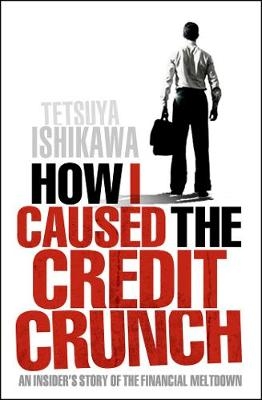

How I Caused the Credit Crunch

Seiten

2009

Icon Books (Verlag)

978-1-84831-067-4 (ISBN)

Icon Books (Verlag)

978-1-84831-067-4 (ISBN)

- Titel z.Zt. nicht lieferbar

- Versandkostenfrei innerhalb Deutschlands

- Auch auf Rechnung

- Verfügbarkeit in der Filiale vor Ort prüfen

- Artikel merken

A personal account of 21st century banking excess. It reveals how a young Oxford graduate finds himself in command of vast sums of other people's money.

This is a vivid and personal account of 21st century banking excess. "How I Caused the Credit Crunch" traces seven years at the forefront of the credit markets - a tale from the heart of the bewildering banking maelstrom whose catastrophic collapse has plunged the world towards the worst recession since the 1930s. Tetsuya Ishikawa's story reveals how a young Oxford graduate finds himself in command of vast sums of other people's money; how a novice to the mysteries of hedge funds, subprime mortgages and CDOs can fix complex deals for billions of dollars in the exclusive bars, brothels and trading floors of London, New York, Frankfurt and Tokyo, and reap the benefits in a colossal annual bonus and an international luxury lifestyle. Ishikawa's book, which deftly explains the arcane financial instruments now grimly associated with the credit crunch, is both a powerful tale of lost innocence and an expose of the disturbing truth of the collective folly, frailty and greed at the heart of the banking crisis.

This is a vivid and personal account of 21st century banking excess. "How I Caused the Credit Crunch" traces seven years at the forefront of the credit markets - a tale from the heart of the bewildering banking maelstrom whose catastrophic collapse has plunged the world towards the worst recession since the 1930s. Tetsuya Ishikawa's story reveals how a young Oxford graduate finds himself in command of vast sums of other people's money; how a novice to the mysteries of hedge funds, subprime mortgages and CDOs can fix complex deals for billions of dollars in the exclusive bars, brothels and trading floors of London, New York, Frankfurt and Tokyo, and reap the benefits in a colossal annual bonus and an international luxury lifestyle. Ishikawa's book, which deftly explains the arcane financial instruments now grimly associated with the credit crunch, is both a powerful tale of lost innocence and an expose of the disturbing truth of the collective folly, frailty and greed at the heart of the banking crisis.

Tetsuya Ishikawa, Japanese by birth, grew up in London, and attended Eton College before reading Philosophy, Politics and Economics at Oxford University. Throughout his banking career that included Goldman Sachs, Morgan Stanley and ABN AMRO, he structured, syndicated and sold Credit Derivative, CDO and Securitisation (including subprime) products to investors globally. He was made redundant by Morgan Stanley in May 2008. He currently lives in London with his wife and children.

| Erscheint lt. Verlag | 2.4.2009 |

|---|---|

| Zusatzinfo | Illustrations |

| Verlagsort | Duxford |

| Sprache | englisch |

| Maße | 129 x 198 mm |

| Gewicht | 272 g |

| Themenwelt | Literatur ► Biografien / Erfahrungsberichte |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Bankbetriebslehre | |

| Wirtschaft ► Volkswirtschaftslehre ► Finanzwissenschaft | |

| ISBN-10 | 1-84831-067-6 / 1848310676 |

| ISBN-13 | 978-1-84831-067-4 / 9781848310674 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

warum unser Geld stirbt und wie Sie davon profitieren

Buch | Hardcover (2024)

FinanzBuch (Verlag)

30,00 €

denken und handeln wie ein professioneller Trader

Buch | Softcover (2023)

Vahlen, Franz (Verlag)

36,90 €