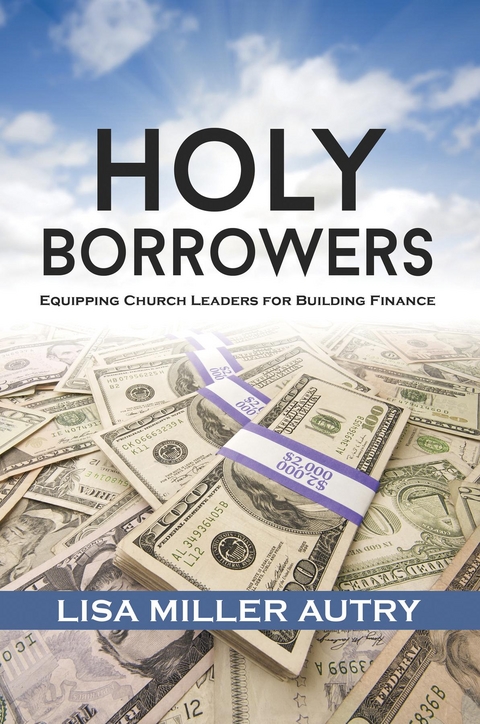

Holy Borrowers (eBook)

324 Seiten

reMix Publishing, LLC (Verlag)

978-1-7350282-3-1 (ISBN)

Foreword by Dr. Frederick Douglass Haynes, III

Introduction

Part I: Preparation

Section Overview

Chapter 1: Should You Borrow?

Chapter 2: The Role of Faith

Chapter 3: Getting Ready Before You're Ready

Chapter 4: Common Banking Terminology

Chapter 5: Race, Discrimination, and the Banking Industry

Part II: Inside the Bank's Credit Process

Section Overview

Chapter 6: Character

Chapter 7: Cash Flow

Chapter 8: Collateral

Chapter 9: Capital

Chapter 10: Conditions

Chapter 11: Unique Guidelines for Churches

Chapter 12: The Loan Evaluation Process

Part III: Advanced Lending Topics

Section Overview

Chapter 13: The Loan's Funded! Now What?

Chapter 14: Construction Loans

Chapter 15: Balloon Notes

Chapter 16: If the Loan Goes South

(With Contribution from Sharon K. Simmons)

Chapter 17: In the Midst of COVID-19

Part IV: Lessons from Successful Churches

Section Overview

Chapter 18: Lessons from Mt. Hebron Missionary Baptist Church

Chapter 19: Lessons from Friendship-West Baptist Church

Conclusion

Appendices

Appendix I: Sample Church Loan Application Checklist

Appendix II: Sample Financial Statements

Appendix III: Calculation of Debt Service Coverage Ratio

Appendix IV: Sample Trend Analysis

Appendix V: Guidelines for Selecting an Attorney (Contributed by Sharon K. Simmons)

Acknowledgements

Bibliography

Index of Key Terms and Topics

| Erscheint lt. Verlag | 25.6.2020 |

|---|---|

| Vorwort | III Dr. Frederick D. Haynes |

| Sprache | englisch |

| Themenwelt | Religion / Theologie ► Christentum ► Kirchengeschichte |

| Religion / Theologie ► Christentum ► Pastoraltheologie | |

| Schlagworte | accountant • Accounting • amortization • Appraisal • balance sheet • Balloon • Bank • Banking • borrow • borrower • Borrowing • Building • Cash Flow • Character • Christian • Church • church leader • Collateral • commercial • commitment letter • Conditions • congregation • Construction • Covenant • Covid-19 • credit • debt • Discrimination • Equity • Faith • Finance • Finances • Financial • Financial statement • Financing • foreclosure • giving unit • income statement • interest expense • Interest Rate • Leadership • lender • Lending • Leverage • Loan • loan document • loan-to-value • Members • Nonprofit • Non Profit • not for profit • Pastor • Pastoral Resources • PPP loan • predatory lender • Real Estate • redlining • senior pastor • statement of activities • statement of financial position • statement of flows • Succession Planning • Term Sheet • Underwriting |

| ISBN-10 | 1-7350282-3-1 / 1735028231 |

| ISBN-13 | 978-1-7350282-3-1 / 9781735028231 |

| Haben Sie eine Frage zum Produkt? |

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich