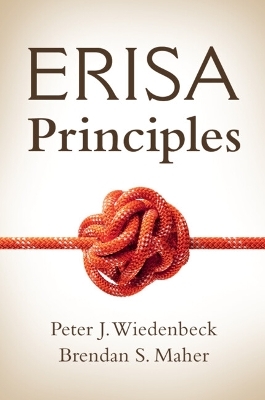

ERISA Principles

Cambridge University Press (Verlag)

978-1-316-61778-6 (ISBN)

ERISA, the detailed and technical amalgam of labor law, trust law, and tax law, directly governs trillions of dollars spent on retirement savings, health care, and other important benefits for more than 100 million Americans. Despite playing this central role in the US economy and social insurance systems, the complexities of ERISA are often understood by only a few specialists. ERISA Principles elucidates employee benefit law from a policy perspective, concisely explaining how common themes apply across a wide range of benefit plans and factual contexts. The book's non-technical language and cross-cutting conceptual organization reveal latent similarities and rationalize differences between the regulatory treatment of apparently disparate programs, including traditional pensions, 401(k), and health care plans. Important legal developments - whether statutory, judicial, or administrative - are framed and analyzed in an accessible, principles-centric manner, explaining how ERISA functions as a coherent whole.

Peter J. Wiedenbeck is the Joseph H. Zumbalen Professor of the Law of Property at Washington University in St. Louis School of Law. He has written numerous books and articles on federal tax law and the tax and labor law regulation of employee benefit plans and has co-authored casebooks on federal income taxation, employee benefits, and partnership taxation. In 2022, he chaired the Advisory Council on Employee Welfare and Pension Benefit Plans. Brendan S. Maher is Professor of Law at Texas A&M University School of Law and the Director of the Health Law, Policy & Management program. He was formerly the Connecticut Mutual Professor of Law at the University of Connecticut, where he ran the school's Insurance Law Center. He retired in 2020 from Stris & Maher LLP, where he handled multiple ERISA matters before the United States Supreme Court.

Table of Cases; Table of Statutes; Part I. General Consideration: 1. Overview of ERISA; 2. ERISA's Coverage; Part II. Conduct Controls: Welfare and Pension Plans: 3. Disclosure; 4. Fiduciary Obligations; 5. Enforcement; 6. Preemption; Part III. Content Controls: Pension Plans: 7. Accumulation; 8. Distribution; 9. Security; Part IV. Tax Controls: Qualified Retirement Saving: 10. Taxes and Retirement Saving; Part V. Health Plan Content Controls: 11. Employment-Based Health; Appendix; Index.

| Erscheinungsdatum | 05.12.2023 |

|---|---|

| Verlagsort | Cambridge |

| Sprache | englisch |

| Gewicht | 811 g |

| Themenwelt | Sachbuch/Ratgeber ► Gesundheit / Leben / Psychologie |

| Recht / Steuern ► EU / Internationales Recht | |

| Recht / Steuern ► Öffentliches Recht | |

| Recht / Steuern ► Steuern / Steuerrecht | |

| ISBN-10 | 1-316-61778-5 / 1316617785 |

| ISBN-13 | 978-1-316-61778-6 / 9781316617786 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich