Forecasting Financial Markets

Kogan Page Ltd (Verlag)

978-0-7494-5637-5 (ISBN)

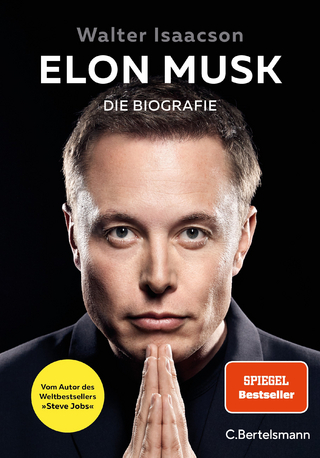

Forecasting Financial Markets provides a compelling insight into the psychology of trading behaviour and shows how "following the herd" can have disastrous results. It demonstrates how your ability to make money in the world's financial markets depends critically on your ability to make decisions independently of the crowd. Given the impact of the global credit crunch, it has become even more essential to be able to distinguish between short-term and longer-term trends at a time when panic selling and 'fire-sale' purchases are common.

Forecasting Financial Markets details the three dimensions essential to achieve successful trading, including an ability to understand the forces at work in logical terms, recognize (and neutralize) any emotional responses to market fluctuations, and design an investment process or trading system that generates objective 'buy' or 'sell' signals.

Taking the author's latest research into account, this important book provides you with an in-depth assessment of the phenomenon of cycles, patterns of economic and financial activity, and how to use cycles as a forecasting tool - including the author's forecasts for when the global economy will emerge from its current downturn.

Tony Plummer is a director of Helmsman Economics Ltd, and is a former director of Guinness Flight Hambro Global Fund Managers Ltd, Hambros Fund Management PLC, and Hambros Bank Ltd. He carries out independent research into the patterns and rhythms of global markets as well as giving global lectures on crowd psychology and technical analysis.

Chapter - 00: Introduction;

Section - ONE: The logic of non-rational behaviour in financial markets;

Chapter - 01: Wholly individual or indivisibly whole;

Chapter - 02: Two’s a crowd;

Chapter - 03: The individual in the crowd;

Chapter - 04: The systems approach to crowd behaviour;

Chapter - 05: Cycles in the crowd;

Chapter - 06: Approaches to forecasting crowd behaviour;

Section - TWO: The dynamics of the bull–bear cycle;

Chapter - 07: The stock market crowd;

Chapter - 08: The shape of the bull–bear cycle;

Chapter - 09: Energy gaps and pro-trend shocks;

Chapter - 10: The spiral and the golden ratio;

Chapter - 11: The mathematical basis of price movements;

Chapter - 12: The shape of things to come;

Section - THREE: Forecasting turning points;

Chapter - 13: The phenomenon of cycles;

Chapter - 14: The threefold nature of cycles;

Chapter - 15: Economic cycles;

Chapter - 16: Recurrence in economic and financial activity;

Chapter - 17: Integrating the cycles;

Chapter - 18: Forecasting with cycles;

Chapter - 19: Price patterns in financial markets;

Chapter - 20: The Elliott wave principle;

Chapter - 21: Information shocks and corrections;

Chapter - 22: The confirmation of buy and sell signals;

Section - FOUR: The psychology of trading;

Chapter - 23: The psychology of fear;

Chapter - 24: The troubled trader;

Chapter - 25: The psychology of success;

Chapter - 26: Summary and conclusions

| Erscheint lt. Verlag | 3.12.2009 |

|---|---|

| Verlagsort | London |

| Sprache | englisch |

| Maße | 162 x 241 mm |

| Gewicht | 904 g |

| Themenwelt | Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Wirtschaft |

| Geisteswissenschaften ► Psychologie | |

| Mathematik / Informatik ► Mathematik ► Finanz- / Wirtschaftsmathematik | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Wirtschaft ► Betriebswirtschaft / Management ► Unternehmensführung / Management | |

| ISBN-10 | 0-7494-5637-X / 074945637X |

| ISBN-13 | 978-0-7494-5637-5 / 9780749456375 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich