Abusive Tax Planning in Canada

Applications of the General Anti-Avoidance Rule to Abusive Surplus Stripping

Seiten

2022

Our Knowledge Publishing (Verlag)

978-620-4-43150-5 (ISBN)

Our Knowledge Publishing (Verlag)

978-620-4-43150-5 (ISBN)

- Titel nicht im Sortiment

- Artikel merken

Surplus stripping has been the most frequent issue of application of the General Anti-Skimming Rule since its inception in 1988. Whether it is the circumvention of specific anti-stripping rules such as section 84.1 and subsection 84(2) of the Income Tax Act; the artificial transfer or creation of tax attributes; the use of a trust or partnership; and the abuse of attribution rules or tax treaties; Surplus stripping generally involves the ultimate distribution of corporate profits to individuals, in any manner other than through taxable dividends, by circumventing or using, often abusively, the provisions of the Income Tax Act.This essay discusses the intent of the legislator and maps out acceptable, uncertain or abusive planning vis-à-vis the GAAR. Case law, technical interpretations, legislative amendments and proposals, and doctrine have been helpful in this exercise.

Minoungou, Jean-LucJean-Luc Minoungou has been working in the field of taxation for seven years and is interested in tax policy, aggressive tax planning, tax equity and environmental taxation. He completed a master's degree in taxation at the University of Sherbrooke in 2020.

| Erscheinungsdatum | 29.01.2022 |

|---|---|

| Sprache | englisch |

| Maße | 150 x 220 mm |

| Gewicht | 137 g |

| Themenwelt | Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Steuern / Steuererklärung |

| Recht / Steuern ► Steuern / Steuerrecht | |

| Schlagworte | Canadian Taxation • Dépouillement de surplus • Fiscalité Canadienne • General Anti-Avoidance Rule • Income Tax Act • Loi de l'impôt sur le revenu • Politique fiscale • Règle générale anti-évitement • Surplus Stripping • Tax Policy |

| ISBN-10 | 620-4-43150-1 / 6204431501 |

| ISBN-13 | 978-620-4-43150-5 / 9786204431505 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

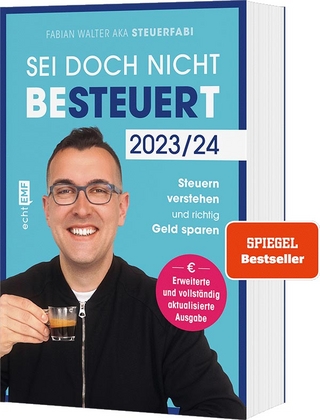

mit Steuerfabi die Welt der Steuern verstehen und richtig Geld …

Buch | Softcover (2023)

EMF Verlag

16,00 €

Allgemeines Steuerrecht, Abgabenordnung, Umsatzsteuer

Buch (2023)

Springer-Verlag GmbH

27,99 €

Buch | Softcover (2024)

Stiftung Warentest (Verlag)

16,90 €