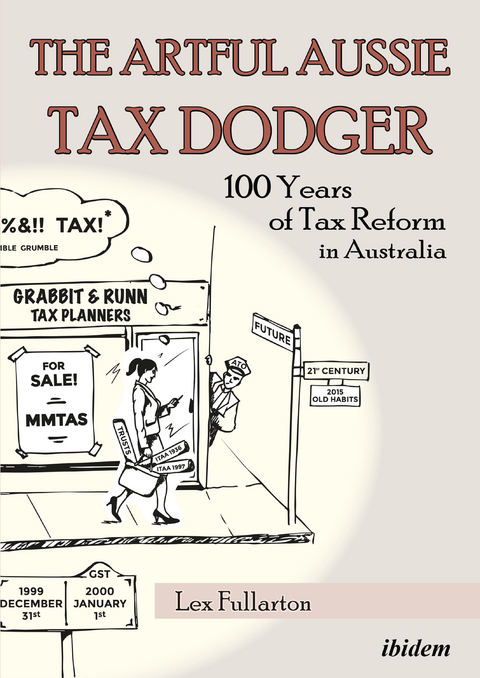

The Artful Aussie Tax Dodger

ibidem (Verlag)

978-3-8382-0994-4 (ISBN)

- Titel nicht im Sortiment

- Artikel merken

Lex Fullarton is a descendent of British Colonists of Western Australia. His family arrived in the Gascoyne region in the early 1880s and he is a native of Carnarvon, WA. He was a real estate agent/tax-practitioner/public accountant for over 20 years. He is, in fact, the proverbial “bush lawyer”. Currently, he is Adjunct Professor at the Curtin Law School, Curtin University, in Western Australia. Fullarton has previously published the books Heat, Dust, and Taxes (2015) and Watts in the Desert (2016).

It is not often that a book on tax challenges us with its insights. This book does that. There is much in here, not just for tax specialists but for all of us trying to get our community to discuss, debate and even to disagree with. Lex Fullarton's book opens up the avenues for a fruitful exploration of ideas about Australian society not often explored in tax. John Passant, former Australian Assistant Commissioner of Taxation and tax academic Australian National University.

| Erscheinungsdatum | 20.02.2017 |

|---|---|

| Sprache | englisch |

| Maße | 148 x 210 mm |

| Themenwelt | Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Steuern / Steuererklärung |

| Geschichte ► Teilgebiete der Geschichte ► Militärgeschichte | |

| Recht / Steuern ► Rechtsgeschichte | |

| Recht / Steuern ► Steuern / Steuerrecht ► Verbrauchsteuern / Zollrecht | |

| Schlagworte | Australia • Australien • History • Lokale Steuern, Abgaben, Verbrauchssteuern • Rechtsgeschichte • Steuerrecht (SteuerR) • Steuer- und Abgabenrecht • Taxes |

| ISBN-10 | 3-8382-0994-X / 383820994X |

| ISBN-13 | 978-3-8382-0994-4 / 9783838209944 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich