Tax doctrine versus legality in Congolese law

Seiten

2023

Our Knowledge Publishing (Verlag)

978-620-6-01815-5 (ISBN)

Our Knowledge Publishing (Verlag)

978-620-6-01815-5 (ISBN)

- Keine Verlagsinformationen verfügbar

- Artikel merken

What principles underlie the tax administration's power to impose taxes and what prospects would allow tax matters, in particular tax doctrine, to be less of an obstacle to legality in Congolese law? The requirement of legality of taxation acts on the one hand and, on the other hand, the conformity of the tax administration's action to the legislator's will and the protection of the taxpayer due to the financial consequences of the interpretation adopted by the tax administration constitute the two major axes of this work. These two axes have been examined in the light of the legal provisions that have an impact on the taxpayer's legal security against changes in tax doctrine, mainly Article 39 of Law No. 04/2003 of 13 March 2003 on the reform of tax procedures as amended and supplemented to date.

Charles KYUNGU KAKUDJI has a doctorate in economic law and is an Associate Professor at the University of Lubumbashi and a Tax Inspector at the General Tax Directorate of the Democratic Republic of Congo.

| Erscheinungsdatum | 29.05.2023 |

|---|---|

| Sprache | englisch |

| Maße | 152 x 229 mm |

| Gewicht | 231 g |

| Themenwelt | Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Steuern / Steuererklärung |

| Recht / Steuern ► EU / Internationales Recht | |

| Recht / Steuern ► Steuern / Steuerrecht | |

| Schlagworte | CONGOLESE TAX LAW • Economic Law • opposability • tax administration • TAX DOCTRINE • Taxes |

| ISBN-10 | 620-6-01815-6 / 6206018156 |

| ISBN-13 | 978-620-6-01815-5 / 9786206018155 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

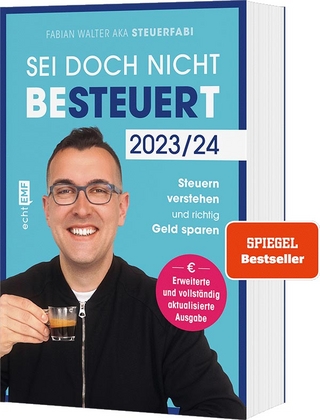

mit Steuerfabi die Welt der Steuern verstehen und richtig Geld …

Buch | Softcover (2023)

EMF Verlag

16,00 €

Allgemeines Steuerrecht, Abgabenordnung, Umsatzsteuer

Buch (2023)

Springer-Verlag GmbH

27,99 €

Buch | Softcover (2024)

Stiftung Warentest (Verlag)

16,90 €