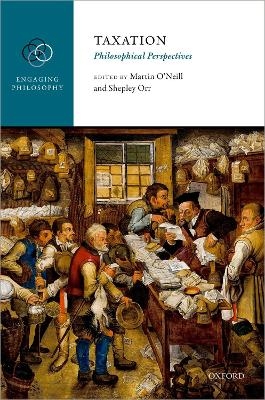

Taxation

Oxford University Press (Verlag)

978-0-19-960922-2 (ISBN)

This is the first book to give a collective treatment of philosophical issues relating to tax. The tax system is central to the operation of states and to the ways in which states interact with individual citizens. Taxes are used by states to fund the provision of public goods and public services, to engage in direct or indirect forms of redistribution, and to mould the behaviour of individual citizens. As the contributors to this volume show, there are a number of pressing and thorny philosophical issues relating to the tax system, and these issues often connect in fascinating ways with foundational questions regarding property rights, public justification, democracy, state neutrality, stability, political psychology, and other moral and political issues. Many of these deep and fascinating philosophical questions about tax have not received as much sustained attention as they clearly merit.

The aim of advancing the debate about tax in political philosophy has both general and more specific aspects, ranging across both over-arching issues regarding the tax system as a whole and more specific issues relating to particular forms of tax policy. Thinking clearly about tax is not an easy task, as much that is of central importance is missed if one proceeds at too great a level of abstraction, and issues of conceptual and normative importance often only come sharply into focus when viewed against real-world questions of implementation and feasibility. Serious philosophical work on the tax system will often therefore need to be interdisciplinary, and so the discussion in this book includes a number of scholars whose expertise spans across neighbouring disciplines to philosophy, including political science, economics, public policy, and law.

Martin O'Neill is Senior Lecturer in Political Philosophy at the University of York. He is co-editor (with Thad Williamson) of Property-Owning Democracy: Rawls and Beyond (Wiley-Blackwell, 2012). Shepley Orr is Lecturer in the Department of Civil, Environmental & Geomatic Engineering in the UCL Faculty of Engineering Sciences, and an affiliate member of the UCL Centre for Philosophy, Justice and Health.

Martin O'Neill and Shepley Orr: Introduction

Part I. On the Tax System: Normative and Conceptual Questions

1: Alan Hamlin: What Political Philosophy Should Learn from Economics about Taxation

2: Marc Fleurbaey: Welfarism, Libertarianism, and Fairness in the Economic Approach to Taxation

3: Geoffrey Brennan: Striving for the Middle Ground: Taxation, Justice and the Status of Private Rights

4: Laura Biron: Taxing or Taking: Property Rhetoric and the Justice of Taxation

5: Peter Vallentyne: Libertarianism and Taxation

6: Alexander Cappelen and Bertil Tungodden: Tax Policy and Fair Inequality

7: Véronique Munoz-Dardé and M. G. F. Martin: Beggar Your Neighbour (Or Why You Do Want to Pay Your Taxes)

Part II. Tax Policy and Forms of Taxation: Philosophical Issues

8: Barbara Fried: The Case for a Progressive Benefits Tax

9: Stuart White: Moral Objections to Inheritance Tax

10: Iain McLean: The Politics of Land Value Taxation

11: Peter Dietsch: The State and Tax Competition: a Normative Perspective

12: Gillian Brock and Rachel McMaster: Global Taxation and Accounting Arrangements: Some Normatively Desirable and Feasible Policy Recommendations

| Erscheinungsdatum | 01.08.2018 |

|---|---|

| Reihe/Serie | Engaging Philosophy |

| Verlagsort | Oxford |

| Sprache | englisch |

| Maße | 163 x 241 mm |

| Gewicht | 592 g |

| Themenwelt | Geisteswissenschaften ► Philosophie ► Ethik |

| Recht / Steuern ► EU / Internationales Recht | |

| Recht / Steuern ► Steuern / Steuerrecht | |

| Sozialwissenschaften ► Politik / Verwaltung ► Politische Theorie | |

| ISBN-10 | 0-19-960922-5 / 0199609225 |

| ISBN-13 | 978-0-19-960922-2 / 9780199609222 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich