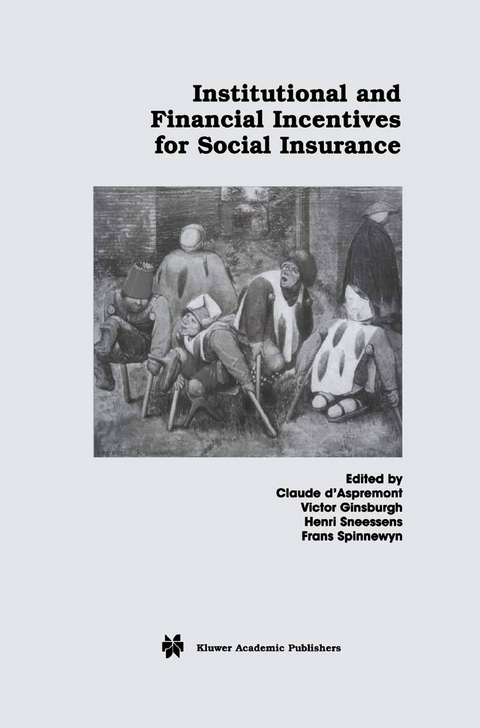

Institutional and Financial Incentives for Social Insurance

Springer-Verlag New York Inc.

978-1-4613-5237-2 (ISBN)

The volume describes a number of studies of social security systems in various countries and assesses the effect of various policies, including welfare or unemployment benefits, training and other active labour market policies, the provision of pension, and competition and budget devolution in health care. It applies empirical tests to individual preferences concerning unemployment compensation, and it analyzes nonfunded and funded social security systems, the transition from one system to the other, and the willingness to pay for pensions.

1 The Effects of Welfare Benefits on the Duration of Welfare Spells.- 1.1 Introduction.- 1.2 Data.- 1.3 Nonparametric Analysis.- 1.4 Parametric Analysis of Welfare Spell Durations.- 1.5 Conclusion.- 2 The Design of Active Labour Market Policies.- 2.1 Introduction.- 2.2 Policy Effectiveness and the Underlying Causes of Unemployment Persistence.- 2.3 Incentives: Do they matter?.- 2.4 Conclusion.- 3 Labor Market Policies and Equilibrium Employment.- 3.1 Introduction.- 3.2 Job Matching, Labor Market Policies and Equilibrium Employment.- 3.3 A Numerical Simulation for Belgium.- 3.4 Conclusion.- 4 Unemployment Compensation Preferences.- 4.1 Introduction.- 4.2 Preferences Concerning Unemployment Insurance: a Simple Model.- 4.3 Design of the Survey.- 4.4 Estimation Results: Preferences Concerning the Unemployment Insurance System.- 4.5 Conclusion.- 5 Competition and Budget Devolution in Health Care.- 5.1 The 1990 Reforms.- 5.2 Evaluating the 1990 Reforms.- 5.3 The New Labour Government Tries Again.- 6 Pension Provision in the United States.- 6.1 Introduction.- 6.2 Public Sources of Income.- 6.3 Private Pension Plans.- 6.4 Sustainability of the Public System.- 6.5 Activity Rates.- 6.6 Income Distribution.- 6.7 Conclusions.- 7 The Willingness to Pay for Pensions.- 7.1 Introduction.- 7.2 Model.- 7.3 The Relationship Between Instantaneous Utilities and Lifetime Utilities.- 7.4 Benchmarks.- 7.5 Funded System with Income Insurance.- 7.6 Pay-as-you-go Pension Systems.- 7.7 Discussion.- 8 Social Security and Risk Sharing.- 8.1 Introduction.- 8.2 The Model.- 8.3 Interim Optimality.- 8.4 Equilibrium and Intergenerational Transfers.- 8.5 Proofs.- 9 Transition from Unfunded to Funded Social Security.- 9.1 A Simple Model.- 9.2 Would the Young Ever Want to Bribe the Old?.- 9.3 How Should Pension Funds Be Managed?.- 9.4 Conclusion.- 10 Voting over Social Security with Uncertain Lifetimes.- 10.1 Introduction.- 10.2 The Economy.- 10.3 Flat-Rate Benefits.- 10.4 Contribution-Related Benefits.- 10.5 Means-Tested Benefits.- 10.6 Summary and Concluding Remarks.- Appendix: Proof of Proposition 4.- 11 The Political Economy.- 11.1 Introduction.- 11.2 The Model.- 11.3 Majority Voting in the Steady State.- 11.4 Demographic Shock.- 11.5 Choosing the Parameters ? and p.- 11.6 Conclusion.

| Zusatzinfo | XI, 242 p. |

|---|---|

| Verlagsort | New York, NY |

| Sprache | englisch |

| Maße | 155 x 235 mm |

| Themenwelt | Recht / Steuern ► Arbeits- / Sozialrecht ► Arbeitsrecht |

| Wirtschaft ► Allgemeines / Lexika | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Wirtschaft ► Volkswirtschaftslehre ► Mikroökonomie | |

| ISBN-10 | 1-4613-5237-1 / 1461352371 |

| ISBN-13 | 978-1-4613-5237-2 / 9781461352372 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich