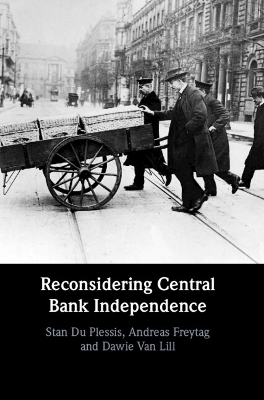

Reconsidering Central Bank Independence

Cambridge University Press (Verlag)

978-1-108-49329-1 (ISBN)

Central bank independence has become one of the most widely accepted tenets of modern monetary policy. According to this view, the main role of independent central banks is to maintain price stability through the adjustment of short-term interest rates. Reconsidering Central Bank Independence argues that the global financial crisis has undermined confidence in this view as central banks increasingly have to address concerns other than price stability, such as financial stability, the need for output recovery and other broader policy goals. Large balance-sheet expansion by central banks followed the global financial crisis, which overlapped considerably with the financial policy of their respective governments. Exploring the consequences of this shift to a more diverse set of policy challenges, this book calls for a return to the consensus role for central banks and analyses what this might mean for their future independence.

Stan du Plessis is Professor of Macroeconomics at Stellenbosch University where he is Chief Operating Officer and formerly a Dean. This Past President of the Economic Society of South Africa studied at the Universities of Cambridge, Stellenbosch and the Wharton Business School and is a member of the Academy of Science of South Africa. Andreas Freytag is Professor of Economics at the Friedrich-Schiller-University Jena, where he heads the Schumpeter Center for Research on Socio-Economic Change (JSEC), and Honorary Professor at the University of Stellenbosch. He is associated to many international education organisations and think tanks. Dr. Dawie van Lill teaches macroeconomics at the University of Stellenbosch. His research spans time series methods and machine learning, with a particular interest in monetary policy. Recently, he's been exploring the development of macroeconomic models to assess the distributional effects of government policies.

Part I. The Theoretical Foundations: 1. History of Central Banking; 2. Focus on Inflation: The Rationale for Central Bank Independence since Ancient Days; 3. The Political Economy of CBI; Part II. Balance Sheet Operations in Different Times and CBI: 4. Central Banks and the Great Moderation; 5. Monetary Policy Response to the Financial Crisis; 6. Balance sheet policies and CBI; Part III. The Political Economy of CBI in the Real Economy: 7. Fiscal Needs and Low Interest Rates Policy in an Olsonian Setting; 8. Are Central Banks Too Independent? CBI and Democracy after the Crises; 9. The Future of Central Bank Independence.

| Erscheinungsdatum | 20.04.2024 |

|---|---|

| Zusatzinfo | Worked examples or Exercises |

| Verlagsort | Cambridge |

| Sprache | englisch |

| Gewicht | 545 g |

| Themenwelt | Wirtschaft ► Volkswirtschaftslehre ► Makroökonomie |

| ISBN-10 | 1-108-49329-7 / 1108493297 |

| ISBN-13 | 978-1-108-49329-1 / 9781108493291 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich