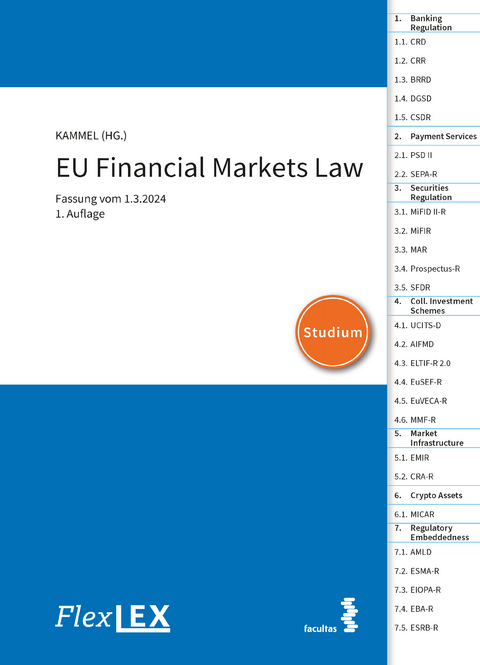

FlexLex EU Financial Markets Law | Studium

Fassung vom 1.3.2024

Seiten

2024

Facultas / FlexLEX (Verlag)

978-3-99071-337-2 (ISBN)

Facultas / FlexLEX (Verlag)

978-3-99071-337-2 (ISBN)

- Titel erscheint in neuer Auflage

- Artikel merken

Zu diesem Artikel existiert eine Nachauflage

The present FlexLex volume „EU Financial Markets Law“ covers essential pillars of EU financial markets regulation spanning from banking regulation to securities regulation and the forthcoming regulatory embeddedness of crypto assets.

The volume “EU Financial Markets Law” intends to provide both practitioners and students with an easy access to EU financial markets law. This can be done both my browsing through the present volume as well as assessing the electronic versions of the displayed regulatory frameworks via the provided QR codes.

The structure of the present volume is designed in a manner that related topics are clustered together. Thus, chapter 1 deals with EU bank regulatory frameworks whereas chapter 2 covers payment services regulation. Chapter 3 addresses EU securities regulation which is followed by chapter 4 that is dedicated to the EU regulation of collective investment schemes. Chapter 5 highlights selected EU market infrastructure regulation whereas chapter 6 deals with the forthcoming EU regulation of crypto assets. Finally, chapter 7 covering anti-money laundering regulation as well as the institutional regulatory embeddedness concludes the volume.

All FlexLex advantages at a glance:

•Print & digital usable on all mobile devices

•E-Mail notification for every change in the law

•Reference date query & version comparison for registered users

The collection of laws includes the following laws:

1. Banking Regulation

1.1. CRD - Directive 2013/36/EU

1.2. CRR - Regulation (EU) 575/2023 (only online)

1.3. BRRD - Directive 2014/59/EU

1.4. DGSD - Directive 2014/49/EU

1.5. CSDR - Regulation (EU) 909/2014 (only online)

2. Payment Services

2.1. PSD II - Directive (EU) 2015/2366

2.2. SEPA-R - Regulation (EU) 260/2012

3. Securities Regulation

3.1. MiFID II-R - Regulation (EU) 65/2014

3.2. MiFIR - Regulation (EU) 600/2014 (only online)

3.3. MAR - Regulation (EU) 596/2014

3.4. Prospectus-R - Regulation (EU) 2017/1129

3.5. SFDR - Regulation (EU) 2019/288

4. Collective Investment Schemes

4.1. UCITS-D - Directive - 2009/65/EC

4.2. AIFMD - Directive 2011/61/EU

4.3. ELTIF-R 2.0 - Regulation (EU) 2023/606

4.4. EuSEF-R - Regulation (EU) 346/2013 (only online)

4.5. EuVECA-R - Regulation (EU) 345/2013 (only online)

4.6. MMF-R - Regulation (EU) 2017/1131 (only online)

5. Market Infrastructure

5.1. EMIR - Regulation (EU) 648/2012

5.2. CRA-R - Regulation (EC) 1060/2009

6. Crypto Assets

6.1. MICAR - Regulation (EU) 2013/1114

7. Regulatory Embeddedness

7.1. AMLD - Directive (EU) 2015/849

7.2. ESMA-R - Regulation (EU) 1095/2010

7.3. EIOPA-R - Regulation (EU) 1094/2010 (only online)

7.4. EBA-R - Regulation (EU) 1093/2010 (only online)

7.5. ESRB-R - Regulation (EU) 1092/2010 (only online)

The volume “EU Financial Markets Law” intends to provide both practitioners and students with an easy access to EU financial markets law. This can be done both my browsing through the present volume as well as assessing the electronic versions of the displayed regulatory frameworks via the provided QR codes.

The structure of the present volume is designed in a manner that related topics are clustered together. Thus, chapter 1 deals with EU bank regulatory frameworks whereas chapter 2 covers payment services regulation. Chapter 3 addresses EU securities regulation which is followed by chapter 4 that is dedicated to the EU regulation of collective investment schemes. Chapter 5 highlights selected EU market infrastructure regulation whereas chapter 6 deals with the forthcoming EU regulation of crypto assets. Finally, chapter 7 covering anti-money laundering regulation as well as the institutional regulatory embeddedness concludes the volume.

All FlexLex advantages at a glance:

•Print & digital usable on all mobile devices

•E-Mail notification for every change in the law

•Reference date query & version comparison for registered users

The collection of laws includes the following laws:

1. Banking Regulation

1.1. CRD - Directive 2013/36/EU

1.2. CRR - Regulation (EU) 575/2023 (only online)

1.3. BRRD - Directive 2014/59/EU

1.4. DGSD - Directive 2014/49/EU

1.5. CSDR - Regulation (EU) 909/2014 (only online)

2. Payment Services

2.1. PSD II - Directive (EU) 2015/2366

2.2. SEPA-R - Regulation (EU) 260/2012

3. Securities Regulation

3.1. MiFID II-R - Regulation (EU) 65/2014

3.2. MiFIR - Regulation (EU) 600/2014 (only online)

3.3. MAR - Regulation (EU) 596/2014

3.4. Prospectus-R - Regulation (EU) 2017/1129

3.5. SFDR - Regulation (EU) 2019/288

4. Collective Investment Schemes

4.1. UCITS-D - Directive - 2009/65/EC

4.2. AIFMD - Directive 2011/61/EU

4.3. ELTIF-R 2.0 - Regulation (EU) 2023/606

4.4. EuSEF-R - Regulation (EU) 346/2013 (only online)

4.5. EuVECA-R - Regulation (EU) 345/2013 (only online)

4.6. MMF-R - Regulation (EU) 2017/1131 (only online)

5. Market Infrastructure

5.1. EMIR - Regulation (EU) 648/2012

5.2. CRA-R - Regulation (EC) 1060/2009

6. Crypto Assets

6.1. MICAR - Regulation (EU) 2013/1114

7. Regulatory Embeddedness

7.1. AMLD - Directive (EU) 2015/849

7.2. ESMA-R - Regulation (EU) 1095/2010

7.3. EIOPA-R - Regulation (EU) 1094/2010 (only online)

7.4. EBA-R - Regulation (EU) 1093/2010 (only online)

7.5. ESRB-R - Regulation (EU) 1092/2010 (only online)

Prof. (FH) Dr. Armin KAMMEL, LL.M. (London), MBA (CLU) is a Professor (FH) of Banking Law and Financial Market Regulation at Lauder Business School in Vienna, Austria. In addition to his (international) teaching activities focusing on financial market regulation, international business law as well as law and economics, he works in interational financial services regulatory advisory business.

| Erscheinungsdatum | 09.03.2024 |

|---|---|

| Sprache | englisch |

| Maße | 148 x 210 mm |

| Themenwelt | Recht / Steuern ► EU / Internationales Recht |

| Recht / Steuern ► Wirtschaftsrecht | |

| Schlagworte | Banking • Collective Investment Schemes • Crypto Assets • Kammel • Law • Market infrastructure • payment services • Regulation • Regulatory Embeddedness • securities regulation |

| ISBN-10 | 3-99071-337-X / 399071337X |

| ISBN-13 | 978-3-99071-337-2 / 9783990713372 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

Vertrag über die Europäische Union, Vertrag über die Arbeitsweise der …

Buch | Softcover (2024)

dtv Verlagsgesellschaft

15,90 €