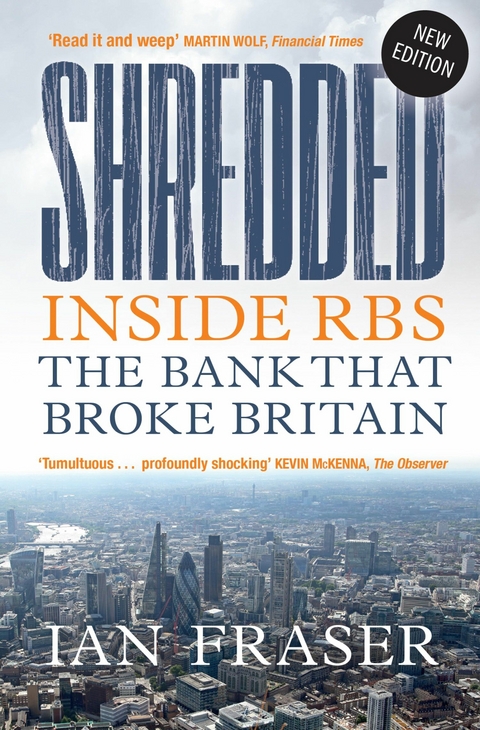

Shredded (eBook)

648 Seiten

Birlinn (Verlag)

978-0-85790-623-6 (ISBN)

Ian Fraser is an award-winning journalist, commentator and broadcaster who writes about business, finance, politics and economics. His work has been published by among others The Sunday Times, The Economist, Financial Times, BBC News, Thomson Reuters, Dow Jones, Daily Mail, Mail on Sunday, Independent on Sunday, the Herald, Sunday Herald, The Scotsman, Accountancy, CA Magazine and Citywire.

This is the definitive account of the Royal Bank of Scotland scandal. For a few brief months in 2007 and 2009, the Royal Bank of Scotland was the largest bank in the world. Then the Edinburgh-based giant - having rapidly grown its footprint to 55 countries and stretched its assets to 2.4 trillion under its hubristic and delinquent former boss Fred Goodwin - crashed to earth. In Shredded, Ian Fraser explores the series of cataclysmic misjudgments, the toxic internal culture and the 'light touch' regulatory regime that gave rise to RBS/NatWest's near-collapse. He also considers why it became the most expensive bank in the world to bail out and why a culture of impunity was allowed to develop in the banking sector. This new edition brings the story up to date, chronicling the string of scandals that have come to light since taxpayers rescued RBS and concluding with an evaluation of the attempts of the bank's post-crisis chief executives, Stephen Hester and Ross McEwan, to dismantle Goodwin's disastrous legacy and restore the damaged institutions to health. 'A gripping account - RBS was a rogue business, operating in what had become a rogue industry, with the connivance of government. Read it and weep' Martin Woolf, Financial Times

Ian Fraser is an award-winning journalist, commentator and broadcaster who writes about business, finance, politics and economics. His work has been published by among others The Sunday Times, The Economist, Financial Times, BBC News, Thomson Reuters, Dow Jones, Daily Mail, Mail on Sunday, Independent on Sunday, the Herald, Sunday Herald, The Scotsman, Accountancy, CA Magazine and Citywire.

Praise for Shredded

‘Shredded is a monumental book, well written, impeccably researched and hard to put down at any point. The tone is set in the first paragraph, in which the bank’s former chief executive, Fred “the Shred” Goodwin, is described as “a sociopathic bully whose achievements had been massively over-hyped”.’

Philip Augar, Financial Times

‘The compelling power of this book – indeed, its monumental achievement – is to provide a definitive account, not only of the failure of what was briefly one of the world’s biggest banks, but also to set its failure in context, a failure not of one management alone, but of the political and regulatory system in which it operated. Shredded is a definitive and unflinching account of exactly what went wrong and few are spared. Its failures were manifold – from the bullying arrogance of its chief executive through the cowardice of its board of directors, to the feckless oversight of regulators, politicians, rating agencies, so-called independent risk assessment committees, analysts – and most of the financial press . . . Shredded is a monument of painstaking analysis and research to Scotland’s greatest financial failure since Darien. As such it serves as a model of the journalist’s craft, Zola-esque in its broad and unsparing study of corporate hubris and nemesis and haunting in the questions it leaves in its wake.’

Bill Jamieson, The Scotsman

‘If you ever want to know about the trail of greed, incompetence and lies that led to the collapse of the Royal Bank of Scotland then you must read Shredded by Ian Fraser . . .The first few hundred pages are replete with tales of the sinister capriciousness of Fred Goodwin, the CEO of RBS. They also detail the sycophancy of his senior directors, which prevented any of them doing their duty and questioning his vain recklessness. But it’s only as you near the end of this tumultuous book that you become aware of something genuinely and profoundly shocking: that this was an institution that had chosen long before to repudiate the human factor in its crazy obsession with becoming one of the world’s top four financial institutions’

Kevin McKenna, The Observer

‘RBS, briefly the biggest bank in the world, was a rogue bank. In this gripping account, Fraser explains how this was allowed to happen. Evidently, the management – above all chief executive Fred Goodwin – bears immediate responsibility for the grotesque hubris and incompetence displayed but so, too, do the regulators and politicians. RBS was a rogue business, operating in what had become a rogue industry, with the connivance of government. Read it and weep.’

Martin Wolf, Financial Times

‘We meet shocking recklessness in Shredded . . . The extent of greed and broken governance is fascinating and highly disturbing. The book raises critical questions about how and why RBS practices persisted and whether much if anything has changed to prevent such institutions from harming society.’

Prof. Anat Admati, Bloomberg

‘The truth about finance is that 40 years of technological change, globalisation and deregulation have conspired to create a system where bankers do not even have to be break the law to bring the world economy to its knees . . . While the outside world concentrates on greed as the motive for bankers, Fraser demonstrates in this immaculate reconstruction how incompetence and hubris also played their part. A riveting read that made me almost grateful for not being British and therefore not on the hook for the debts that RBS saddled this country with’

Joris Luyendijk, The Guardian

‘Of two excellent recent books about the implosion of Royal Bank of Scotland, Fraser’s is the darker, deeper and ultimately more satisfying version. It is given added weight by the author’s evident, and justified, anger at the way in which one bank brought the British financial system to the brink of catastrophe.’

Andrew Hill, Financial Times

‘It is always invidious to describe any work as definitive, but I do not see how Shredded: Inside RBS, The Bank That Broke Britain is going to be outdone . . . For the fullest survey we are ever going to have, then, we need to read Fraser . . . Fraser offers us plenty of narrative excitement . . . The hero with the fatal flaw defies the gods and at the end the gods wreak their revenge, in the greatest corporate failure of British history. More to the point, though, there is a kind of moral force that keeps Fraser’s narrative going and makes the reader want to turn the page. He is scrupulously fair to the characters he puts before us, for instance to Mathewson, a good man who acquires a sort of tragic stature as he sees his dream turn to nightmare, even to Tom McKillop, the next chairman, who is pitied for his miserable inadequacy. Fraser understands and can even sympathise with human beings caught up in the events that overwhelm them. Yet in a final chapter, drawing up a balance-sheet of blame, he is quite unsparing in his judgments. This, amid an immense mass of detail, remains an extremely clear-sighted book: a great achievement.’

Michael Fry, Scottish Review of Books

‘Ian Fraser’s magisterial Shredded has an “Oh My God” moment on practically every page. None ends happily for customers. It is the most detailed catalogue to date of the errors and misdemeanours leading up to the financial Hiroshima of RBS’s £45.5 billion collapse in 2008, and the failure, as Fraser sees it, to reform the bank in its aftermath . . . Fraser places the smoke and mirrors that sustained this artifice in the context of Scots financial tradition, of which he offers a startlingly revisionist version . . . His obsessive immersion enables him elegantly to re-enact in slow-motion the car crash that followed RBS’s triumphant 2002 NatWest takeover . . . Combining detailed research with the drymouthed, heart-thumping human drama of Britain brought to the brink of social meltdown, Shredded has a place on the top shelf of financial investigative journalism. Its afterlife will be as a what-not-to-do textbook of management science, but it would also make a cracking film, if toned down for the sake of realism. Too bad Apocalypse Now has already bagged the most appropriate last lines of this movie: “The horror. The horror.”

Colin Donald, The Herald

‘My book of the year . . . amazing stuff. It is very readable, a magnum opus of research and perspective . . . Moral hazard is well explained. Basically it means bankers can bet the ranch. Lose. And we taxpayers buy them a new one. And let them pay themselves millions because they’re so amazing and important to the economy.’

Douglas Mills, The Firm Magazine

‘Shredded is compulsory reading for everybody interested in finding out important truths about the political and financial worlds we live in . . . to learn about these links [between politics and finance], the arrogance and impudence of the people involved in an explicit, straightforward, illuminating, and often humorous way is a wonderful experience for the reader and proof of the author’s exceptional achievement. This is simply a masterpiece.’

Klaus-Peter Müller, Scottish Studies

‘The definitive account of the Royal Bank of Scotland fiasco . . . an engaging tale of how self-serving bank executives systematically broke the rules, lent with astonishing recklessness, abused customers and got suckered by Wall Street – before dumping their mess on the taxpayers.’

Yves Smith, Naked Capitalism

‘Shredded is the definitive account of degenerate financial capitalism.’

Iain Macwhirter. The Herald

‘Magnificent . . . one of the best investigative books of the past decade. It’s also a book that, uniquely, makes us reflect on the past but the future too. And for me the best part is that – in finest investigative journalism tradition – it names the “guilty men”. It provides chapter and verse in forensic detail on their crimes and misdemeanours. These include the people we are already familiar with and some that seem to have crept back into public life via broadcasters who should know better. I cannot praise Ian Fraser and this work highly enough.’

Eamonn O’Neill, Edinburgh Napier University

‘We need more journalists of Fraser’s calibre, who are able to delve into the often arcane world of high finance and to take a strong, independent viewpoint.’

Robert Alstead, The Edinburgh Guide

‘I don’t think I have ever read such a perfect morality tale for our times.’

Iona Bain, FT Adviser

‘Engrossing, fascinating and appalling . . . a fast-paced and sickeningly-depressing exposition of what can go wrong when corporate governance fails.’

Ruth Bender, Cranfield University

‘Ian Fraser’s Shredded should be required reading for every civil servant at HM Treasury, for every apparatchik in the FCA, and for every politician whose brief engages with the City. [It] leaves a wide variety of players badly bruised and with reputations seriously diminished . . . It is an important piece of work because it throws down a heavy gauntlet to the financial establishment and challenges...

| Erscheint lt. Verlag | 14.10.2015 |

|---|---|

| Verlagsort | London |

| Sprache | englisch |

| Themenwelt | Literatur ► Biografien / Erfahrungsberichte |

| Literatur ► Romane / Erzählungen | |

| Geschichte ► Teilgebiete der Geschichte ► Wirtschaftsgeschichte | |

| Recht / Steuern ► Strafrecht ► Kriminologie | |

| Sozialwissenschaften ► Politik / Verwaltung ► Politische Systeme | |

| Sozialwissenschaften ► Politik / Verwaltung ► Staat / Verwaltung | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Bankbetriebslehre | |

| Wirtschaft ► Betriebswirtschaft / Management ► Unternehmensführung / Management | |

| Wirtschaft ► Volkswirtschaftslehre ► Finanzwissenschaft | |

| Schlagworte | 2018 • Bank • Behind • Collapse • Crisis • Edition • Ian Fraser • RBS • royal bank • scenes • shredded • the • Updated |

| ISBN-10 | 0-85790-623-2 / 0857906232 |

| ISBN-13 | 978-0-85790-623-6 / 9780857906236 |

| Haben Sie eine Frage zum Produkt? |

Größe: 4,8 MB

DRM: Digitales Wasserzeichen

Dieses eBook enthält ein digitales Wasserzeichen und ist damit für Sie personalisiert. Bei einer missbräuchlichen Weitergabe des eBooks an Dritte ist eine Rückverfolgung an die Quelle möglich.

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür die kostenlose Software Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür eine kostenlose App.

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich