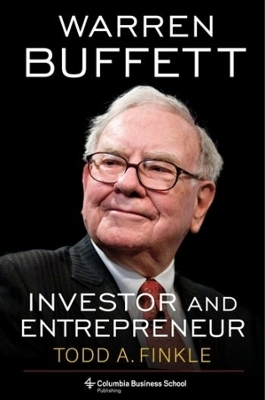

Warren Buffett

Columbia University Press (Verlag)

978-0-231-20712-6 (ISBN)

Warren Buffett is perhaps the most accomplished investor of all time. The CEO and chair of Berkshire Hathaway has earned admiration for not only his financial feats but also the philosophy behind them. Todd A. Finkle provides striking new insights into Buffett’s career through the lens of entrepreneurship. This book demonstrates that although Buffett is thought of primarily as an investor, one of the secrets to his success has been running Berkshire as an entrepreneur.

Finkle—a Buffett family friend—shares his perspective on Buffett’s early life and business ventures. The book traces the entrepreneurial paths that shaped Buffett’s career, from selling gum door-to-door during childhood to forming Berkshire Hathaway and developing it into a global conglomerate through the imaginative deployment of financial instruments and creative deal making. Finkle considers Buffett’s investment methodology, management strategy, and personal philosophy on building a rewarding life in terms of entrepreneurship. He also zeros in on Buffett’s longtime business partner, Charlie Munger, and his contributions to Berkshire’s success. Finkle draws key lessons from Buffett’s mistakes as well as his successes, using these failures to explore the ways behavioral biases can affect investors and how to overcome them.

By viewing Buffett as an entrepreneur, this book offers readers a fresh take on one of the world’s best-known financial titans.

Todd A. Finkle is the Pigott Professor of Entrepreneurship at Gonzaga University. He is also an investor, entrepreneur, speaker, and consultant who has worked with a wide range of organizations.

Preface

Acknowledgments

Part I. Early Life

1. Warren E. Buffett’s Background

2. Early Influences, College, and Partnership Years

3. Charlie Munger

Part II. Buffett’s Secret Sauce

4. Berkshire’s Value Investment Philosophy and Advice

5. Berkshire’s Investment Methodology

6. Case Studies: GEICO and Apple

7. How to Make Better Investment Decisions

Part III. The History of Berkshire Hathaway

8. Berkshire Hathaway: 1967–2009

9. Berkshire Hathaway: 2010–2020

A New Decade for Berkshire

10. Buffett’s Investing Mistakes

Part IV. Warren Buffett: The Person

11. Shareholder Meetings, Life Advice, and Philanthropy

12. A Day with Warren Buffett

13. Berkshire Hathaway Looking Forward

Appendix 1. Berkshire Hathaway and Subsidiaries Consolidated Balance Sheets: 2016–2021

Appendix 2. Berkshire Hathaway and Subsidiaries Consolidated Statements of Earnings and Comprehensive Income: 2016–2021

Appendix 3. Berkshire Hathaway and Subsidiaries Consolidated Statements of Cash Flows: 2016–2021

Appendix 4. Question-and-Answer Sessions with Warren Buffett in 2009 and 2011

Notes

Index

| Erscheinungsdatum | 12.12.2022 |

|---|---|

| Zusatzinfo | 20 tables |

| Verlagsort | New York |

| Sprache | englisch |

| Maße | 156 x 235 mm |

| Themenwelt | Literatur ► Biografien / Erfahrungsberichte |

| Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Wirtschaft | |

| ISBN-10 | 0-231-20712-3 / 0231207123 |

| ISBN-13 | 978-0-231-20712-6 / 9780231207126 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich