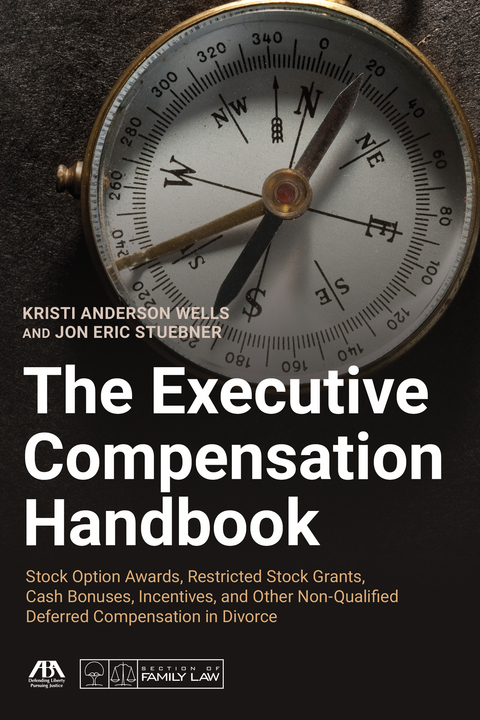

The Executive Compensation Handbook (eBook)

254 Seiten

American Bar Association (Verlag)

978-1-64105-220-7 (ISBN)

In clear, accessible language, the authors explain how to gather information, negotiate settlements, divide executive compensation plans, and draft separation agreements, as well as to use in drafting court financial statements where income needs to be disclosed. Topics range from the common types of executive compensation to valuation and issues in dividing assets to practical drafting tips and techniques.

For the family lawyer handling a case involving executive compensation, there can be a dizzying array of arrangements, plans, bonuses, and agreements that can seem overwhelming. Providing an invaluable roadmap to a complicated aspect of financial issues occurring in divorce, this book offers a practical guide to understanding, negotiating, and dividing assets that fall into the broad category of executive compensation. These assets are notoriously complex, and this book provides alerts to common pitfalls while providing the background to allow the lawyer to explain the issues to both clients and judges.Executive compensation can include stock options, restricted stock, restricted stock units, phantom stock, stock appreciation rights, longterm incentive plans, short-term incentive plans, cash bonuses, and supplemental executive retirement plans, among a myriad of other arrangements. This book looks at the executive compensation options where the benefit is in the category of nonqualified deferred compensation, providing guidance to enable family law practitioners to understand and navigate issues that arise with respect to deferred compensation.Topics addressed in The Executive Compensation Handbook include:The most common types of executive compensationWhere to find essential informationWhat constitutes propertySeparate versus marital propertyValuationIssues in dividing assetsUsing executive compensation for support purposesTax considerationsPractical drafting tips and techniquesThis is an accessible reference manual for family lawyer on how to gather information, negotiate settlements, divide executive compensation plans, and draft separation agreements, as well as to use in drafting court financial statements where income needs to be disclosed and explained. In addition, family court judges can use this book for knowing the issues associated with dividing executive compensation and determining income when drafting orders in a dissolution of marriage or legal separation action, and the lawyer's staff can use it to understand the types of questions to ask clients and opposing parties when gathering documentation or creating first drafts of disclosure documents and discovery requests.

| Erscheint lt. Verlag | 7.10.2020 |

|---|---|

| Sprache | englisch |

| Themenwelt | Recht / Steuern ► EU / Internationales Recht |

| Recht / Steuern ► Öffentliches Recht | |

| Recht / Steuern ► Privatrecht / Bürgerliches Recht ► Besonderes Schuldrecht | |

| ISBN-10 | 1-64105-220-1 / 1641052201 |

| ISBN-13 | 978-1-64105-220-7 / 9781641052207 |

| Haben Sie eine Frage zum Produkt? |

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich