Dual Income Tax

Physica (Verlag)

978-3-7908-2051-5 (ISBN)

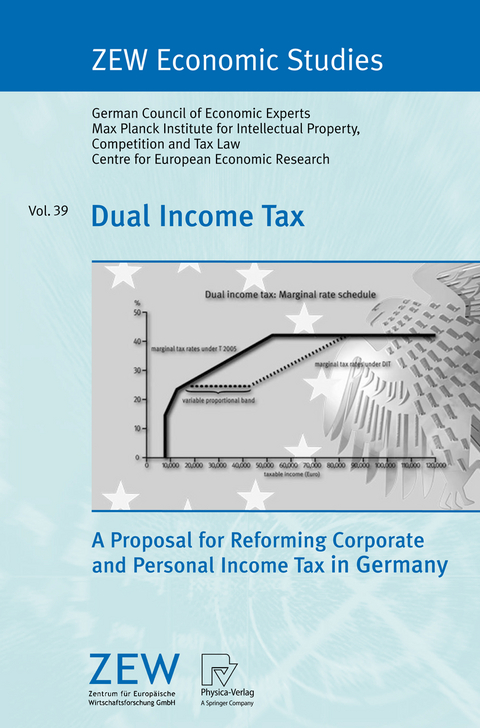

In its Annual Report 2003/2004, the German Council of Economic Experts launched a dual income tax as an option for a fundamental tax reform in Germany. In February 2005, the German government appointed the Council to prepare a detailed report on economic effects of a business tax reform, with special emphasis on a dual income tax. With regard to the latter, conceptual problems of tax law and of tax administration were to be addressed as well as possible transitional problems when implementing a dual income tax. This book presents an English version of the original report completed in April 2006.

Dual Income Tax: Supporting Arguments and Design An Overview.- Taxing Corporations and Their Shareholders.- Taxing Transparent Entities.- Individual Aspects of Dual Income Tax.

| Erscheint lt. Verlag | 24.4.2008 |

|---|---|

| Reihe/Serie | ZEW Economic Studies |

| Zusatzinfo | XII, 147 p. 5 illus. |

| Verlagsort | Heidelberg |

| Sprache | englisch |

| Maße | 155 x 235 mm |

| Gewicht | 520 g |

| Themenwelt | Recht / Steuern ► Steuern / Steuerrecht |

| Recht / Steuern ► Wirtschaftsrecht ► Bank- und Kapitalmarktrecht | |

| Wirtschaft ► Volkswirtschaftslehre ► Wirtschaftspolitik | |

| Schlagworte | Auslandstätigkeitserlaß • Company Taxation • Dual income tax • Effective Tax Burdens • Reform • Tax Reform |

| ISBN-10 | 3-7908-2051-2 / 3790820512 |

| ISBN-13 | 978-3-7908-2051-5 / 9783790820515 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich