

Example: Budgetary Entries 115

An Alternative Method: Crediting or Debiting the Difference Between Revenues and Expenditures to “Budgetary Control” 117

How Does Encumbrance Accounting Prevent Overspending? 117

Example: The Encumbrance Cycle—Year 1 118

Example: The Encumbrance Cycle—Year 2 120

Example: Impact of Encumbrances on Fund Balance 121

Are Budgetary and Encumbrance Entries Really Needed? 124

Summary 125

Key Terms in this Chapter 125

Exercise for Review and Self-Study 126

Questions for Review and Discussion 126

Exercises 127

Continuing Problem 131

Problems 131

Questions for Research, Analysis, and Discussion 139

Solution to Exercise for Review and Self-Study 139

4 Recognizing Revenues in Governmental Funds 141

Why and How Do Governments Use the Modified Accrual Basis? 141

What are the Main Types of Nonexchange Revenues and the Limitations on How and When They Can be Used? 145

How Should Property Taxes and Other Imposed Nonexchange Revenues be Accounted for? 146

I n Practice: In Practice: Just as it did with individuals, corona viruses make some governments

far more sick than others 146

Example: Property Taxes 148

Example: Fines 153

How Should Sales Taxes and Other Derived Tax Revenues be Accounted for? 154

Example: Sales Taxes 154

Example: Sales Taxes Collected by State 156

Example: Income Taxes 157

What are Tax Abatements and Why and How Must They be Disclosed? 159

How Should Grants and Similar Government-Mandated and Voluntary Nonexchange Revenues be Accounted For? 160

Example: Unrestricted Grant with Time Requirement 161

Example: Grant with Purpose Restriction 162

Example: Reimbursement (Eligibility Requirement) Grant 162

Example: Unrestricted Grant with Contingency Eligibility Requirement 163

Example: Endowment Gift 163

Example: Pledges 163

Example: Donations of Land for Differing Purposes 164

Example: On-Behalf Payments 167

How Should Sales of Capital Assets be Accounted For? 167

Example: Sales of Capital Assets 168

How Should Licenses, Permits, and Other Exchange Transactions be Accounted for? 169

Example: License Fees 169

How Should Governments Report Revenues in their Government-Wide Statements? 170

Summary 171

Key Terms In This Chapter 173

Exercise for Review and Self-Study 173

Questions for Review and Discussion 174

Exercises 174

Continuing Problem 178

Problems 178

Questions for Research, Analysis, and Discussion 184

Solution to Exercise for Review and Self-Study 185

5 Recognizing Expenditures in Governmental Funds 187

Hierarchical Approach to Transaction Analysis 187

How is the Accrual Concept Modified for Expenditures? 189

How Should Wages and Salaries be Accounted for? 190

Example: Wages and Salaries 190

How Should Compensated Absences Be Accounted For? 191

In Practice: Changing the Pay Date by One Day 191

Example: Vacation Leave 192

Example: Sick Leave 193

Example: Sabbatical Leave 196

How Should Pensions and Other Postemployment Benefits Be Accounted For? 197

Example: Pension Expenditure 197

How Should Claims and Judgments Be Accounted For? 198

Example: Claims and Judgments 198

How Should the Acquisition and Use of Materials and Supplies Be Accounted For? 200

Example: Supplies 200

How Should Prepayments Be Accounted For? 203

Example: Prepayments 203

How Should Capital Assets Be Accounted For? 205

Example: Capital Assets 205

Example: Installment Notes 206

Example: Capital Leases 207

How Should Interest and Principal on Long-Term Debt Be Accounted For? 208

Example: Long-term Debt 209

In Practice: California School Children May Pay for Their Own Education 210

How Should Nonexchange Expenditures be Accounted for? 212

Example: Unrestricted Grant with Time Requirement 212

Example: Grant with Purpose Restriction 213

Example: Reimbursement (Eligibility Requirement) Grant 213

How Should Interfund Transactions Be Accounted For? 214

Example: Interfund Transfer 215

Example: Interfund Purchase/Sale 215

How Should Revenues, Expenditures, and Other Financing Sources and Uses Be Reported? 218

In Practice: Is the Coronavirus Pandemic an Extraordinary or Special Event? 218

What is the Significance of the Current Financial Governmental Fund Statements? An Overview 219

Summary 220

Key Terms In This Chapter 221

Exercise for Review and Self-Study 221

Questions for Review and Discussion 222

Exercises 223

Continuing Problem 227

Problems 227

Questions for Research, Analysis, and Discussion 233

Solution to Exercise for Review and Self-Study 233

6 Accounting for Capital Projects and Debt Service 236

How do Governments Account for Capital Projects Funds? 237

Example: Bond Issue Costs 239

Example: Bond Premiums and Discounts 239

Comprehensive Example: Main Types of Transactions Accounted for in Capital Projects Funds 241

How do Governments Account for Resources Dedicated to Debt Service? 245

Comprehensive Example: Main Types of Transactions Accounted for in Debt Service Funds 246

How do Governments Handle Special Assessments? 250

In Practice: Use and Abuse of Special Assessments 252

In Practice: What We Might Learn from “Net Investment in Capital Assets” 256

Why is Arbitrage a Concern of Governments? 256

How can Governments Benefit from Debt Refundings? 258

Example: Debt Refundings 258

Example: In-Substance Defeasance 260

In Practice: Current and Advance Refundings 261

Summary 263

Key Terms in This Chapter 264

Exercise for Review and Self-Study 264

Questions for Review and Discussion 265

Exercises 265

Continuing Problem 270

Problems 270

Questions for Research, Analysis, and Discussion 277

Solution to Exercise for Review and Self-Study 278

7 Capital Assets and Investments in Marketable Securities 281

What Accounting Practices Do Governments Follow for General Capital Assets? 282

Acquiring and Placing Value on Capital Assets 285

Example: Trade-Ins 285

Why and How Should Governments Report Infrastructure? 287

In Practice: Nation’s Infrastructure Earns a Cumulative Grade of C-287

In Practice: Fair Values May (Or May not) Facilitate Sales Decisions 292

How Should Governments Account for Assets that Are Impaired? 294

Example: Restoration Approach 294

Example: Service Units Approach 295

Example: Deflated Depreciated Replacement Cost Approach 296

What Are the Critical Issues with Respect To Marketable Securities And Other Investments? 297

Investments Should Be Reported at Fair Values 297

Example: Investment Income 300

I n Practice: Some Governments May Make Suboptimal Investment Decisions in Order to Avoid Financial Statement Volatility 301

Example: Interest Income 303

In Practice: One Common-Type Derivative 305

In Practice: Investment Debacles 305

In Practice: Common Sense Investment Practices 307

Summary 307

Key Terms In This Chapter 308

Exercise for Review and Self-Study 308

Questions for Review and Discussion 309

Exercises 309

Continuing Problem 312

Problems 313

Questions for Research, Analysis, and Discussion 320

Solution to Exercise for Review and Self-Study 320

8 Long-Term Obligations 321

Why is Information on Long-Term Debt Important to Statement Users? 322

Can Governments and Not-For-Profits Go Bankrupt? 322

In Practice: It is not So Easy to Declare Municipal Bankruptcy 323

How Do Governments Account for Long-Term Obligations? 325

Example: Accounting for Bonds in Government-Wide Statements 327

In Practice: Valuing a Lottery Prize 328

What Constitutes a Government’s Long-Term Debt? 329

Example: Demand Bonds 331

Example: Bond Anticipation Notes 332

Example: Tax Anticipation Notes 333

Example: Lessee Accounting 335

Example: Lessor Accounting 336

Example: Overlapping Debt 343

In Practice: 49Ers Score Big in the Financial Arena 346

I n Practice: Tobacco Bonds Are Both Risky and Inconsistent with Government Policies 347

What Other Information Do Users Want to Know About Outstanding Debt? 347

Example: Debt Margin 349

What are Bond Ratings, and Why are They Important? 351

In Practice: Bond Ratings 352

Summary 352

Key Terms in This Chapter 354

Exercise for Review and Self-Study 354

Questions for Review and Discussion 354

Exercises 355

Continuing Problem 359

Problems 359

Questions for Research, Analysis, and Discussion 365

Solution to Exercise for Review and Self-Study 366

9 Business-Type Activities 367

What Types of Funds Involve Business-Type Activities? 368

Why Do Governments and Not-For-Profits

Engage in Business-Type Activities? 368

Should Business-Type Activities be Accounted for Differently than Governmental Activities? 369

What are the Three Basic Statements of Proprietary Fund Accounting? 371

What Accounting Issues are Unique to Enterprise Funds of Governments? 377

Example: Revenue Bond Proceeds as Restricted Assets 380

Example: Landfill Costs in an Enterprise Fund 382

Example: Pollution Remediation Costs in an Enterprise Fund 385

What are Internal Service Funds, and How are they Accounted For? 386

Example: Internal Service Fund Accounting 390

In Practice: Full-Cost Pricing May Encourage Dysfunctional Decisions 392

Accounting for Insurance Premiums 394

Example: Insurance Premiums 395

Example: Self-Insurance in a General Fund 396

How are Proprietary Funds Reported? 397

Example: Eliminating Interfund Balances and Transactions 399

PPPs and APAs 403

Example: Public-Private Partnership (PPP) 404

Example: PPP But Not a SCA 406

In Practice: Want to Own a Bridge? 409

What Do Users Want to Know About Revenue Debt? 409

Summary 411

Key Terms in This Chapter 412

Exercise for Review and Self-Study 413

Questions for Review and Discussion 413

Exercises 414

Continuing Problem 418

Problems 418

Questions for Research, Analysis, and Discussion 424

Solution to Exercise for Review and Self-Study 425

10 Pensions and Other Fiduciary Activities 426

Why is Pension Accounting so Important? 426

In Practice 428

How Do Defined Contribution Plans Differ from Defined Benefit Plans? 429

In Practice: Defined Benefit Plans Are More Efficient Than Defined Contribution Plans 430

In Practice: Can Defined Benefit Plans Be Saved? 431

What is the Relationship Between An Employer and its Pension Plan? 432

How Should the Pension Expense in Full Accrual Statements be Determined? 435

Example: The Pension Expense 437

How Should the Pension Expenditure In Governmental Funds be Determined? 441

What Special Problems Do Multiple-Employer Cost-Sharing Plans Pose? 441

How Should The Pension Plan be Accounted for? 442

What Types of Disclosures are Required? 444

How Should Post-Employment Benefits Other Than Pensions (OPEB) be Accounted for? 445

What Are Fiduciary Funds? 446

I n Practice: Difficulty of Determining Whether an Activity is Fiduciary or Governmental 451

Should Investment Income of A Permanent Fund be Reported in the Permanent Fund Itself or The Beneficiary Fund? 454

Example: Expendable Investment Income 455

Summary 455

Key Terms in This Chapter 457

Exercise for Review and Self-Study 457

Questions for Review and Discussion 458

Exercises 458

Continuing Problem 461

Problems 461

Questions for Research, Analysis, and Discussion 466

Solution to Exercise for Review and Self-Study 467

11 Issues of Reporting, Disclosure, and Financial Analysis 469

How Can a Government Prepare Government-Wide

Statements from Fund Statements? 469

Why is the Reporting Entity an Issue for Governments and Not-For-Profits? 471

Example: The Reporting Entity 472

What Criteria Have Been Established for Government Reporting Entities? 473

Example: Financially Accountable Component Units 474

Example: Fiscal Dependency 475

Example: Blended Component Units 476

Example: A Closely Affiliated Organization 479

Example: Application of Current Standards 480

What Other Elements Make Up the Annual Comprehensive Financial Report? 482

What are the Reporting Requirements for Special-Purpose Governments?

487

How Can A Government’s Fiscal Condition be Assessed? 488

I n Practice: Balanced Budget Requirements Don’t Always Result in Balanced Budgets 497

Drawing Conclusions 504

Summary 509

Key Terms in This Chapter 511

Exercise for Review and Self-Study 511

Questions for Review and Discussion 512

Exercises 512

Continuing Problem 516

Problems 516

Questions for Research, Analysis, and Discussion 520

Solution to Exercise for Review and Self-Study 521

12 Not-for-Profit Organizations 523

Who’s in Charge? 523

What Should be The Form And Content of Financial Statements? 524

In Practice 526

What Is An Endowment? 527

Reporting Revenues and Expenses 529

Example: Reporting Revenues and Expenses 530

Reporting Cash Flows 535

What are The Main Types of Contributions, and How Should Pledges Be Accounted For? 538

In Practice: Even the Very Wealthy Sometimes Renege on Their Contributions 539

Example: Pledges 540

When Should Use-Restricted (Purpose-Restricted) Contributions Be Recognized? 542

Example: Use-Restricted Contributions 542

In Practice: A Gift with Strings Attached 543

Should Noncash Contributions be Recognized? 544

Example: Noncash Contributions 545

Example 545

Example: Examples of Contributed Services 546

In Practice 546

Should Receipts of Collection Items be Recognized As Revenues? 547

When Should Conditional Promises be Recognized? 547

Example: Conditional Promises 548

How Should “Pass-Through” Contributions Be Accounted For? 548

Example: A Federated Fund-Raising Organization 549

Example: A Foundation That Transfers Assets to a Specified Organization 549

Example: A Foundation That Supports a Related Organization 549

When Should Gains and Losses On Investments be Recognized? 551

Example: Investment Gains 551

Should Endowment Gains Be Considered Net Additions To Principal Or Expendable Income? 552

Example: Investment Gains 553

What Are Split Interest Agreements, and How Should They be Accounted For? 554

How Should Depreciation Be Reported? 555

Example: Depreciation 555

What Issues Does A Not-For-Profit

Face In Establishing Its Reporting Entity? 556

Comprehensive Example: Museum of American Culture 558

How Should The Costs of Fund-Raising Activities Be Determined? 566

Criteria for Allocating A Portion of Costs To Program or Management Functions 566

Example: Allocating Charitable Costs 568

How Can A Not-For-Profit’s Fiscal Condition Be Assessed? 569

In Practice: Not-For-Profits, Like Corporations, Tainted by Scandals 571

Summary 573

Key Terms In This Chapter 574

Exercise for Review and Self-Study 574

Questions for Review and Discussion 577

Exercises 578

Problems 582

Solution to Exercise for Review and Self-Study 586

13 Colleges and Universities 587

What Unique Issues do Colleges and Universities Face? 587

Standards for Public Colleges and Universities 589

Standards for Private Not-For-Profit Colleges and Universities 590

Accounting for Revenues and Expenses 597

In Practice: Which Set of Standards Do We Follow? 598

In Practice: From Public to Private 599

In Practice: How Should a University Classify a Gift that May not Be a Gift? 600

Example: Tuition and Fee Revenues 600

Other Issues 602

Example: Grants 603

Example: Student Loans 604

In Practice: How Auxiliary Enterprises Can Be Misused 605

Comprehensive Example: Mars University 606

Evaluating The Fiscal Wherewithal of Colleges And Universities 610

In Practice: Colleges on the Brink 612

Summary 613

Key Terms In This Chapter 613

Exercise for Review and Self-Study 613

Questions for Review and Discussion 616

Exercises 616

Problems 619

Solution to Exercise for Review and Self-Study 623

14 Health-care Providers 625

In Practice: Hospitals Face Economic Challenges While Also Implementing Policy Changes 626

