Local taxes

Seiten

2024

Our Knowledge Publishing (Verlag)

978-620-7-84560-6 (ISBN)

Our Knowledge Publishing (Verlag)

978-620-7-84560-6 (ISBN)

- Titel nicht im Sortiment

- Artikel merken

I suggest that the calculation rule that determines the amount of local taxes for private real estate and land should be based on the value of the property and not the rental value. I also believe that, whether you're an owner-occupier or a tenant in the commune where you live, you use the infrastructure to get around and various services, and the investments to build and maintain them have a cost that everyone should contribute to by paying a minimum local tax. I also believe that we need to carry out a territorial reform of the communes, by reducing their number and merging them on the basis, in whole or in part, of the inter-municipalities, which would be abolished.

Retired from SNCF. Co-founder of Les Verts Parti écologiste and Les Verts. Former member of the national council of the Mouvement Ecologiste Indépendant (MEI). Former ecologist elected in Givors, a town of 20,000 inhabitants south of Lyon. Author of several books and texts on political ecology, as well as publications on media sites.

| Erscheinungsdatum | 25.07.2024 |

|---|---|

| Sprache | englisch |

| Maße | 152 x 229 mm |

| Gewicht | 136 g |

| Themenwelt | Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Steuern / Steuererklärung |

| Recht / Steuern ► EU / Internationales Recht | |

| Recht / Steuern ► Steuern / Steuerrecht | |

| Schlagworte | Abolition • Calculation rules • communes • define the amount • Intercommunality • Merger • property • property value • Real Estate • reduce the number • Rental Value • Taxes |

| ISBN-10 | 620-7-84560-9 / 6207845609 |

| ISBN-13 | 978-620-7-84560-6 / 9786207845606 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

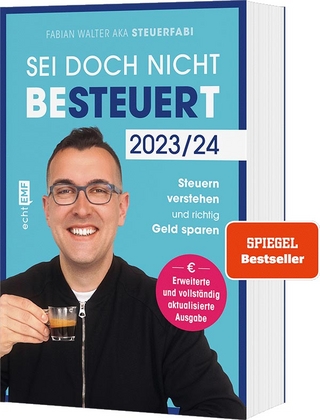

mit Steuerfabi die Welt der Steuern verstehen und richtig Geld …

Buch | Softcover (2023)

EMF Verlag

16,00 €

Allgemeines Steuerrecht, Abgabenordnung, Umsatzsteuer

Buch (2023)

Springer-Verlag GmbH

27,99 €

Buch | Softcover (2024)

Stiftung Warentest (Verlag)

16,90 €