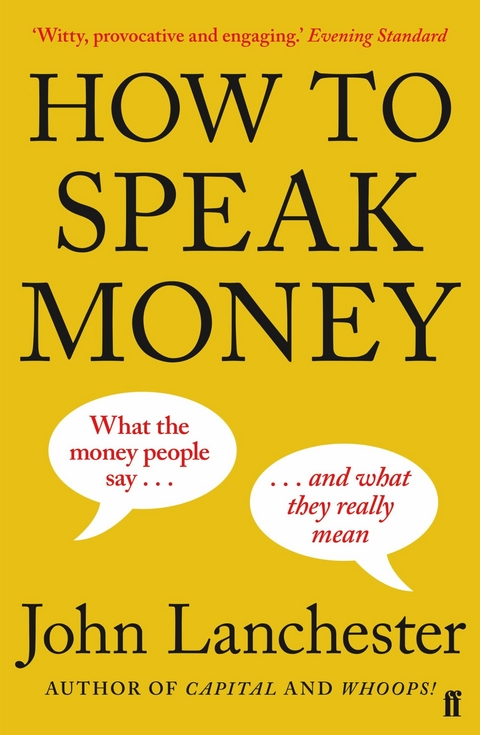

How to Speak Money (eBook)

256 Seiten

Faber & Faber (Verlag)

978-0-571-30983-2 (ISBN)

John Lanchester has written five novels, The Debt to Pleasure, Mr Phillips, Fragrant Harbour, Capital and The Wall, and three works of non-fiction: Family Romance, a memoir; Whoops!: Why everyone owes everyone and no one can pay, about the global financial crisis; and How to Speak Money, a primer in popular economics. His books have won the Hawthornden Prize, the Whitbread First Novel Prize, the E. M. Forster Award, and the Premi Llibreter, been longlisted for the Booker Prize, and been translated into twenty-five languages. He is a contributing editor to the London Review of Books and a regular contributor to the New Yorker.

Money is our global language. Yet so few of us can speak it. The language of the economic elite can be complex, jargon-filled and completely baffling. Above all, the language of money is the language of power - power in the hands of the same economic elite. Now John Lanchester, bestselling author of Capital and Whoops! sets out to decode the world of finance for all of us, explaining everything from high-frequency trading and the World Bank to the difference between bullshit and nonsense. As funny as it is devastating, How To Speak Money is a primer and a polemic. It's a reference book you'll find yourself reading in one sitting. And it gives you everything you need to demystify the world of high finance - the world that dominates how we all live now.

One of the great explainers of the financial crisis and its aftermath.

I have read and re-read John Lanchester's wonderful book on economics. It's a dazzling, most wonderful book and it really excites me - it is so witty and so clear and so original - a most extraordinary book!

A A mathematical term I’ve just made up to denote 16,438, for the purpose of making sure it comes first in this lexicon. This number is, in the words of Melinda Gates, ‘the most important statistic in the world’. It’s the number of children under five who aren’t dying every day, compared to the number who were dying daily in 1990. The change is from 12.6 million to 6.6 million deaths a year: a total of six million children’s lives saved every year. Why isn’t this a famous fact, a famous success? As Melinda Gates (that’s Mrs Bill) points out, the number of child deaths has gone down every single year for fifty years: ‘I challenge you to name something else that gets better on that kind of schedule.’ Remember those really annoying ads where a celebrity would click their fingers while saying, ‘Every time I click my fingers, a child dies’? (Prompting somebody in Ireland to shout at Bono, clicking his fingers on screen, ‘Stop fecking doing it then!’) That could now be shown the other way around: the annoying celebs could click their fingers every five and a quarter seconds to show how many lives have been saved. There are still six million child deaths too many, but surely Melinda Gates is right that the UNICEF statistic, published every year in mid-September, matters a lot more than most of the numbers plastered all over the media every day. See also MDGS.

*

A and B shares A device used by companies to create different categories of rights among their shareholders. The most common is to separate owners with voting rights, i.e. the ability to influence the decisions companies make, from owners who have a share in the business but no right to make decisions. It’s very often families who use this kind of structure, to keep control of their business while also raising lots of lovely money from the public: examples are the Sainsburys at Sainsburys, the Murdochs at News Corp and the Sulzbergers at the New York Times. Why would anybody invest in a company but choose to have no say in how the business is run? Because these businesses are often well run and managed for the long term, make money for their shareholders, and have the track record to prove it. There’s some evidence that family-controlled businesses do better than purely public companies. The reason for that must surely be that they, if well managed, have a longer-term focus and steadier nerve than companies chasing a good set of quarterly figures to keep their shareholders happy. There may also be a strong element of ‘survivorship bias’ in the statistics, in that family firms which are less competent will be forced out of the market and/or bought out by more efficient competitors; so the ones which are still in business are by definition the successful survivors.

*

AAA Also called triple-A, this is the highest rated category of DEBT, which in practice means the rating as assessed by one of the three big RATINGS AGENCIES: Moody’s, Standard and Poor’s, and Fitch. The idea of AAA debt is that it shows, in the words of S&P, ‘extremely strong capacity to meet financial commitments’. Mistakes made by the agencies in assessing the riskiness of debt, especially in the AAA category, played a big part in the credit crisis of 2008.

*

Abenomics The name given to the policies of Shinzo Abe, the prime minister of JAPAN, who started his second term in office in 2012. There were supposed to be three ‘arrows’ – the Japanese are keen on archery – to the policy, involving a revised approach to FISCAL policy, reforms to the labour market, and printing money like it’s about to go out of style, in an attempt to end DEFLATION and start a beneficial level of INFLATION. Of these three arrows, the easiest to use, and therefore the only one to have been loosed, is the third: basically, the Governor of the Bank of Japan has turned on the printing press and wandered off, saying, ‘Don’t come and get me until inflation hits 2 per cent.’ The yen has dropped, which is a good thing for Japanese industry, and inflation is showing signs of returning, which is also a good thing, though some commentators are worried that the process could quickly get out of hand. In that case Japan would be facing – to use a new term which I read just yesterday for the first time – ‘Abegeddon’.

Policy makers in the West are fascinated by Abenomics. That’s because they see a similar process of slow GROWTH and deflation as a distinct possibility locally. Combined with the political difficulty of certain types of economic REFORM, the kind which cause suffering to powerful entrenched interests, that makes the Japanese example very relevant. Add ZOMBIE BANKS to the mix, and the similarities are, as Dame Edna would say, spooky. Especially the similarities to Europe: deflation, check; reforms impossible, check; zombie banks, check. If Abenomics were to cure Japan’s problems, then it would be a wonderfully useful model for Europe, and maybe for the UK too.

‘That,’ says a mate of mine who works for a Japanese bank, ‘is why they’re all obsessed with Abenomics. Especially the Treasury. If you want a load of Treasury people to turn up to a talk or event, you just tell them it’s about Abenomics, and they’re hanging from the rafters.’

*

Adam Smith Institute A right-wing British think tank, describing itself as ‘libertarian’, which always argues in favour of free markets. It did influential work when Mrs Thatcher’s government was in office but the trouble with it, as is often the case with this kind of ideological body, is that you always know what it’s going to say: the solution to everything is DEREGULATION and free markets.

*

amortisation The process by which the value of something is reduced, or ‘written down’, over time on a set of accounts. If you buy a new computer for £1,200, and the rate at which it amortises is 25 per cent, after a year your computer is now worth £900. You can then put this £300 of ‘loss’ on your company BALANCE SHEET for that year. Why would you want to do that? Because the ‘loss’ allows you to reduce the amount of tax you have to pay. The tax rules for amortisation are very complicated, as a way of stopping people pulling accounting tricks with it – which is a sure sign that companies try to pull accounting tricks with it.

*

analysts see TRADERS, ANALYSTS, QUANTS

*

arbitrage The process of using differences between prices to make what should be a guaranteed profit, by buying for one price and simultaneously selling for another. If you can buy cocoa futures in London for $1,000 a tonne, and sell them immediately in New York for $1,001, that’s arbitrage, and you are making a guaranteed profit. The words ‘guaranteed profit’ are magical in finance, and so arbitrage is a beloved feature of the markets, appearing in very many complicated forms, in every imaginable cranny of every imaginable market.

*

asset allocation An approach to investment that has grown in popularity with modern theories of efficient markets. If it’s impossible to do a better job of picking and choosing shares than the market does – which is what many studies of the stock market claim to have proved – it follows that you should save the time you spend on picking STOCKS and spend it instead on choosing the right areas of the market to be in. Don’t think about BP versus Shell versus Exxon, think about whether you should be in oil at all; more generally, think about the balance between stocks and BONDS and property and COMMODITIES, developed and emerging markets, and then allocate your ASSETS accordingly, investing wherever possible via cheap pooled funds preferably. This balance of asset allocation is, in the modern theory of investing, the most important thing to get right.

*

assets and liabilities These are the two main categories on a BALANCE SHEET, always depicted with assets on the left, liabilities on the right. Your EQUITY, i.e. the stuff you actually own outright, is always equal to your assets minus your liabilities.

In the language of maths, Assets = Liabilities + Equity. These ideas are based on common sense but they can also be strangely hard to get your head around. In the case of banks, for instance, customer deposits – the money we customers have put in our bank accounts – appear as liabilities: that’s because it is our money and we could ask for it back at any moment. The money the bank lends to us, on the other hand, appears as a bank asset. It seems a bit weird that my MORTGAGE is a bank asset and my cash is a bank liability, but that’s the way it is.

*

austerity This is, I think, the strangest piece of political/economic vocabulary to have come along in my adult lifetime. What ‘austere’ means in normal life is, in the words of the fifth edition of the Concise Oxford Dictionary, ‘harsh, stern; morally strict, severely simple’. But that’s a general quality which doesn’t really mean anything tangible, which is a problem, since in this context only the specifics matter. What we’re talking about here is spending cuts. Funds are either cut or...

| Erscheint lt. Verlag | 2.9.2014 |

|---|---|

| Verlagsort | London |

| Sprache | englisch |

| Themenwelt | Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Wirtschaft |

| Schulbuch / Wörterbuch ► Lexikon / Chroniken | |

| Technik | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Schlagworte | Capital • Capital in the Twenty-First Century • economics the user's guide • the establishment and how they get away with it • the shifts and the shocks • the undercover economist tim harford • wolf of wall street |

| ISBN-10 | 0-571-30983-6 / 0571309836 |

| ISBN-13 | 978-0-571-30983-2 / 9780571309832 |

| Haben Sie eine Frage zum Produkt? |

Größe: 372 KB

DRM: Digitales Wasserzeichen

Dieses eBook enthält ein digitales Wasserzeichen und ist damit für Sie personalisiert. Bei einer missbräuchlichen Weitergabe des eBooks an Dritte ist eine Rückverfolgung an die Quelle möglich.

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür die kostenlose Software Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür eine kostenlose App.

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich