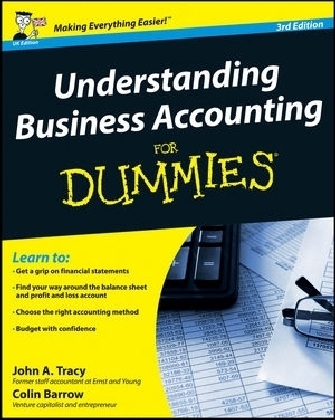

Understanding Business Accounting for Dummies 3E

John Wiley & Sons Inc (Verlag)

978-1-119-95128-5 (ISBN)

- Titel erscheint in neuer Auflage

- Artikel merken

Get your head around company finance. Whether you're a small business owner or a corporate manager with budget responsibilities, having an understanding of your company's finances is crucial. This user-friendly guide takes you through all the key elements of UK business accounting, covering everything from evaluating profit margins and establishing budgets to controlling cash flow and writing financial reports. The third edition has been fully updated throughout and includes brand new content on the emergence of IFRS and dealing with foreign exchange. The book is organised into five Parts: Part I: Accounting Basics Part II: Getting a Grip on Financial Statements (Including cash flow, cash flow statements financial reports, profit and loss accounts) Part III: Accounting in Managing a Business (Including managing profit performance, budgeting, ownership structures, costs, and difference accounting methods) Part IV: Financial Reports in the Outside World (All about auditors and advisors, and how investors read financial reports) Part V: Part of Tens

John A. Tracy is a former staff accountant at Ernst & Young. Colin Barrow was the Head of the Enterprise Group at Cranfield School of Management and is the author of more than 30 books including Starting a Business For Dummies, Business Plans For Dummies and Business Plans Kit For Dummies.

Introduction 1 Part I: Accounting Basics 9 Chapter 1: Introducing Accounting to Non-Accountants 11 Chapter 2: Bookkeeping 101: From Shoe Boxes to Computers 33 Chapter 3: Taxes, Taxes and More Taxes 51 Chapter 4: Accounting and Your Personal Finances 67 Part II: Getting a Grip on Financial Statements 85 Chapter 5: Profit Mechanics 87 Chapter 6: The Balance Sheet from the Profit and Loss Account Viewpoint 109 Chapter 7: Cash Flows and the Cash Flow Statement 131 Chapter 8: Getting a Financial Report Ready for Prime Time 153 Part III: Accounting in Managing a Business 173 Chapter 9: Managing Profit Performance 175 Chapter 10: Business Budgeting 197 Chapter 11: Choosing the Right Ownership Structure 219 Chapter 12: Cost Conundrums 241 Chapter 13: Choosing Accounting Methods 261 Part IV: Financial Reports in the Outside World 285 Chapter 14: How Investors Read a Financial Report 287 Chapter 15: Professional Auditors and Advisers 313 Part V: The Part of Tens 329 Chapter 16: Ten Ways Savvy Business Managers Use Accounting 331 Chapter 17: Ten Places a Business Gets Money From 345 Chapter 18: Ten (Plus One) Questions Investors Should Ask When Reading a Financial Report 355 Chapter 19: Ten Ways to Get a Better Handle on the Financial Future 367 Part VI: Appendixes 377 Appendix A: Glossary: Slashing through the Accounting Jargon Jungle 379 Appendix B: Accounting Software and Other Ways to Get the Books in Good Order 395 Index 399

| Erscheint lt. Verlag | 13.2.2012 |

|---|---|

| Verlagsort | New York |

| Sprache | englisch |

| Maße | 186 x 235 mm |

| Gewicht | 1 g |

| Themenwelt | Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Wirtschaft |

| Wirtschaft ► Betriebswirtschaft / Management ► Rechnungswesen / Bilanzen | |

| ISBN-10 | 1-119-95128-3 / 1119951283 |

| ISBN-13 | 978-1-119-95128-5 / 9781119951285 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich