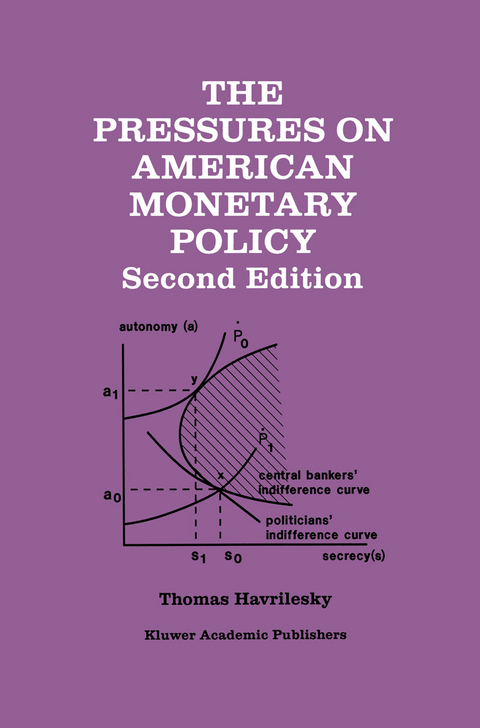

The Pressures on American Monetary Policy

Seiten

2012

|

2nd ed. 1995. Softcover reprint of the original 2nd ed. 1995

Springer (Verlag)

978-94-010-4285-7 (ISBN)

Springer (Verlag)

978-94-010-4285-7 (ISBN)

The basic motivation for this book is my lifelong interest in the relationship between political processes and macroeconomic outcomes, especially in the area of monetary policy. Nowadays, monetary policy is an area where political considerations are believed by scholars to regularly impact upon economic results. In contrast, when my interest in this subject began thirty years ago, the scholarly literature on monetary policy hardly ever mentioned systematic political influences. My dissertation at the University of Illinois in 1966 and my first article (in the Joumal of Political Economy in 1967) addressed the modeling and estimation of the concerns that propel monetary policy. In the political and economic turbulence of the period from the late 1960s through the early 1980s, it became clear that the directions taken by monetary policy were changing with some frequency. My research during that period dealt with models of monetary policy. In attempting to measure these changes, it suggested that monetary policy reactions to the state of the economy were not stable over time. During this period I became interested in reforms which might reduce the resulting instability in the economy. For example, my 1972 article in the Joumal of Political Economy suggested systematic penalties Federal Reserve officials who failed to meet the goal of monetary stability by tying their budgets or salaries inversely to the rate of inflation.

One The Pressures on Monetary Policy: An Overview.- Two Executive Branch Pressures on Monetary Policy: 1914–1994.- Three Legislative Branch Pressures on Monetary Policy: 1914

–1994.- Four Is the Federal Reserve Responsive to Monetary Policy Signaling from The Administration.- Five Is Federal Reserve Responsiveness to Signaling Propelled by Congressional Threats or Chairmen’s Allegiances.- Six The Causes of Signaling from the Administration and Threats from Congress to the Federal Reserve.- Seven Monetary Policy Signaling from Congress to the Federal Reserve.- Eight Banking and Other Private Sector Influences on Monetary Policy.- Nine The Power of Appointment and Monetary Policy.- Ten Monetary Reform.

| Zusatzinfo | XI, 381 p. |

|---|---|

| Verlagsort | Dordrecht |

| Sprache | englisch |

| Maße | 155 x 235 mm |

| Themenwelt | Sozialwissenschaften ► Politik / Verwaltung ► Politische Theorie |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Wirtschaft ► Volkswirtschaftslehre ► Finanzwissenschaft | |

| Wirtschaft ► Volkswirtschaftslehre ► Makroökonomie | |

| ISBN-10 | 94-010-4285-3 / 9401042853 |

| ISBN-13 | 978-94-010-4285-7 / 9789401042857 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

Der »progressive« Angriff auf Israel, Judentum und …

Buch | Softcover (2024)

edition TIAMAT (Verlag)

28,00 €

ein Vortrag

Buch | Softcover (2024)

Suhrkamp (Verlag)

10,00 €