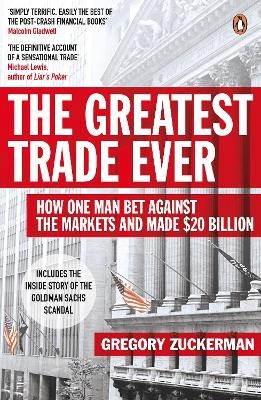

The Greatest Trade Ever

How One Man Bet Against the Markets and Made $20 Billion

Seiten

2010

Penguin Books Ltd (Verlag)

978-0-14-104315-9 (ISBN)

Penguin Books Ltd (Verlag)

978-0-14-104315-9 (ISBN)

Autumn 2008. The world's finances collapse but one man makes a killing. John Paulson, a softly spoken hedge-fund manager who still took the bus to work, seemed unlikely to stake his career on one big gamble. This title tells the story of the trader John Paulson who predicted the economic crash in 2008 - and made the biggest windfall in history.

'The definitive account of a sensational trade' Michael Lewis, author of The Big Short

Autumn 2008. The world's finances collapse but one man makes a killing.

John Paulson, a softly spoken hedge-fund manager who still took the bus to work, seemed unlikely to stake his career on one big gamble. But he did - and The Greatest Trade Ever is the story of how he realised that the sub-prime housing bubble was going to burst, making $15 Billion for his fund and more than $4 Billion for himself in a single year. It's a tale of folly and wizardry, individual brilliance versus institutional stupidity.

John Paulson made the biggest winning bet in history. And this is how he did it.

'Extraordinary, excellent' Observer

'A must-read for anyone fascinated by financial madness' Mail on Sunday

'A forensic, read-in-one-sitting book' Sunday Times

'Simply terrific. Easily the best of the post-crash financial books' Malcolm Gladwell

'A great page-turner and a great illuminator of the market's crash' John Helyar, author of Barbarians at the Gate

'The definitive account of a sensational trade' Michael Lewis, author of The Big Short

Autumn 2008. The world's finances collapse but one man makes a killing.

John Paulson, a softly spoken hedge-fund manager who still took the bus to work, seemed unlikely to stake his career on one big gamble. But he did - and The Greatest Trade Ever is the story of how he realised that the sub-prime housing bubble was going to burst, making $15 Billion for his fund and more than $4 Billion for himself in a single year. It's a tale of folly and wizardry, individual brilliance versus institutional stupidity.

John Paulson made the biggest winning bet in history. And this is how he did it.

'Extraordinary, excellent' Observer

'A must-read for anyone fascinated by financial madness' Mail on Sunday

'A forensic, read-in-one-sitting book' Sunday Times

'Simply terrific. Easily the best of the post-crash financial books' Malcolm Gladwell

'A great page-turner and a great illuminator of the market's crash' John Helyar, author of Barbarians at the Gate

Gregory Zuckerman is a special writer at the Wall Street Journal. He writes about business subjects like financial trades, hedge funds and private-equity firms, and about innovation and cutting-edge science. He's a three-time winner of the Gerald Loeb Award, the highest honour in business journalism. Zuckerman is the author of The Greatest Trade Ever and The Frackers, and he appears regularly on CNBC, Fox Business, and the BBC. He lives in New York.

| Erscheint lt. Verlag | 29.7.2010 |

|---|---|

| Verlagsort | London |

| Sprache | englisch |

| Maße | 129 x 198 mm |

| Gewicht | 213 g |

| Themenwelt | Literatur ► Biografien / Erfahrungsberichte |

| Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Wirtschaft | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Wirtschaft ► Betriebswirtschaft / Management ► Rechnungswesen / Bilanzen | |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Immobilienwirtschaft | |

| ISBN-10 | 0-14-104315-6 / 0141043156 |

| ISBN-13 | 978-0-14-104315-9 / 9780141043159 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

Handbuch für Studium und Praxis

Buch | Hardcover (2023)

Vahlen (Verlag)

79,00 €

Erfolgsstrategien für den modernen Immobilienmarkt

Buch | Softcover (2024)

ForwardVerlag

18,00 €

warum Rene Benkos Immobilienimperium zusammenbrach und was dem …

Buch | Hardcover (2024)

FinanzBuch Verlag

22,00 €