What Unique Issues do Health-Care Providers Face? 627

What are the Basic Financial Statements? 628

How are Key Revenues and Expenses Recognized? 633

Example: Patient Care Revenues 634

Example: Implicit Price Concessions 635

Example: Capitation Fee Revenues 636

Example: Charity Care 637

Example: Malpractice Claims 638

Example: Retrospective Premiums 639

Comprehensive Example: Medical Center Hospital 639

How can the Fiscal Wherewithal of Health-Care Organizations be Evaluated? 645

In Practice: Financial Problems not Caused by Single Issue 646

Summary 648

Key Terms in This Chapter 649

Exercise for Review and Self-Study 649

Questions for Review and Discussion 649

Exercises 650

Problems 654

Solution to Exercise for Review and Self-Study 658

15 Auditing Governments and Not-for-Profit Organizations 659

How Do Audits Of Governments and Not-For-Profits

Differ from Those of Businesses? 660

How Has The Yellow Book Influenced Governmental and Not-For-Profit Auditing? 660

What Types of Audits Do Governments Conduct? 662

What Levels of Standards are Applicable To All Engagements? 662

In Practice: To Whom Should a City Auditor Report? 663

What are Performance Audits? 667

Key Differences Between Financial And Performance Audits 667

In Practice: Targeting Seemingly Trivial Activities 670

Example: Evidence Gathering 673

In Practice: Findings Must Relate to Program Objectives 674

How Have The Single Audit Act and Other Pronouncements Influenced Auditing? 675

What Approach Do Auditors Take In Performing Single Audits? 676

What Reports Result From Single Audits? 679

What Unique Ethical Issues Do Governmental and Not-For-Profit Accounting and Auditing Present? 682

Example: Ethical Dilemma 684

Summary 686

Key Terms In This Chapter 687

Exercise for Review and Self-Study 687

Questions for Review and Discussion 688

Exercises 688

Problems 690

Cases in Ethics 694

Solution to Exercise for Review and Self-Study 696

16 Federal Government Accounting 697

Which Agencies are Responsible for Federal Accounting and Reporting? 700

What Constitutes the Federal Budget? 703

What Constitutes the Federal Government Reporting Entity? 705

What are the Form and Content of Government-Wide Federal Statements? 707

What Types of Accounts are Maintained by Federal Entities? 709

What Statements are Required of Federal Agencies? 710

What are Other Key Features of the FASAB Model? 712

Example: Subsidized Loan 721

Example: Loan Guarantees 722

What Else Constitutes the Federal Government’s Reporting System 724

What are the Key International Trends in Governmental Accounting? 725

An International Standard-Setting Agency 726

Summary 727

Key Terms in This Chapter 728

Exercise for Review and Self-Study 728

Questions for Review and Discussion 729

Exercises 730

Problems 733

Solution to Exercise for Review and Self-Study 737

17 Managing for Results 739

What Role Do Accountants Play in the Management Cycle of Governments and Not-For-Profits? 740

How Can the Limits of Traditional Budgets Be Overcome? 741

What are the Characteristics of Sound Operational Objectives? 743

What are the Perils of Establishing Operational Objectives? 746

I n Practice: A Classic Case of Reliance on Misspecified Objectives (Two Perspectives of the Vietnam War) 747

How Do Program Budgets Relate Expenditures to Operational Objectives? 748

Advantages and Disadvantages of Program Budgets 753

How Should Service Efforts and Accomplishments Be Reported? 755

How are Capital Expenditures Planned and Budgeted Within a Framework of Operational

Objectives? 762

Example: Benefits Are Cash Savings 764

Example: Choosing among Options with Similar Benefits 765

In Practice: September 11 Victim Compensation Fund 767

Summary 769

Key Terms in This Chapter 770

Exercise for Review and Self-Study 770

Questions for Review and Discussion 770

Exercises 771

Problem 774

Solution to Exercise for Review and Self-Study 778

Glossary G-1

Value Tables VT-1

Index I-1

| Erscheinungsdatum | 25.11.2021 |

|---|---|

| Verlagsort | New York |

| Sprache | englisch |

| Maße | 203 x 254 mm |

| Gewicht | 1497 g |

| Themenwelt | Sozialwissenschaften ► Politik / Verwaltung ► Staat / Verwaltung |

| Wirtschaft ► Betriebswirtschaft / Management ► Planung / Organisation | |

| Wirtschaft ► Betriebswirtschaft / Management ► Rechnungswesen / Bilanzen | |

| ISBN-10 | 1-119-80389-6 / 1119803896 |

| ISBN-13 | 978-1-119-80389-8 / 9781119803898 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich