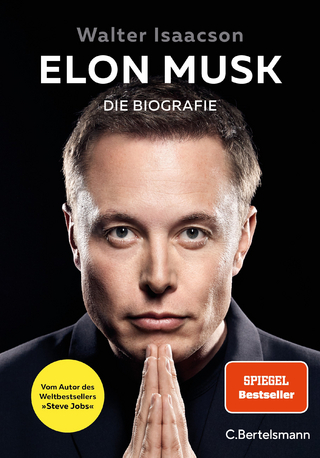

Sarbanes-Oxley For Dummies

For Dummies (Verlag)

978-0-470-22313-0 (ISBN)

You may not believe that there’s a fun and easy way to comply with Sarbanes –Oxley, but once you have Sarbanes-Oxley For Dummies, Second Edition in front of you, you’re sure to change your mind. This friendly guide gets you quickly up to speed with the latest SOX legislation and shows you safe and effective ways to reduce compliance costs. In plain English, this completely reliable handbook walks you through the new and revised SOX laws, introduces compliance strategies for changed and unchanged guidelines, and gives you an effective framework for implementation You’ll find out how to create an efficient audit committee, purchase and use SOX software solutions, and make practical, cost-effective decisions in your initial compliance year and beyond. You’ll also find proven strategies for staying public or going private and learn how to deal with all those SOX forms. Discover how to:

Establish SOX standards for IT professionals

Minimize compliance costs in every area of your company

Survive a section 404 audit

Avoid litigation under SOX

Anticipate future rules and trends

Create a post-SOX paper trail

Bolster your company’s standing and reputation

Work with SOX in a small business

Meet new SOX standards

Build a board that can’t be bought

Comply with all SOX management mandates

Complete with invaluable tips on how to form an effective audit committee, Sarbanes-Oxley For Dummies is the resource you need to keep your SOX clean.

Jill Gilbert Welytok, JD, CPA, LLM, practices in the areas of corporate, nonprofit law, and intellectual property. She is the founder of Absolute Technology Law Group, LLC (www.abtechlaw.com). She went to law school at DePaul University in Chicago, where she was on the Law Review, and she picked up a Masters Degree in Computer Science from Marquette University in Wisconsin, where she now lives. Ms. Welytok also has an LLM in Taxation from DePaul. She was formerly a tax consultant with the predecessor firm to Ernst & Young. She frequently speaks on nonprofit, corporate governance, and taxation issues and will probably come speak to your company or organization if you invite her. You may e-mail her with questions you have about Sarbanes-Oxley or anything else in this book at jwelytok@abtechlaw.com. You can find updates to this book and ongoing information about SOX developments at the author’s Web site, located at www.abtechlaw.com.

Introduction 1

Part I: The Scene Before and After SOX 7

Chapter 1: The SOX Saga 9

Chapter 2: SOX in Sixty Seconds 27

Chapter 3: SOX and Securities Regulations 43

Chapter 4: SOX and Factual Financial Statements 67

Chapter 5: What’s New for Non-Accelerated Filers 83

Part II: SOX in the City: Meeting New Standards 89

Chapter 6: A New Audit Ambience 91

Chapter 7: A Board to Audit the Auditors 105

Chapter 8: The Almighty Audit Committee 119

Chapter 9: Building Boards That Can’t Be Bought 131

Chapter 10: SOX: Under New Management 143

Chapter 11: More Management Mandates 159

Part III: Scaling Down Section 404 169

Chapter 12: Clearing Up Confusion about Control 171

Chapter 13: Surviving a Section 404 Audit 183

Chapter 14: Taking the Terror Out of Testing 191

Part IV: SOX for Techies 207

Chapter 15: Getting Technical with SOX 209

Chapter 16: Surveying SOX Software 219

Chapter 17: Working with Some Actual SOX Software 233

Part V: To SOX-finity and Beyond 249

Chapter 18: Lawsuits under SOX 251

Chapter 19: The Surprising Scope of SOX 267

Part VI: The Part of Tens 273

Chapter 20: Ten Ways to Avoid Getting Sued or Criminally Prosecuted Under SOX 275

Chapter 21: Ten Tips for an Effective Audit Committee 281

Chapter 22: Ten Smart Management Moves 289

Chapter 23: Ten Things You Can’t Ask an Auditor to Do After SOX 295

Chapter 24: Top Ten Places to Get Smart about SOX 301

Part VII: Appendixes 307

Appendix A: Selected Sections, Auditing Standard No 5 309

Appendix B: Sample Certifications 313

Appendix C: Sample Audit Committee Charter 319

Appendix D: Sample Code of Ethics 329

Appendix E: Sample SAS 70 Report 337

Index 339

| Erscheint lt. Verlag | 22.2.2008 |

|---|---|

| Sprache | englisch |

| Maße | 185 x 231 mm |

| Gewicht | 522 g |

| Themenwelt | Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Wirtschaft |

| Recht / Steuern ► EU / Internationales Recht | |

| Recht / Steuern ► Wirtschaftsrecht ► Gesellschaftsrecht | |

| ISBN-10 | 0-470-22313-8 / 0470223138 |

| ISBN-13 | 978-0-470-22313-0 / 9780470223130 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich