An annotated guide to US federal taxation

A comparison between income taxes on individuals in the United States and Germany

Seiten

2016

AV Akademikerverlag

978-3-330-50305-2 (ISBN)

AV Akademikerverlag

978-3-330-50305-2 (ISBN)

- Titel nicht im Sortiment

- Artikel merken

Income taxation is an important tool for governments to generate revenue, incentivize certain actions, and redistribute wealth among a population. However, because it serves multiple purposes, income taxation can be a very complex topic. In fact, every country has developed a different approach to the challenges surrounding income taxation. This book provides a comparison between the income tax systems of the United States and Germany on a federal level. The system used by the U.S. is explained in detail in the body of this work while annotations written in German discuss the ways in which the German system differs. The majority of the focus will be on income taxes for individuals, but other types of taxes will also be touched upon in order to create a broader understanding. The main topics are the regulatory framework, including filing statuses and tax rates, plus the composition of taxable income, which includes the sources of taxable income, exclusions and deductions from taxable income, and tax credits.

Öttl, NadineThe author studied International Management at the TH Deggendorf. She familiarized herself with German and American income taxation during her bachelor's degree program. Upon graduation, she moved to the USA to get a master's degree in accountancy and work toward the CPA exam. Since February 2016 she has been working at a small California CPA firm.

| Erscheinungsdatum | 29.09.2016 |

|---|---|

| Sprache | englisch |

| Maße | 150 x 220 mm |

| Gewicht | 147 g |

| Themenwelt | Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Steuern / Steuererklärung |

| Recht / Steuern ► Steuern / Steuerrecht | |

| Schlagworte | Comparison Germany - USA • Einkommensteuern • Income Tax • Steuerrecht (SteuerR) • Vergleich Deutschland - USA |

| ISBN-10 | 3-330-50305-X / 333050305X |

| ISBN-13 | 978-3-330-50305-2 / 9783330503052 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

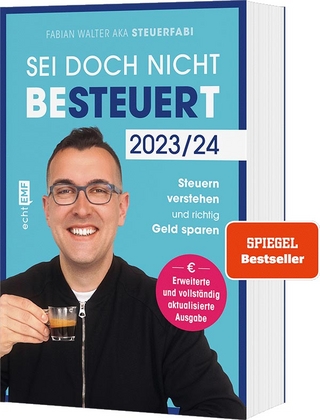

mit Steuerfabi die Welt der Steuern verstehen und richtig Geld …

Buch | Softcover (2023)

EMF Verlag

16,00 €

Allgemeines Steuerrecht, Abgabenordnung, Umsatzsteuer

Buch (2023)

Springer-Verlag GmbH

27,99 €

Buch | Softcover (2024)

Stiftung Warentest (Verlag)

16,90 €