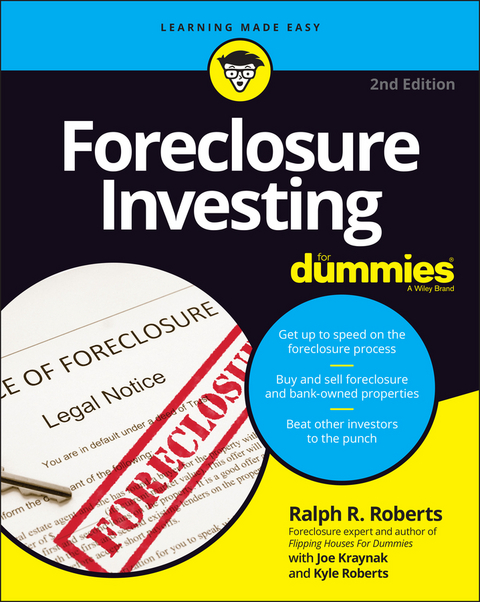

Foreclosure Investing For Dummies (eBook)

400 Seiten

John Wiley & Sons (Verlag)

978-1-119-86100-3 (ISBN)

Looking to kick start your own property management career? Check out Foreclosure Investing For Dummies, which will get you started buying foreclosed properties to turn into your own income property!

In this book, you'll learn to navigate the complexities of home auctions, deal with emotional former homeowners, and how to handle renovations. You'll also get a heads-up on the foreclosure laws in all 50 states so you don't accidentally run afoul of any complicated regulations.

Foreclosure Investing For Dummies shows you how to:

* Locate properties for sale and identify associated opportunities and risks

* Buy properties below market value at auction, from lending institutions, and from government agencies

* Fix up, renovate, and sell or lease your new property for a profit

This hands-on guide can help anyone make foreclosure investing work. So, grab a copy of Foreclosure Investing For Dummies, roll up your sleeves, and get going!

Ralph R. Roberts has been investing in foreclosed properties for over 30 years. He knows every step of the process, from scouting properties to cashing out after the sale, from helping distressed homeowners keep their homes to buying those homes when the owners can no longer afford them. He also has assisted homeowners who have been taken advantage of by unscrupulous investors.

Introduction 1

Part 1: Prepping Yourself for Foreclosure Success 7

Chapter 1: Wrapping Your Brain around Foreclosure Investing 9

Chapter 2: Getting Up to Speed on the Foreclosure Process 29

Chapter 3: Picking Your Point of Entry in the Foreclosure Process 41

Part 2: Laying the Groundwork for Maximized Profit and Minimized Risk 57

Chapter 4: Building a Powerful Foreclosure Investment Team 59

Chapter 5: Filling Your Foreclosure Tank with Financial Fuel 77

Chapter 6: Networking Your Way to Foreclosure Success 95

Part 3: Creating Win-Win Situations in Pre-Foreclosure (Before Auction) 107

Chapter 7: Discovering Homeowners Facing Foreclosure 109

Chapter 8: Performing Your Due Diligence 125

Chapter 9: Contacting the Homeowners and Lenders 145

Chapter 10: Analyzing the Deal and Presenting Your Offer 173

Part 4: Finding and Buying Foreclosure and Bankruptcy Properties 187

Chapter 11: Bidding for Properties at a Foreclosure Sale 189

Chapter 12: Buying Repos: Bank Foreclosures and REO Properties 207

Chapter 13: Finding and Buying Government Repos 225

Chapter 14: Banking on Bankruptcies 241

Chapter 15: Sampling Some Other Foreclosure Strategies 255

Part 5: Cashing Out Your Profit After the Sale 277

Chapter 16: Assisting the Previous Homeowners Out the Door 279

Chapter 17: Repairing and Renovating Your Investment Property 291

Chapter 18: Cashing Out: Selling or Leasing Your Property 305

Chapter 19: Checking Out Other Cash-Out Strategies 319

Part 6: The Part of Tens 329

Chapter 20: Ten Common Beginner Blunders 331

Chapter 21: Ten Ways to Maximize Future Leads by Acting with Integrity 337

Chapter 22: Ten Tips for Avoiding Common Foreclosure Minefields 345

Appendix: Foreclosure Rules and Regulations for the 50 States 353

Index 367

| Erscheint lt. Verlag | 24.3.2022 |

|---|---|

| Sprache | englisch |

| Themenwelt | Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Wirtschaft |

| Recht / Steuern ► Wirtschaftsrecht | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Immobilienwirtschaft | |

| Schlagworte | Business & Management • Immobilien • Immobilien u. Grundbesitz • Investition • Property & Real Estate • Wirtschaft u. Management |

| ISBN-10 | 1-119-86100-4 / 1119861004 |

| ISBN-13 | 978-1-119-86100-3 / 9781119861003 |

| Haben Sie eine Frage zum Produkt? |

Größe: 4,0 MB

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich