Portfolio Optimization

Chapman & Hall/CRC (Verlag)

978-1-032-92596-7 (ISBN)

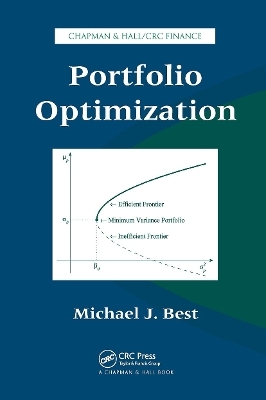

Eschewing a more theoretical approach, Portfolio Optimization shows how the mathematical tools of linear algebra and optimization can quickly and clearly formulate important ideas on the subject. This practical book extends the concepts of the Markowitz "budget constraint only" model to a linearly constrained model.

Only requiring elementary linear algebra, the text begins with the necessary and sufficient conditions for optimal quadratic minimization that is subject to linear equality constraints. It then develops the key properties of the efficient frontier, extends the results to problems with a risk-free asset, and presents Sharpe ratios and implied risk-free rates. After focusing on quadratic programming, the author discusses a constrained portfolio optimization problem and uses an algorithm to determine the entire (constrained) efficient frontier, its corner portfolios, the piecewise linear expected returns, and the piecewise quadratic variances. The final chapter illustrates infinitely many implied risk returns for certain market portfolios.

Drawing on the author’s experiences in the academic world and as a consultant to many financial institutions, this text provides a hands-on foundation in portfolio optimization. Although the author clearly describes how to implement each technique by hand, he includes several MATLAB® programs designed to implement the methods and offers these programs on the accompanying downloadable resources.

Michael J. Best is a professor in the Department of Combinatorics and Optimization at the University of Waterloo in Ontario, Canada. He received his Ph.D. from the Department of Industrial Engineering and Operations Research at the University of California, Berkeley. Dr. Best has authored over 37 papers on finance and nonlinear programming and co-authored a textbook on linear programming. He also has been a consultant to Bank of America, Ibbotson Associates, Montgomery Assets Management, Deutsche Bank, Toronto Dominion Bank, and Black Rock-Merrill Lynch.

Optimization. The Efficient Frontier. The Capital Asset Pricing Model. Sharpe Ratios and Implied Risk-Free Returns. Quadratic Programming Geometry. A QP Solution Algorithm. Portfolio Optimization with Linear Inequality Constraints. Determination of the Entire Efficient Frontier. Sharpe Ratios under Constraints and Kinks. Appendix. References.

| Erscheinungsdatum | 16.10.2024 |

|---|---|

| Reihe/Serie | Chapman and Hall/CRC Financial Mathematics Series |

| Zusatzinfo | 48 Illustrations, black and white |

| Sprache | englisch |

| Maße | 156 x 234 mm |

| Gewicht | 439 g |

| Themenwelt | Technik ► Umwelttechnik / Biotechnologie |

| Wirtschaft ► Betriebswirtschaft / Management | |

| Wirtschaft ► Volkswirtschaftslehre | |

| ISBN-10 | 1-032-92596-5 / 1032925965 |

| ISBN-13 | 978-1-032-92596-7 / 9781032925967 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich