Metamodeling for Variable Annuities

Crc Press Inc (Verlag)

978-0-8153-4858-0 (ISBN)

Guojun Gan Guojun Gan is an Assistant Professor in the Department of Mathematics at the University of Connecticut, where he has been since August 2014. Prior to that, he worked at a large life insurance company in Toronto, Canada for six years and a hedge fund in Oakville, Canada for one year. He received a BS degree from Jilin University, Changchun, China, in 2001 and MS and PhD degrees from York University, Toronto, Canada, in 2003 and 2007, respectively. He is also a Fellow of the Society of Actuaries (FSA). His research interests include actuarial science and data mining. He has published several books and papers on a variety of topics, including data clustering, variable annuity, applied statistics, VBA programming, and mathematical finance. Emiliano A. Valdez Emiliano Valdez is a Fellow of the Society of Actuaries and holds a Ph.D. from the University of Wisconsin in Madison. His most recent post was at Michigan State University in East Lansing as professor and director of their actuarial science program. His primary research interest is actuarial science that covered topics in copula models and dependencies, applications of statistics to insurance problems, managing post-retirement assets, and risk measures and capital requirements related to enterprise risk management. In recognition for the quality of his research, he has been awarded several prizes that include the E. A. Lew Award, the Halmstad Memorial Prize, and the Hachemeister Prize.

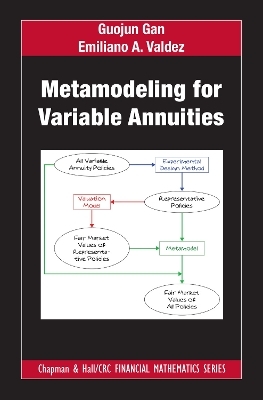

Preface. Part 1: Preliminaries. 1. Computational Problems in Variable Annuities. 2. Existing Approaches. 3. Metamodeling Approach. Part 2: Experimental Design Methods. 4. Conditional Latin Hypercube Sampling. 5. Hierarchical Clustering. 6. Partitional Clustering. Part 3: Predictive Modeling. 7. Ordinary Kriging. 8. Universal Kriging. 9. GB2 Regression Model. 10. Spliced Regression Model. 11. Neural Networks. Appendix A: Sample Datasets.

| Erscheinungsdatum | 17.07.2019 |

|---|---|

| Reihe/Serie | Chapman and Hall/CRC Financial Mathematics Series |

| Zusatzinfo | 14 Tables, black and white; 68 Illustrations, black and white |

| Verlagsort | Bosa Roca |

| Sprache | englisch |

| Maße | 156 x 234 mm |

| Gewicht | 467 g |

| Themenwelt | Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Versicherungsbetriebslehre |

| ISBN-10 | 0-8153-4858-4 / 0815348584 |

| ISBN-13 | 978-0-8153-4858-0 / 9780815348580 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich