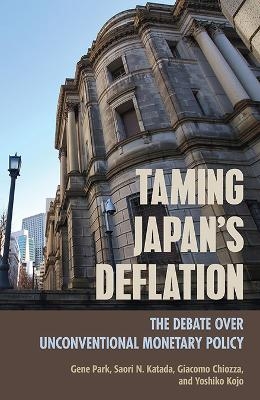

Taming Japan's Deflation

The Debate over Unconventional Monetary Policy

Seiten

2018

Cornell University Press (Verlag)

978-1-5017-2817-4 (ISBN)

Cornell University Press (Verlag)

978-1-5017-2817-4 (ISBN)

Bolder economic policy could have addressed the persistent bouts of deflation in post-bubble Japan, write Gene Park, Saori N. Katada, Giacomo Chiozza, and Yoshiko Kojo in Taming Japan's Deflation. Despite warnings from economists, intense political pressure, and well-articulated unconventional policy options to address this problem, Japan's...

Bolder economic policy could have addressed the persistent bouts of deflation in post-bubble Japan, write Gene Park, Saori N. Katada, Giacomo Chiozza, and Yoshiko Kojo in Taming Japan's Deflation. Despite warnings from economists, intense political pressure, and well-articulated unconventional policy options to address this problem, Japan's central bank, the Bank of Japan (BOJ), resisted taking the bold actions that the authors believe would have significantly helped.

With Prime Minister Abe Shinzo's return to power, Japan finally shifted course at the start of 2013 with the launch of Abenomics—an economic agenda to reflate the economy—and Abe's appointment of new leadership at the BOJ. As Taming Japan's Deflation shows, the BOJ's resistance to experimenting with bolder policy stemmed from entrenched policy ideas that were hostile to activist monetary policy. The authors explain how these policy ideas evolved over the course of the BOJ's long history and gained dominance because of the closed nature of the broader policy network.

The explanatory power of policy ideas and networks suggests a basic inadequacy in the dominant framework for analysis of

the politics of monetary policy derived from the literature on central bank independence. This approach privileges the interaction between political principals and their supposed agents, central bankers; but Taming Japan's Deflation shows clearly that central bankers' views, shaped by ideas and institutions, can be decisive in determining monetary policy. Through a combination of institutional analysis, quantitative empirical tests, in-depth case studies, and structured comparison of Japan with other countries, the authors show that, ultimately, the decision to adopt aggressive monetary policy depends largely on the bankers' established policy ideas and policy network.

Bolder economic policy could have addressed the persistent bouts of deflation in post-bubble Japan, write Gene Park, Saori N. Katada, Giacomo Chiozza, and Yoshiko Kojo in Taming Japan's Deflation. Despite warnings from economists, intense political pressure, and well-articulated unconventional policy options to address this problem, Japan's central bank, the Bank of Japan (BOJ), resisted taking the bold actions that the authors believe would have significantly helped.

With Prime Minister Abe Shinzo's return to power, Japan finally shifted course at the start of 2013 with the launch of Abenomics—an economic agenda to reflate the economy—and Abe's appointment of new leadership at the BOJ. As Taming Japan's Deflation shows, the BOJ's resistance to experimenting with bolder policy stemmed from entrenched policy ideas that were hostile to activist monetary policy. The authors explain how these policy ideas evolved over the course of the BOJ's long history and gained dominance because of the closed nature of the broader policy network.

The explanatory power of policy ideas and networks suggests a basic inadequacy in the dominant framework for analysis of

the politics of monetary policy derived from the literature on central bank independence. This approach privileges the interaction between political principals and their supposed agents, central bankers; but Taming Japan's Deflation shows clearly that central bankers' views, shaped by ideas and institutions, can be decisive in determining monetary policy. Through a combination of institutional analysis, quantitative empirical tests, in-depth case studies, and structured comparison of Japan with other countries, the authors show that, ultimately, the decision to adopt aggressive monetary policy depends largely on the bankers' established policy ideas and policy network.

Gene Park is Associate Professor of Political Science at Loyola Marymount University. He is the author of Spending without Taxation. Saori N. Katada is Associate Professor in the School of International Relations at the University of Southern California. She is the author of Banking on Stability. Giacomo Chiozza is an expert in world politics and statistical modeling, and co-author, most recently, of Leaders and International Conflict. He is Associate Professor in the Department of International Studies at the American University of Sharjah. Yoshiko Kojo is Professor in the Department of Advanced Social and International Relations at the University of Tokyo. She is a contributor to Japan in International Politics.

| Erscheinungsdatum | 05.10.2018 |

|---|---|

| Reihe/Serie | Cornell Studies in Money |

| Zusatzinfo | 3 Line drawings, black and white; 13 Charts |

| Verlagsort | Ithaca |

| Sprache | englisch |

| Maße | 152 x 229 mm |

| Gewicht | 907 g |

| Themenwelt | Geisteswissenschaften ► Geschichte ► Regional- / Ländergeschichte |

| Wirtschaft ► Volkswirtschaftslehre ► Finanzwissenschaft | |

| Wirtschaft ► Volkswirtschaftslehre ► Wirtschaftspolitik | |

| ISBN-10 | 1-5017-2817-2 / 1501728172 |

| ISBN-13 | 978-1-5017-2817-4 / 9781501728174 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

Erinnerungen

Buch | Softcover (2024)

Pantheon (Verlag)

16,00 €