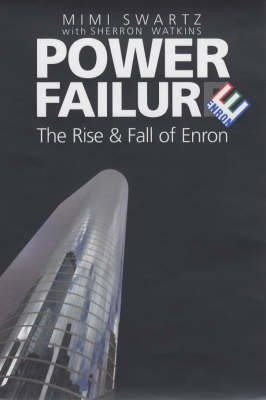

Power Failure

The Rise and Fall of Enron

Seiten

2003

Aurum Press (Verlag)

978-1-85410-883-8 (ISBN)

Aurum Press (Verlag)

978-1-85410-883-8 (ISBN)

- Titel ist leider vergriffen;

keine Neuauflage - Artikel merken

The Enron scandal has rocked corporate America. Drawing closely on the testimony of the Enron vice-president who blew the whistle on the company's dubious accounting methods, Mimi Swartz has written the first full account of the debacle.

By 2000, the Enron Corporation was a colossus. Over 16 years it had transformed itself from a stodgy Texas pipeline company into the world's biggest energy trader, with annual revenues of $100 billion. From its glittering skyscraper in Houston Enron hustled deals in the world's energy, from natural gas to wind power, from Third World refineries to Britain's Wessex Water. Its share price increased by 1700 per cent; its aggressively casual staff prided themselves on their ruthless competitiveness, lavish wages, and obligatory Porsche Boxster. Even Enron's skewed "E" logo seemed to revel in a jaunty angle from conventional business reality. A year later, at the end of 2001, Enron imploded. Thousands of staff were laid off, their pensions - invested in its stocks - worthless, the banks were exposed for hundreds of millions of dollars, and suddenly President Bush's close friendship with Enron's founder looked unwise. It has been an ongoing news story ever since.

Now, drawing closely on the testimony of Sherron Watkins, the vice-president first to blow the whistle on its dubious accounting methods, Mimi Swartz has written a full account of the Enron debacle, showing how its whole mercenary culture was just as much to blame.

By 2000, the Enron Corporation was a colossus. Over 16 years it had transformed itself from a stodgy Texas pipeline company into the world's biggest energy trader, with annual revenues of $100 billion. From its glittering skyscraper in Houston Enron hustled deals in the world's energy, from natural gas to wind power, from Third World refineries to Britain's Wessex Water. Its share price increased by 1700 per cent; its aggressively casual staff prided themselves on their ruthless competitiveness, lavish wages, and obligatory Porsche Boxster. Even Enron's skewed "E" logo seemed to revel in a jaunty angle from conventional business reality. A year later, at the end of 2001, Enron imploded. Thousands of staff were laid off, their pensions - invested in its stocks - worthless, the banks were exposed for hundreds of millions of dollars, and suddenly President Bush's close friendship with Enron's founder looked unwise. It has been an ongoing news story ever since.

Now, drawing closely on the testimony of Sherron Watkins, the vice-president first to blow the whistle on its dubious accounting methods, Mimi Swartz has written a full account of the Enron debacle, showing how its whole mercenary culture was just as much to blame.

Mimi Swartz has written for the New Yorker, Talk magazine and Texas Monthly, for whom she wrote the first extensive investigation of the Enron collapse. She lives in Houston, Texas.

| Erscheint lt. Verlag | 25.3.2003 |

|---|---|

| Sprache | englisch |

| Maße | 156 x 234 mm |

| Gewicht | 603 g |

| Themenwelt | Geisteswissenschaften ► Geschichte |

| Technik ► Elektrotechnik / Energietechnik | |

| ISBN-10 | 1-85410-883-2 / 1854108832 |

| ISBN-13 | 978-1-85410-883-8 / 9781854108838 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

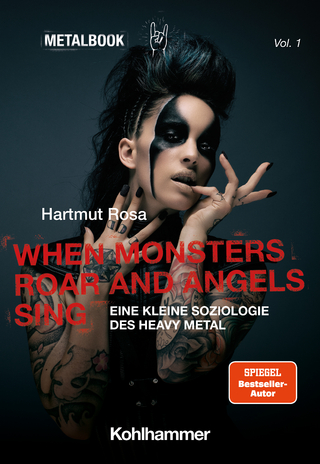

eine kleine Soziologie des Heavy Metal

Buch | Softcover (2023)

Kohlhammer (Verlag)

20,00 €

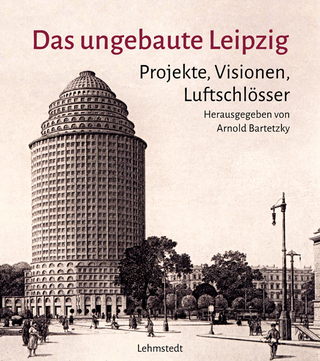

Projekte, Visionen, Luftschlösser

Buch | Hardcover (2023)

Lehmstedt Verlag

30,00 €